Top Industry Leaders in the SerDes Market

Competitive Landscape of SerDes Market

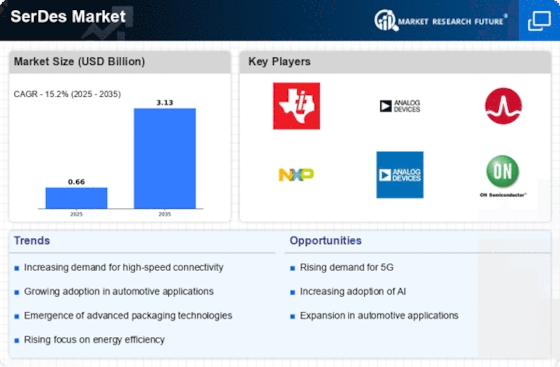

The Serializer-Deserializer (SerDes) market, responsible for transforming data between parallel and serial formats, is experiencing a surge in demand fueled by the insatiable data appetite of modern technology. This burgeoning realm attracts diverse players, each vying for a slice of the pie. Understanding the competitive landscape is critical for both established champions and aspiring contenders in this dynamic scene.

Some of the SerDes companies listed below:

- Rambus

- Texas Instruments Inc.

- ON Semiconductor Corporation

- STMicroelectronics NV

- ROHM Semiconductor

- Renesas Electronics Corp

- NXP Semiconductors NV

- Maxim Integrated

- Cypress Semiconductor Corp.Broadcom

Strategies Adopted by Key Players:

- Vertical Integration: Controlling key aspects of the supply chain, from chip design to fabrication, can improve efficiency and reduce costs.

- Strategic Partnerships: Collaborating with other players in the ecosystem, such as equipment manufacturers, system designers, and end-user equipment vendors, can accelerate development and market penetration.

- Focus on Niche Markets: Targeting specific application areas, like automotive, medical, or industrial automation, with tailored SerDes solutions can create a competitive advantage.

- Continuous Innovation: Investing in R&D to develop next-generation SerDes technologies with higher data rates, lower power consumption, and improved signal integrity is crucial for market leadership.

- Standardization Compliance: Aligning with industry standards and protocols facilitates interoperability and opens up broader market opportunities.

Factors for Market Share Analysis:

- Product Portfolio: Offering a diverse range of SerDes solutions, catering to various data rates, power requirements, and protocols, expands market reach.

- Technological Prowess: Pioneering innovations in SerDes architecture, signal integrity, and low-power consumption builds a competitive edge.

- Manufacturing Scalability: Possessing robust and scalable manufacturing capabilities, from chip design to packaging, assures cost-effectiveness and efficient production.

- Brand Recognition: A well-established reputation for reliability, performance, and technical expertise fosters customer trust and loyalty.

- Distribution Network: A broad and well-oiled distribution network facilitates access to key markets and customers.

- Pricing Strategy: Balancing competitive pricing with profitability requires careful consideration of production costs, market dynamics, and customer value perception.

New and Emerging Companies:

- Innovium Inc.: A rising star in the data center SerDes market, offering high-performance and low-power solutions.

- EdgeQ Inc.: Focused on developing high-speed SerDes solutions for emerging applications like 5G and AI.

- Alpha and Omega Semiconductor Inc.: A growing player in the industrial and automotive SerDes market, known for its reliable and rugged solutions.

- EnnoSemi Inc.: A Chinese company specializing in high-speed SerDes solutions for the telecom and data center markets.

- MACOM Technology Solutions Holdings Inc.: A leading provider of optical networking components, actively developing SerDes solutions for high-bandwidth applications.

Latest Company Updates:

On Oct. 17, 2023, Marvell Technology demonstrated 200 Gbit/s SerDes for active copper cables and chiplet interconnect. The 200G/lane active electrical cable (AEC) technology lays the foundation for next-generation AI clusters and cloud infrastructure from Marvell. The PAM4 DSP technology drives 200 Gbit/s per lane over electrical channels on a 5nm 224G long-reach SerDes technology, capable of driving 40dB+ of insertion loss at 224G/lane.

On Aug. 09, 2023, The MIPI Alliance, a leading global provider of interface specifications for mobile and mobile-influenced industries, announced entering into a liaison agreement with the Automotive SerDes Alliance (ASA), a non-profit industry alliance of automotive technology providers to enable native MIPI CSI-2 implementation with ASA-ML PHY. This agreement will benefit the automotive industry by aligning MIPI camera specifications with ASA and MIPI-standardized SerDes solutions.

On July 24, 2023, Cadence announced the acquisition of Rambus' memory physical interface IP and SerDes businesses. Cadence will get a comprehensive portfolio of memory PHY IP and SerDes assets, as well as a large client base, while Rambus will now solely focus on licensing digital IP. The acquisition will enable Cadence to broaden its well-established enterprise IP portfolio, PHY IP, and reach across geographies and vertical markets, such as the aerospace and defense market.

On July 11, 2023, Faraday Technology Corporation, a leading ASIC design service and IP provider launched its SerDes advanced service to accelerate ASICs into production. SerDes (serializer/deserializer) total solution comprises SerDes IP design on UMC 28nm and the corresponding IP advanced (IPA) service, which includes IP subsystem integration, PHY hardcore implementation, and signal integrity/power integrity (SI/PI) analysis on the system with package and PCB design.