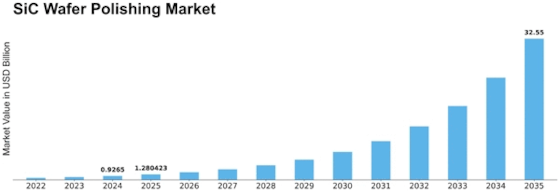

Sic Wafer Polishing Size

SiC Wafer Polishing Market Growth Projections and Opportunities

The SiC wafer polishing market is influenced by several market factors that play a pivotal role in shaping its dynamics. One of the primary factors driving the market is the increasing demand for SiC-based devices in various applications such as power electronics, automotive, and telecommunications. SiC wafers are essential components in the manufacturing of these devices, and as the demand for high-performance and energy-efficient electronic products grows, so does the demand for polished SiC wafers.

Technological advancements in the semiconductor industry also contribute significantly to the SiC wafer polishing market. As manufacturing processes become more sophisticated, there is a continuous need for improved polishing techniques to enhance the quality of SiC wafers. Innovations in polishing materials, equipment, and methods are crucial for achieving the desired level of smoothness and flatness in SiC wafers, ultimately impacting the market's growth.

Moreover, the market is influenced by the overall growth of the semiconductor industry. SiC wafers find applications in the production of high-frequency and high-power electronic devices, making them integral to the semiconductor manufacturing ecosystem. As the semiconductor industry continues to expand globally, the SiC wafer polishing market experiences a parallel growth trend, driven by the need for advanced materials in semiconductor fabrication.

The SiC wafer polishing market is also sensitive to fluctuations in raw material prices. Silicon carbide, the key material used in manufacturing SiC wafers, is subject to market price variations. Factors such as the availability of raw materials, geopolitical tensions, and global economic conditions can impact the cost of silicon carbide, thereby influencing the overall pricing and profitability of SiC wafer polishing. Market players closely monitor these factors to make informed decisions and maintain competitiveness.

Government regulations and policies related to the semiconductor industry also contribute to the market dynamics. Supportive policies, incentives, and investments in research and development initiatives aimed at advancing semiconductor technologies can positively impact the SiC wafer polishing market. Conversely, regulatory hurdles or trade restrictions may pose challenges for market players, affecting the overall growth of the industry.

Additionally, the market is influenced by the competitive landscape and strategic initiatives undertaken by key players. Technological collaborations, partnerships, mergers, and acquisitions play a crucial role in shaping the market structure. Companies that invest in research and development to introduce innovative polishing solutions gain a competitive edge, driving advancements in SiC wafer polishing technologies.

The SiC wafer polishing market is also influenced by end-user industries such as automotive, aerospace, and consumer electronics. The increasing adoption of SiC-based devices in these sectors fuels the demand for polished SiC wafers. Emerging applications in 5G technology and electric vehicles further contribute to the market's expansion, as SiC wafers play a vital role in enabling the performance and efficiency required in these applications.

Leave a Comment