Regulatory Support

Regulatory frameworks are playing a crucial role in shaping the Single Phase Recloser Market. Governments and regulatory bodies are increasingly mandating the adoption of advanced recloser technologies to improve grid reliability and reduce outage durations. Policies aimed at enhancing energy efficiency and promoting renewable energy sources are driving utilities to invest in modern reclosers. For instance, certain regions have implemented incentives for utilities that adopt smart grid technologies, which include advanced reclosers. This regulatory support is expected to bolster market growth, as utilities seek to comply with evolving standards and improve service delivery. The market is anticipated to witness a steady increase in demand as these regulations take effect.

Technological Advancements

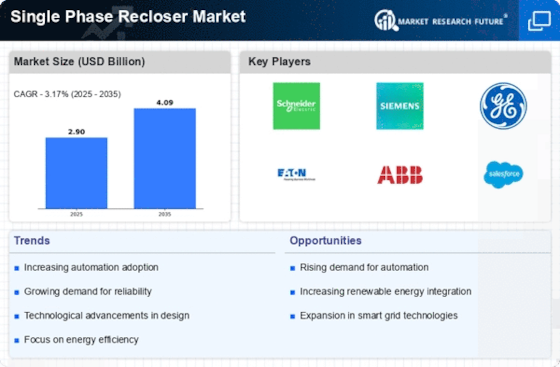

The Single Phase Recloser Market is experiencing a notable transformation due to rapid technological advancements. Innovations in automation and smart grid technologies are enhancing the functionality and efficiency of reclosers. These advancements allow for real-time monitoring and control, which significantly reduces outage times and improves system reliability. The integration of IoT devices into reclosers is also becoming prevalent, enabling utilities to gather data and optimize performance. According to recent estimates, the market for smart reclosers is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth is indicative of the increasing reliance on advanced technologies to enhance grid resilience and operational efficiency.

Increased Demand for Reliability

The demand for reliability in power distribution is a significant driver for the Single Phase Recloser Market. As consumers and businesses increasingly rely on uninterrupted power supply, utilities are compelled to enhance their infrastructure. The need to minimize outages and ensure consistent service is leading to a greater adoption of reclosers, which can automatically restore power after transient faults. Market analysis indicates that the demand for reliable power solutions is expected to rise, particularly in urban areas where the density of consumers is high. This trend is likely to result in a substantial increase in the installation of single phase reclosers, as utilities strive to meet customer expectations and regulatory requirements.

Rising Investment in Infrastructure

Investment in electrical infrastructure is a pivotal factor influencing the Single Phase Recloser Market. Many regions are undergoing significant upgrades to their aging power distribution systems, which necessitates the incorporation of modern recloser technologies. This investment trend is driven by the need to enhance grid reliability and accommodate the growing demand for electricity. According to industry reports, the global investment in power infrastructure is projected to reach trillions of dollars over the next decade. Such investments are likely to create substantial opportunities for the single phase recloser market, as utilities seek to modernize their systems and improve operational efficiency.

Growing Focus on Renewable Energy Integration

The integration of renewable energy sources into the power grid is increasingly influencing the Single Phase Recloser Market. As more utilities adopt solar, wind, and other renewable technologies, the need for reliable and efficient power management solutions becomes paramount. Single phase reclosers play a critical role in managing the variability associated with renewable energy generation. They help maintain grid stability by quickly isolating faults and restoring service. The market is expected to grow as utilities invest in reclosers that can effectively support the integration of renewables, ensuring a stable and reliable power supply. This trend reflects a broader shift towards sustainable energy practices and the modernization of electrical infrastructure.