Market Analysis

In-depth Analysis of Single-Photon Emission Computed Tomography Market Industry Landscape

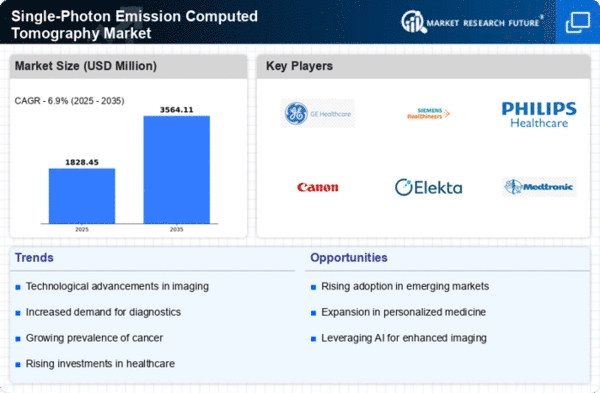

The market dynamics of Single-Photon Emission Computed Tomography (SPECT) mirror a complex interaction of technological advancements, healthcare trends, and regulatory influences. Advances in SPECT generation are a riding force in market dynamics. Continuous upgrades in detector generation, photograph reconstruction algorithms, and the combination of hybrid imaging systems, including SPECT/CT, enhance the diagnostic abilities of SPECT scanners, contributing to improved adoption and market boom. The versatility of SPECT in numerous medical packages shapes market dynamics. SPECT performs an essential function in nuclear medicine for imaging and diagnosing conditions consisting of cardiovascular sicknesses, cancer, and neurological disorders. The increasing variety of scientific packages broadens the market's scope and relevance in the healthcare landscape. The growing occurrence of continual sicknesses, which include cardiovascular problems and cancer, notably affects market dynamics. SPECT's ability to provide detailed practical information aids in the early detection and tracking of those conditions, riding its adoption as a precious diagnostic tool. The increasing demand for nuclear medicine approaches contributes to market dynamics. SPECT is a key component of nuclear imaging, and the growing range of nuclear medication research for both diagnostic and healing functions drives the demand for SPECT scanners in healthcare facilities. Market dynamics are stimulated through the fee-effectiveness and accessibility of SPECT generation. Compared to a few superior imaging modalities, SPECT structures are regularly more price-powerful, making them a viable choice for healthcare companies, specifically in aid-restricted settings. This affordability complements market penetration. Regulatory frameworks and compliance requirements play a pivotal role in shaping market dynamics. Adherence to regulatory necessities ensures the protection and efficacy of SPECT structures, and evolving rules impact product development, market access, and normal enterprise practices. Concerns about radiation exposure contribute to market dynamics. The enterprise's commitment to minimizing radiation doses without compromising diagnostic accuracy influences the improvement of recent technologies and protocols, aligning with the growing emphasis on affected person protection in healthcare. Ongoing studies and improvement projects make contributions to market dynamics by fostering innovation. Investments in novel radiotracers, imaging protocols, and software answers beautify the abilities of SPECT, using its continued relevance within the evolving landscape of diagnostic imaging. The globalization of healthcare offerings impacts market dynamics, with a growing demand for standardized diagnostic answers internationally. SPECT's position as a flexible imaging device aligns with the globalization trend, leading to elevated adoption in various healthcare settings.

Leave a Comment