Rising Demand in Automotive Sector

The automotive sector is experiencing a notable surge in demand for sheet metal fabrication services. This trend is primarily driven by the increasing production of electric vehicles, which require specialized components that are often fabricated from sheet metal. In 2025, the automotive industry is projected to account for a substantial portion of the sheet metal fabrication service market, with estimates suggesting a growth rate of approximately 5% annually. As manufacturers seek to enhance vehicle performance and reduce weight, the reliance on advanced sheet metal fabrication techniques becomes more pronounced. This shift not only supports the automotive industry's transition towards more sustainable practices but also emphasizes the critical role of sheet metal fabrication services in meeting evolving consumer preferences.

Infrastructure Development Projects

Infrastructure development projects are a significant driver of the sheet metal fabrication service market. Governments and private entities are increasingly investing in infrastructure, including bridges, buildings, and transportation systems. In 2025, the construction sector is expected to witness a robust growth trajectory, with expenditures projected to reach trillions of dollars. This surge in infrastructure spending creates a heightened demand for sheet metal components, which are essential for structural integrity and durability. The versatility of sheet metal allows for its application in various construction elements, from roofing to framing. As urbanization continues to expand, the need for efficient and reliable sheet metal fabrication services will likely intensify, further propelling market growth.

Expansion of Renewable Energy Sector

The expansion of the renewable energy sector is emerging as a pivotal driver for the sheet metal fabrication service market. As the world shifts towards sustainable energy sources, there is a growing need for components used in solar panels, wind turbines, and other renewable technologies. In 2025, investments in renewable energy infrastructure are projected to reach unprecedented levels, creating a substantial demand for sheet metal fabrication services. These services are essential for producing durable and efficient components that can withstand harsh environmental conditions. The alignment of sheet metal fabrication with the renewable energy sector not only supports environmental goals but also positions manufacturers to capitalize on the burgeoning market for clean energy solutions.

Growing Emphasis on Energy Efficiency

The growing emphasis on energy efficiency is significantly influencing the sheet metal fabrication service market. Industries are increasingly adopting energy-efficient practices to reduce operational costs and comply with regulatory standards. In 2025, it is expected that energy-efficient building designs will drive demand for specialized sheet metal components, such as reflective roofing and insulated panels. These components not only contribute to energy savings but also enhance the overall sustainability of construction projects. As businesses and governments prioritize energy efficiency, the demand for sheet metal fabrication services that align with these goals is likely to increase. This trend underscores the importance of innovation in fabrication techniques to meet the evolving needs of energy-conscious consumers.

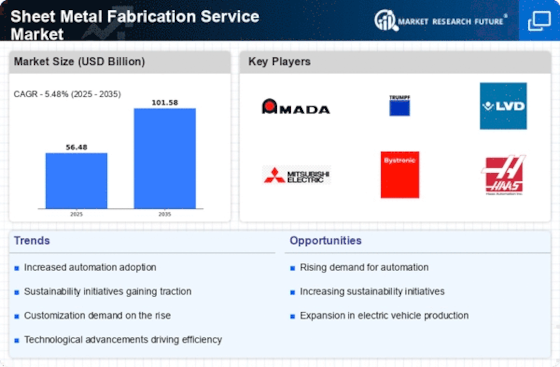

Technological Innovations in Fabrication Processes

Technological innovations are reshaping the landscape of the sheet metal fabrication service market. Advancements in automation, robotics, and computer-aided design (CAD) are enhancing production efficiency and precision. In 2025, it is anticipated that the integration of Industry 4.0 technologies will revolutionize fabrication processes, allowing for real-time monitoring and optimization. These innovations not only reduce lead times but also improve the quality of fabricated products. As manufacturers adopt these cutting-edge technologies, they are better positioned to meet the increasing demands for customization and rapid prototyping. The ability to produce complex geometries with high accuracy is likely to attract more clients to sheet metal fabrication services, thereby expanding the market.