Self Compacting Concrete Size

Self Compacting Concrete Market Growth Projections and Opportunities

Various factors drive the market of the self-compacting concrete (SCC), which in turn are responsible for the constant change on the dynamics and the growth rate of the SCC. Market solidifier is callous of the spike in demand for high-quality construction materials. Construction processes flow and continually change with a prerequisite for building structures to be sustainable and long-lasting. Being able to fill massive forms without the need for shaking, SCC as a technology gives an advantage over standard concrete in these circumstances.

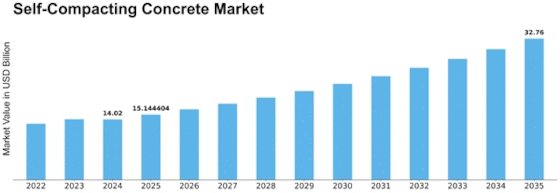

The market size of Self-Compacting Concrete (SCC) reached 12.14 billion US dollars in the year of 2022. The Self-Compacting Concrete market is forecasted to expand from a base value of USD 13.46 Billion to USD 22.11 Billion in the end of the forecast period of 2030 and which is accounted to a compound annual growth rate (CAGR) of 8.14%.

Unlike the normal concrete use –the trend of utilizing self-compacting concrete is a characteristic to the sustainability practice in the construction industry. SCC implies with the lower magnitude for water consumption and emission of carbon dioxide and hence with the efforts to lessen the carbon footprint of construction activities at the global level. As it happens, the trend is for environmental rules to become increasingly tighter, thus necessitating the proliferation of SCC usage.

Technological progress, on the one hand, is also a powerful force that forms self-consolidating concrete market. Constant testings and improvement on SCC property improvement aspects includes its workability, strength and so on. Through the evolution of mixing proportions and the application of suplementary cementious materials, SCC formulations are continually enhanced and made more applicable to various construction projects which help to take care of the environment.

The health and growth of the construction sector have become the main indicator with regard to trends in the SCC industry. Economic proxies like investment in the infrastructure industry, increased residential and commercial construction, influence the demand for high caliber concrete. During good business days and when activities in the construction sector are booming, high-performance materials such as SCC attract the interest of the construction market running from new to affordable products in terms to quality and innovation.

Regulatory body is as critical as the market itself to the self-compacting concrete market. Governments’ construction material policies, environment impact standards and building code are some of the areas where they are able to control the growing SCC. Along with it, governments everywhere would be committed to take friendly environmental and sound construction practices by issuing regulations that favor the application of self-compacting concrete.

Besides, other considerations associated with cost are definitely questions that concerning the SCC market. Apart from SCC advantages, such as inexpensive labor due to the non-presence of vibration processes and the short construction times, SCC can sometimes even be quite costly because of its initial price.

Leave a Comment