Enhanced Connectivity Features

The trend towards enhanced connectivity features in vehicles is a significant driver for the SerDes Chipsets for Automotive Applications Market. With the rise of connected cars, there is a growing need for seamless communication between the vehicle and external networks. SerDes chipsets enable this connectivity by providing the necessary bandwidth for data-intensive applications such as real-time traffic updates, over-the-air software updates, and cloud-based services. The market is likely to expand as consumers increasingly demand vehicles equipped with advanced connectivity options. Recent studies indicate that nearly 70% of new vehicles are expected to be connected by 2025, further propelling the need for efficient SerDes solutions to support these features.

Increasing Focus on Vehicle Safety

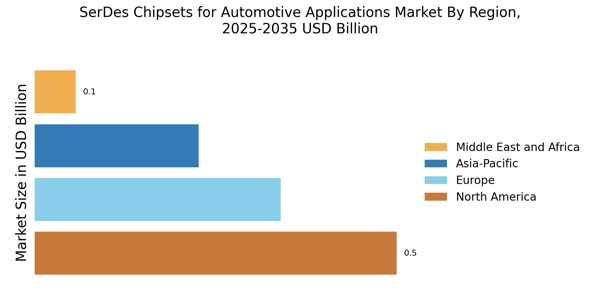

The automotive industry is placing a heightened emphasis on vehicle safety, which serves as a key driver for the SerDes Chipsets for Automotive Applications Market. Advanced safety features, such as collision avoidance systems and adaptive cruise control, require reliable data transmission between various sensors and control units. SerDes chipsets are integral to ensuring that this data is communicated swiftly and accurately, thereby enhancing overall vehicle safety. Regulatory bodies are also advocating for improved safety standards, which is likely to result in increased adoption of these chipsets. The market for SerDes solutions is expected to grow as manufacturers prioritize safety in their vehicle designs, with projections indicating a potential market size of USD 500 million by 2026.

Growing Demand for Autonomous Vehicles

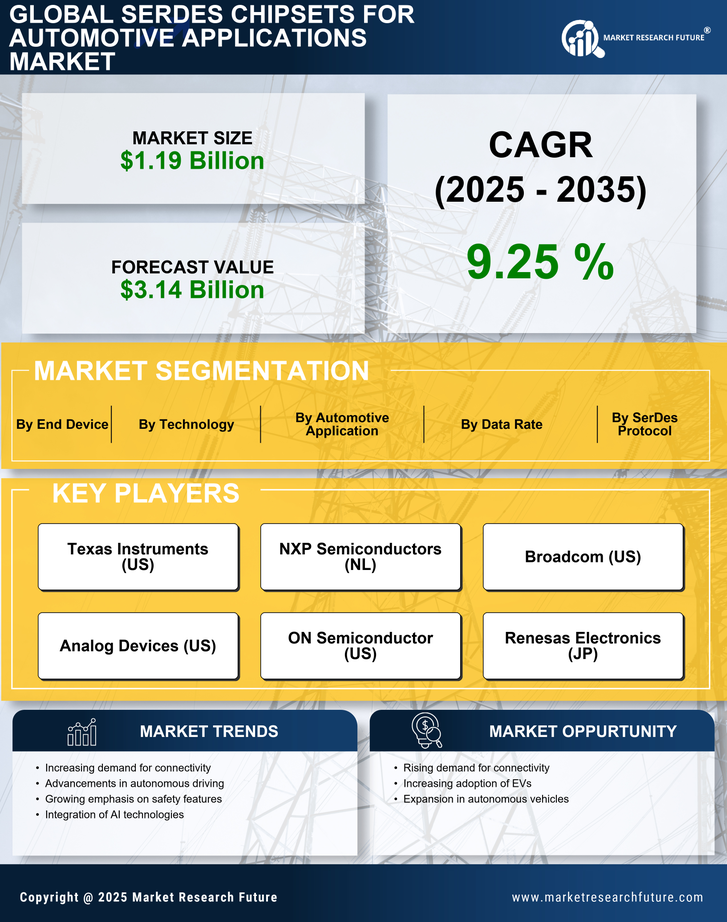

The push towards autonomous vehicles is reshaping the automotive landscape, thereby driving the SerDes Chipsets for Automotive Applications Market. Autonomous vehicles rely heavily on a multitude of sensors and cameras that generate vast amounts of data. SerDes chipsets play a crucial role in managing this data flow, ensuring that information is transmitted efficiently and in real-time. As manufacturers invest in the development of self-driving technology, the demand for high-performance SerDes solutions is expected to surge. Analysts predict that the market for these chipsets could witness a substantial increase, potentially exceeding USD 1 billion by 2027, as more automakers incorporate autonomous features into their vehicle offerings.

Integration of High-Speed Data Transmission

The increasing demand for high-speed data transmission in vehicles is a primary driver for the SerDes Chipsets for Automotive Applications Market. As vehicles become more technologically advanced, the need for efficient communication between various electronic components intensifies. SerDes chipsets facilitate this by enabling high-speed serial data transmission, which is essential for applications such as infotainment systems, navigation, and vehicle-to-everything (V2X) communication. The market for these chipsets is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 15% in the coming years. This growth is largely attributed to the rising complexity of automotive electronics and the increasing integration of advanced features that require robust data handling capabilities.

Technological Advancements in Semiconductor Manufacturing

Technological advancements in semiconductor manufacturing are significantly influencing the SerDes Chipsets for Automotive Applications Market. Innovations in fabrication processes and materials are enabling the production of more efficient and compact chipsets, which are essential for modern automotive applications. As vehicles become increasingly electrified and automated, the demand for high-performance SerDes solutions is expected to rise. The semiconductor industry is projected to experience a growth rate of approximately 10% annually, driven by the automotive sector's need for advanced electronic components. This trend suggests that the SerDes market will benefit from improved manufacturing techniques, leading to enhanced performance and reduced costs, thereby making these chipsets more accessible to automotive manufacturers.