Rising Data Volume and Complexity

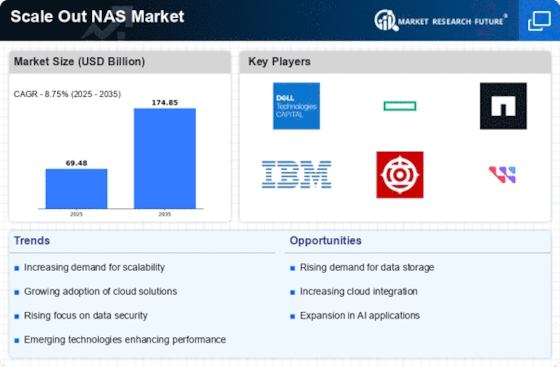

The Scale Out Nas Market is experiencing a surge in demand driven by the exponential growth of data generated across various sectors. Organizations are increasingly faced with the challenge of managing vast amounts of unstructured data, which necessitates scalable storage solutions. According to recent estimates, data creation is projected to reach 175 zettabytes by 2025, compelling enterprises to adopt Scale Out NAS systems that can efficiently handle this influx. These systems offer the flexibility to expand storage capacity seamlessly, thereby addressing the complexities associated with data management. As businesses seek to leverage data for strategic insights, the Scale Out Nas Market is likely to witness sustained growth, as these solutions provide the necessary infrastructure to support advanced analytics and big data applications.

Shift Towards Hybrid IT Environments

The Scale Out Nas Market is significantly influenced by the ongoing transition towards hybrid IT environments. Organizations are increasingly adopting a combination of on-premises and cloud-based solutions to optimize their IT infrastructure. This shift is driven by the need for flexibility, cost efficiency, and enhanced performance. Scale Out NAS systems are particularly well-suited for hybrid environments, as they can integrate seamlessly with cloud storage, allowing businesses to scale their storage needs dynamically. Recent data indicates that nearly 70% of enterprises are expected to implement hybrid cloud strategies by 2025, further propelling the demand for Scale Out NAS solutions. This trend suggests that the Scale Out Nas Market will continue to evolve, as organizations seek to balance their storage requirements with operational agility.

Regulatory Compliance and Data Governance

The Scale Out Nas Market is increasingly shaped by the need for regulatory compliance and robust data governance frameworks. Organizations are under mounting pressure to adhere to various data protection regulations, such as GDPR and CCPA, which necessitate secure and compliant storage solutions. Scale Out NAS systems provide features that enhance data security, such as encryption and access controls, making them an attractive option for businesses aiming to meet compliance requirements. Recent studies indicate that nearly 80% of organizations consider regulatory compliance a top priority when selecting storage solutions. This focus on compliance is likely to drive growth in the Scale Out Nas Market, as businesses seek to implement storage systems that not only support their operational needs but also align with legal and regulatory standards.

Emergence of AI and Machine Learning Applications

The integration of artificial intelligence (AI) and machine learning (ML) technologies is reshaping the Scale Out Nas Market. As organizations increasingly leverage AI and ML for data analysis and decision-making, the demand for scalable storage solutions that can accommodate the vast datasets required for training algorithms is on the rise. Scale Out NAS systems are particularly advantageous in this context, as they offer the necessary performance and scalability to support complex AI workloads. Industry reports suggest that the AI market is expected to reach 190 billion dollars by 2025, driving the need for robust storage solutions. Consequently, the Scale Out Nas Market is likely to benefit from this trend, as businesses seek to harness the power of AI and ML while ensuring efficient data management.

Increased Focus on Data Accessibility and Collaboration

In the contemporary business landscape, the Scale Out Nas Market is witnessing a heightened emphasis on data accessibility and collaboration. As remote work and distributed teams become more prevalent, organizations require storage solutions that facilitate easy access to data from various locations. Scale Out NAS systems provide a centralized repository that enables multiple users to access and share data efficiently, thereby enhancing collaboration. Furthermore, the ability to scale storage capacity in response to growing user demands is a critical factor driving adoption. Recent surveys indicate that over 60% of organizations prioritize data accessibility as a key criterion when selecting storage solutions. This trend underscores the importance of Scale Out NAS systems in fostering a collaborative work environment, positioning the Scale Out Nas Market for continued growth.

.png)