Expansion of Renewable Energy Sector

The Sic On Insulator Film Market is significantly influenced by the expansion of the renewable energy sector. As the world increasingly shifts towards sustainable energy sources, the demand for efficient and reliable insulating materials in solar panels and wind turbines is on the rise. Sic On Insulator Films offer exceptional thermal stability and electrical insulation, making them ideal for use in renewable energy applications. The market is expected to witness a growth rate of around 10% as more manufacturers adopt these films to enhance the performance and longevity of renewable energy systems. This trend indicates a broader commitment to sustainability and energy efficiency, further propelling the Sic On Insulator Film Market.

Advancements in Semiconductor Technology

The Sic On Insulator Film Market is poised for growth due to advancements in semiconductor technology. As semiconductor devices become increasingly complex, the need for high-quality insulating materials is critical. Sic On Insulator Films provide superior dielectric properties, which are essential for the performance of modern semiconductor devices. The semiconductor market is projected to reach a valuation of over 500 billion dollars by 2026, with Sic On Insulator Films playing a crucial role in enhancing device efficiency and reducing power consumption. This trend suggests that the Sic On Insulator Film Market will continue to expand as manufacturers seek to innovate and improve the performance of their semiconductor products.

Rising Demand for High-Performance Electronics

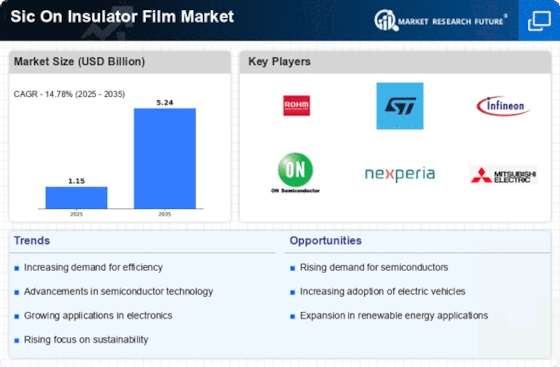

The Sic On Insulator Film Market is experiencing a notable surge in demand driven by the increasing need for high-performance electronic devices. As industries such as telecommunications, automotive, and consumer electronics evolve, the requirement for materials that can withstand high temperatures and provide excellent electrical insulation becomes paramount. The market for Sic On Insulator Films is projected to grow at a compound annual growth rate of approximately 8% over the next five years, reflecting the industry's shift towards more efficient and reliable electronic components. This growth is further fueled by the integration of advanced technologies such as 5G and electric vehicles, which necessitate the use of superior insulating materials to enhance performance and reliability.

Growing Awareness of Electrical Safety Standards

The Sic On Insulator Film Market is also influenced by the growing awareness of electrical safety standards. As regulatory bodies implement stricter safety guidelines, manufacturers are compelled to adopt materials that comply with these standards. Sic On Insulator Films, known for their excellent electrical insulation properties, are increasingly being utilized to meet these requirements. This trend is likely to drive market growth as companies prioritize safety and compliance in their product offerings. The Sic On Insulator Film Market could see an increase in demand, potentially growing at a rate of 6% as industries adapt to these evolving safety standards. This shift highlights the critical role of Sic On Insulator Films in ensuring electrical safety across various applications.

Increased Investment in Research and Development

The Sic On Insulator Film Market is benefiting from increased investment in research and development across various sectors. Companies are focusing on developing new materials and technologies that can enhance the performance of Sic On Insulator Films. This investment is likely to lead to the introduction of innovative products that meet the evolving needs of industries such as aerospace, automotive, and consumer electronics. As R&D efforts intensify, the market is expected to see a rise in the adoption of Sic On Insulator Films, which could potentially lead to a market growth rate of around 7% in the coming years. This trend underscores the importance of innovation in driving the Sic On Insulator Film Market forward.