Rising Demand in Oil and Gas Sector

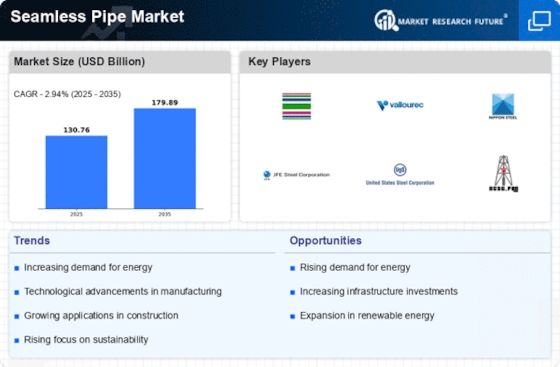

The Seamless Pipe Market is experiencing a notable surge in demand, particularly from the oil and gas sector. This sector relies heavily on seamless pipes due to their superior strength and ability to withstand high pressures. As exploration and production activities expand, the need for durable and reliable piping solutions becomes paramount. Recent data indicates that the oil and gas industry accounts for a substantial portion of seamless pipe consumption, with projections suggesting a growth rate of approximately 5% annually. This trend is likely to continue as energy companies invest in new projects and technologies, further driving the demand for seamless pipes.

Increasing Focus on Energy Efficiency

The Seamless Pipe Market is witnessing a shift towards energy efficiency, driven by both regulatory frameworks and consumer preferences. Industries are increasingly seeking seamless pipes that not only meet performance standards but also contribute to energy savings. This trend is particularly evident in sectors such as automotive and manufacturing, where energy-efficient solutions are prioritized. Recent analyses indicate that energy-efficient seamless pipes can reduce operational costs by approximately 15%, making them an attractive option for businesses. As awareness of sustainability grows, the demand for energy-efficient seamless pipes is likely to rise, further propelling the market forward.

Expansion of the Chemical Processing Industry

The Seamless Pipe Market is benefiting from the expansion of the chemical processing industry, which requires high-quality piping solutions for transporting corrosive materials. Seamless pipes are preferred in this sector due to their ability to withstand harsh environments and high pressures. The chemical processing industry is projected to grow at a rate of 3% annually, driven by increasing production capacities and the need for efficient transportation systems. This growth is expected to create a substantial demand for seamless pipes, as manufacturers seek reliable and durable solutions to meet their operational needs. Consequently, the seamless pipe market is poised for growth as it aligns with the requirements of this expanding industry.

Growth in Construction and Infrastructure Projects

The Seamless Pipe Market is significantly influenced by the ongoing growth in construction and infrastructure projects. As urbanization accelerates, the need for robust piping solutions in residential, commercial, and industrial applications increases. Seamless pipes are favored for their structural integrity and resistance to corrosion, making them ideal for various construction applications. Recent statistics reveal that the construction sector is projected to grow at a rate of 4% per year, which directly correlates with the rising demand for seamless pipes. This growth is expected to be fueled by government initiatives aimed at enhancing infrastructure, thereby creating a favorable environment for the seamless pipe market.

Technological Innovations in Manufacturing Processes

Technological advancements in manufacturing processes are playing a crucial role in shaping the Seamless Pipe Market. Innovations such as advanced welding techniques and improved quality control measures are enhancing the production efficiency and quality of seamless pipes. These advancements not only reduce production costs but also improve the overall performance of the pipes. Data suggests that manufacturers adopting these technologies are witnessing a reduction in defect rates by up to 20%, which is likely to bolster consumer confidence in seamless pipes. As the industry continues to embrace these innovations, the seamless pipe market is expected to benefit from increased competitiveness and product offerings.