Growth in Renewable Energy Sector

The growth in the renewable energy sector is a significant driver for the SF6 Gas Circuit Breaker Market. As countries strive to meet renewable energy targets, the integration of wind, solar, and other renewable sources into the power grid is becoming increasingly prevalent. SF6 gas circuit breakers are essential for managing the variability and intermittency associated with renewable energy sources. Their ability to operate efficiently in high voltage applications makes them suitable for connecting renewable energy plants to the grid. Market analysis suggests that the demand for SF6 gas circuit breakers will rise in tandem with the expansion of renewable energy infrastructure, as utilities seek reliable solutions to enhance grid stability.

Stringent Environmental Regulations

Stringent environmental regulations are increasingly influencing the SF6 Gas Circuit Breaker Market. Governments and regulatory bodies are implementing policies aimed at reducing greenhouse gas emissions, including SF6, which is known for its high global warming potential. As a result, manufacturers are compelled to innovate and develop eco-friendly alternatives or improve the efficiency of existing SF6 gas circuit breakers. The market is witnessing a shift towards hybrid technologies that combine SF6 with other insulating mediums, thereby addressing environmental concerns while maintaining performance standards. This regulatory landscape is likely to shape the future of the SF6 gas circuit breaker market, pushing for sustainable practices in the electrical industry.

Investment in Electrical Infrastructure

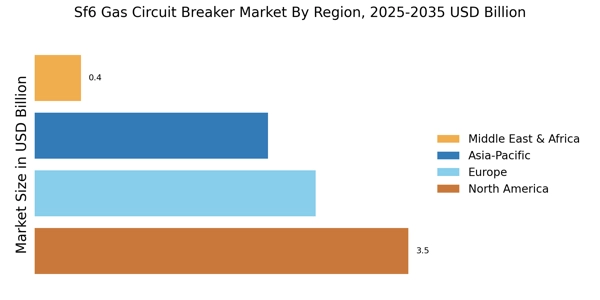

Investment in electrical infrastructure is a key driver of the SF6 Gas Circuit Breaker Market. As nations modernize their power systems to accommodate growing energy demands, substantial capital is being allocated to upgrade and expand electrical networks. SF6 gas circuit breakers are integral to these modernization efforts due to their reliability and efficiency in high voltage applications. Recent reports indicate that the global investment in electrical infrastructure is expected to reach trillions of dollars over the next decade, creating a favorable environment for the SF6 gas circuit breaker market. This influx of investment is likely to accelerate the deployment of advanced circuit breaker technologies, further solidifying their role in contemporary power systems.

Rising Demand for Reliable Power Supply

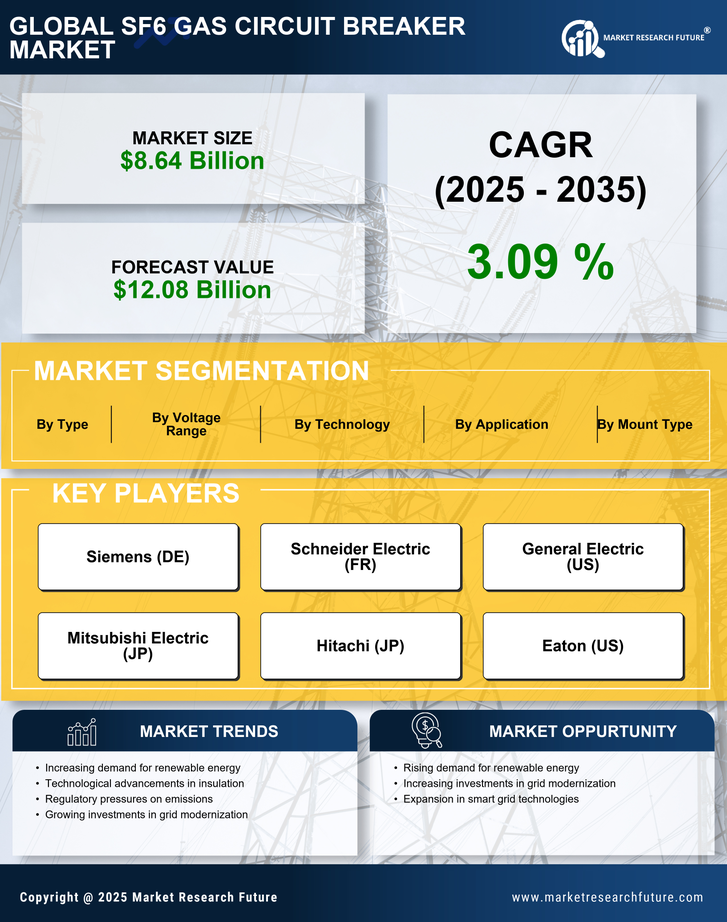

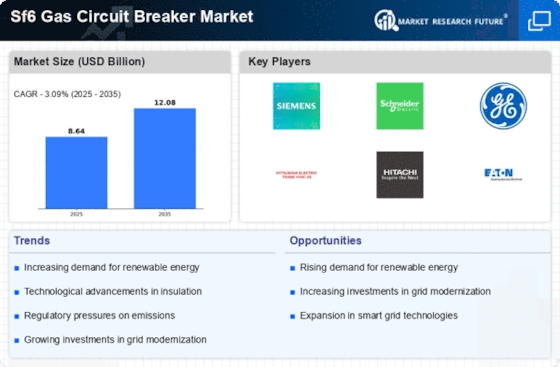

The increasing demand for reliable and uninterrupted power supply is a primary driver for the SF6 Gas Circuit Breaker Market. As urbanization and industrialization continue to expand, the need for robust electrical infrastructure becomes paramount. SF6 gas circuit breakers are favored for their superior performance in high voltage applications, providing enhanced reliability and safety. According to recent data, the market for SF6 gas circuit breakers is projected to grow at a compound annual growth rate of approximately 6% over the next few years. This growth is largely attributed to the rising investments in power generation and distribution networks, which necessitate the deployment of advanced circuit breaker technologies to ensure operational efficiency.

Technological Innovations in Circuit Breakers

Technological innovations play a crucial role in shaping the SF6 Gas Circuit Breaker Market. The development of smart grid technologies and automation in electrical systems has led to the integration of advanced features in SF6 gas circuit breakers. These innovations enhance monitoring, control, and maintenance capabilities, thereby improving overall system reliability. The introduction of digital solutions, such as remote monitoring and predictive maintenance, is expected to drive the adoption of SF6 gas circuit breakers. Market data indicates that the segment of smart circuit breakers is anticipated to witness substantial growth, reflecting the industry's shift towards more intelligent and efficient power management solutions.