Growing Global Energy Demand

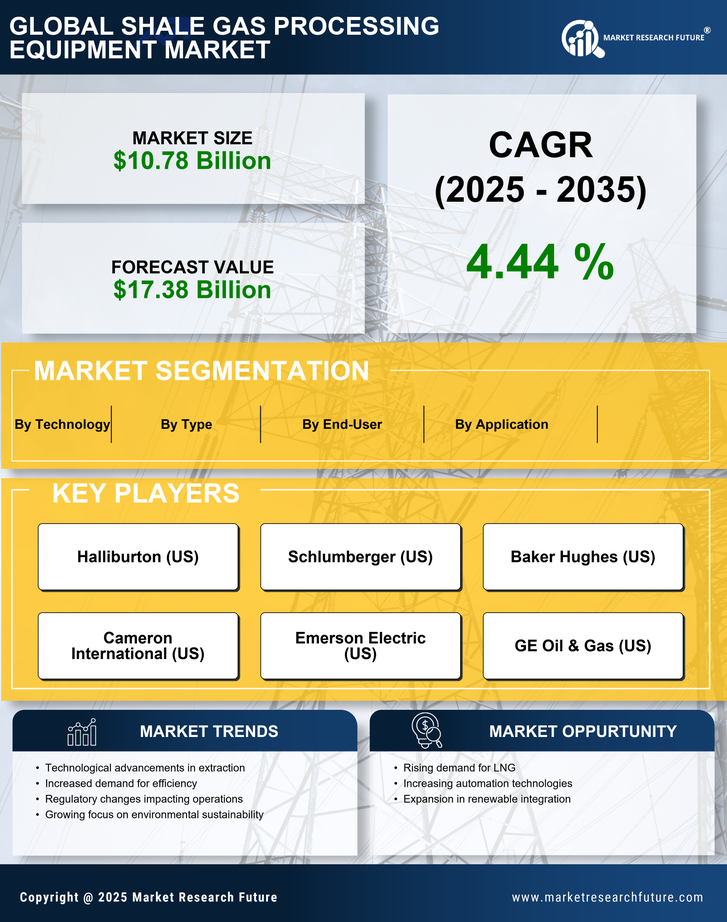

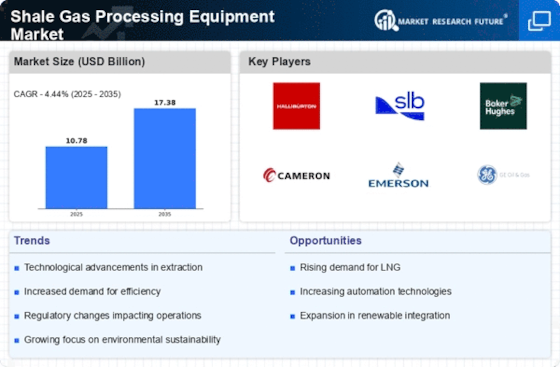

The increasing The Shale Gas Processing Equipment Industry. As populations grow and economies expand, the need for reliable and affordable energy sources intensifies. Natural gas, particularly from shale formations, is emerging as a key player in meeting this demand due to its abundance and lower carbon footprint compared to other fossil fuels. Projections indicate that global energy consumption will rise by approximately 30% by 2040, further emphasizing the need for efficient shale gas processing solutions. The Shale Gas Processing Equipment Market is likely to thrive as energy producers seek to enhance their processing capabilities to meet this burgeoning demand.

Increasing Demand for Natural Gas

The rising demand for natural gas as a cleaner alternative to coal and oil is a primary driver for the Shale Gas Processing Equipment Market. As countries strive to reduce carbon emissions, natural gas is increasingly viewed as a transitional fuel. According to recent data, natural gas consumption is projected to grow by approximately 1.5% annually over the next decade. This trend necessitates the expansion of shale gas production, thereby driving the need for advanced processing equipment. The Shale Gas Processing Equipment Market is likely to benefit from this shift, as more efficient and innovative processing technologies are required to meet the growing demand. Furthermore, the integration of renewable energy sources with natural gas systems may further enhance the market's growth potential.

Regulatory Support and Policy Frameworks

Supportive regulatory frameworks and policies aimed at promoting natural gas production are crucial for the Shale Gas Processing Equipment Market. Governments are increasingly recognizing the economic and environmental benefits of natural gas, leading to favorable policies that encourage exploration and production. For instance, tax incentives and subsidies for shale gas projects can significantly enhance investment in processing equipment. Recent legislative measures in various regions have indicated a commitment to expanding natural gas infrastructure, which is expected to bolster the market. The Shale Gas Processing Equipment Market stands to gain from these developments, as enhanced regulatory support can lead to increased production capacities and technological advancements.

Rising Investments in Infrastructure Development

The surge in investments aimed at developing shale gas infrastructure is a significant driver for the Shale Gas Processing Equipment Market. As countries seek to enhance their energy security and reduce dependence on imports, substantial capital is being allocated to build processing plants, pipelines, and storage facilities. Recent reports indicate that infrastructure investments in the energy sector are expected to reach trillions of dollars over the next decade. This influx of capital is likely to create a favorable environment for the Shale Gas Processing Equipment Market, as new projects will require advanced processing technologies to ensure efficient operations. Consequently, the market is poised for growth as infrastructure development accelerates.

Technological Innovations in Processing Equipment

Technological advancements in shale gas processing equipment are transforming the Shale Gas Processing Equipment Market. Innovations such as modular processing units and advanced separation technologies are enhancing efficiency and reducing operational costs. The introduction of automation and digitalization in processing facilities is also streamlining operations, leading to improved productivity. Market data suggests that investments in innovative processing technologies could increase by over 20% in the coming years. These advancements not only improve the economic viability of shale gas projects but also address environmental concerns by minimizing waste and emissions. As a result, the Shale Gas Processing Equipment Market is likely to experience robust growth driven by these technological innovations.