Technological Innovations

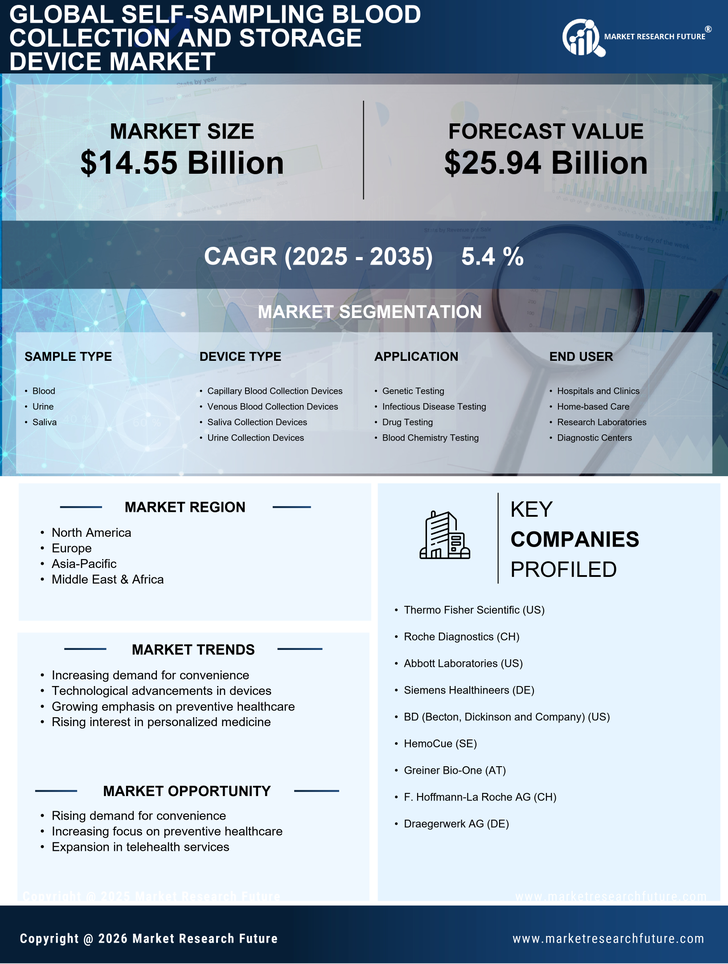

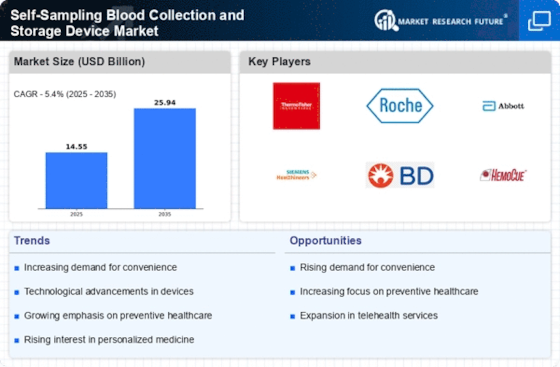

The Self-Sampling Blood Collection and Storage Device Market is experiencing a surge in technological innovations that enhance the efficiency and reliability of blood sampling. Devices are becoming increasingly user-friendly, incorporating features such as automated sampling and integrated storage solutions. These advancements not only streamline the collection process but also improve the accuracy of results. For instance, the introduction of micro-sampling techniques allows for smaller blood volumes, making it easier for patients to collect samples at home. The market is projected to grow at a compound annual growth rate of approximately 8% over the next five years, driven by these technological enhancements.

Regulatory Support and Standardization

The Self-Sampling Blood Collection and Storage Device Market is influenced by regulatory support and standardization efforts aimed at ensuring the safety and efficacy of these devices. Regulatory bodies are increasingly recognizing the importance of self-sampling technologies, leading to the establishment of guidelines that facilitate their development and approval. This regulatory backing not only enhances consumer confidence but also encourages manufacturers to innovate. The market is anticipated to see a steady growth trajectory, with regulatory frameworks potentially contributing to a 12% increase in market penetration over the next few years.

Increased Focus on Personalized Medicine

The Self-Sampling Blood Collection and Storage Device Market is aligned with the rising focus on personalized medicine, which emphasizes tailored healthcare solutions based on individual patient needs. Self-sampling devices enable more frequent and personalized monitoring of health parameters, facilitating the customization of treatment plans. This trend is particularly relevant in the management of chronic diseases, where regular data collection can inform more effective interventions. Market analysts predict that the integration of self-sampling devices into personalized medicine strategies could lead to a 20% increase in market demand by 2026, reflecting the growing importance of individualized healthcare.

Growing Awareness of Preventive Healthcare

The Self-Sampling Blood Collection and Storage Device Market is benefiting from a growing awareness of preventive healthcare among the population. Individuals are increasingly recognizing the importance of regular health monitoring and early disease detection. This trend is leading to a higher acceptance of self-sampling devices, as they empower users to take charge of their health. Market data indicates that the preventive healthcare segment is projected to grow by 10% annually, further driving the adoption of self-sampling blood collection devices. This heightened awareness is likely to foster a culture of proactive health management.

Rising Demand for Home Healthcare Solutions

The Self-Sampling Blood Collection and Storage Device Market is witnessing a notable increase in demand for home healthcare solutions. As patients seek more convenient and accessible healthcare options, self-sampling devices provide an effective alternative to traditional blood collection methods. This trend is particularly evident among chronic disease patients who require regular monitoring. The market is expected to expand significantly, with estimates suggesting a potential increase in market size by 15% within the next three years. This shift towards home-based healthcare is reshaping the landscape of blood collection, making self-sampling devices more prevalent.