Emerging Applications in Immunology

Emerging applications of single cell analysis in immunology are significantly influencing the Single Cell Analysis Market. The ability to analyze immune cells at the single-cell level is revolutionizing the understanding of immune responses and disease mechanisms. This is particularly relevant in the context of autoimmune diseases and infectious diseases, where cellular heterogeneity plays a critical role. The immunology market is anticipated to grow substantially, with single cell technologies being integral to the development of novel immunotherapies and vaccines. As researchers seek to unravel the complexities of the immune system, the demand for single cell analysis tools is likely to increase. This trend suggests that the Single Cell Analysis Market will continue to expand, driven by the need for innovative approaches to tackle pressing immunological challenges.

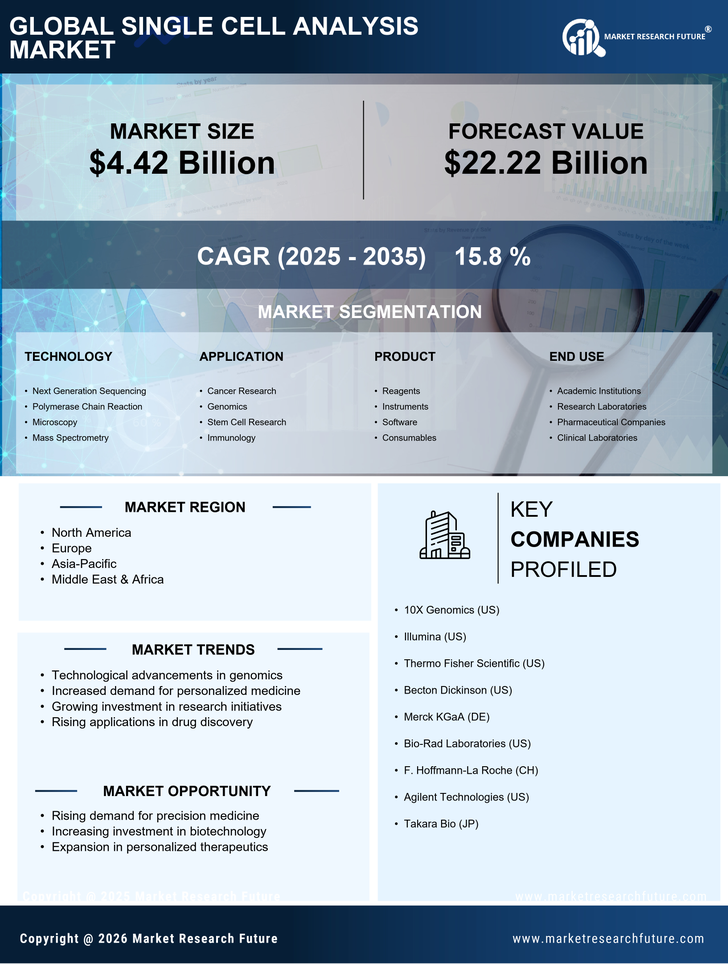

Rising Demand for Precision Medicine

The increasing emphasis on precision medicine is a pivotal driver for the Single Cell Analysis Market. As healthcare shifts towards more personalized treatment approaches, the need for detailed cellular insights becomes paramount. Single cell analysis enables researchers to understand the heterogeneity of diseases at a granular level, facilitating tailored therapies. According to recent estimates, the precision medicine market is projected to reach USD 217 billion by 2026, indicating a robust growth trajectory. This surge in demand for precision medicine directly correlates with the advancements in single cell technologies, which provide critical data for drug development and patient stratification. Consequently, the Single Cell Analysis Market is likely to experience significant growth as stakeholders seek innovative solutions to meet the evolving healthcare landscape.

Growing Applications in Cancer Research

The growing applications of single cell analysis in cancer research are propelling the Single Cell Analysis Market forward. As cancer remains one of the leading causes of mortality worldwide, understanding its complexity at the cellular level is crucial for developing effective therapies. Single cell analysis allows researchers to dissect tumor heterogeneity, identify rare cell populations, and monitor treatment responses in real-time. The cancer diagnostics market is projected to reach USD 200 billion by 2026, with single cell technologies playing a vital role in this growth. By providing insights into the molecular underpinnings of cancer, single cell analysis is becoming an indispensable tool for oncologists and researchers alike. Consequently, the Single Cell Analysis Market is expected to witness robust growth as it aligns with the urgent need for innovative solutions in cancer research.

Increased Funding for Research and Development

Increased funding for research and development is a significant driver of the Single Cell Analysis Market. Governments and private organizations are recognizing the importance of single cell technologies in advancing biomedical research. For instance, funding initiatives aimed at supporting innovative research projects have surged, with billions allocated to life sciences annually. This influx of capital is facilitating the development of novel single cell analysis tools and methodologies, thereby enhancing research capabilities. Moreover, collaborative efforts between academic institutions and industry players are fostering innovation and accelerating the translation of research findings into clinical applications. As funding continues to rise, the Single Cell Analysis Market is likely to benefit from enhanced research activities and the introduction of cutting-edge technologies that address critical scientific questions.

Technological Innovations in Single Cell Techniques

Technological innovations are transforming the Single Cell Analysis Market, driving its expansion. Recent advancements in microfluidics, imaging, and sequencing technologies have enhanced the ability to analyze individual cells with unprecedented accuracy and efficiency. For instance, the development of next-generation sequencing (NGS) has revolutionized genomic analysis, allowing for comprehensive profiling of single cells. The market for NGS is expected to grow at a CAGR of 20% through 2025, reflecting the increasing adoption of these technologies in research and clinical applications. Furthermore, innovations in data analysis tools are enabling researchers to extract meaningful insights from complex datasets, thereby accelerating discoveries in various fields, including oncology and immunology. As these technologies continue to evolve, the Single Cell Analysis Market is poised for substantial growth, driven by the demand for more precise and informative cellular data.