Market Share

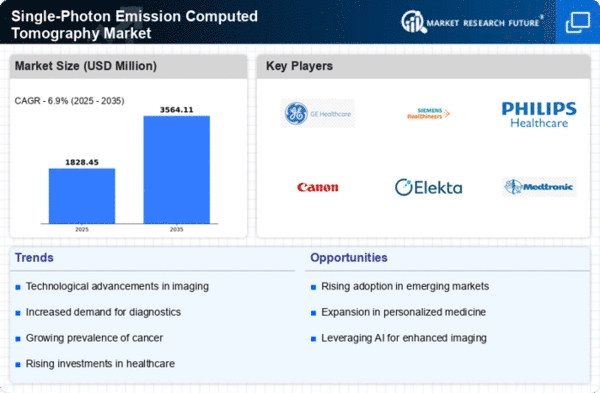

Single-Photon Emission Computed Tomography Market Share Analysis

The Single-Photon Emission Computed Tomography (SPECT) market has seen a giant boom due to its diagnostic competencies in nuclear medicinal drugs. As the demand for superior imaging technologies rises, organizations in this market rent various strategies to put themselves competitively and seize a massive share of the market. Integrating SPECT with different imaging modalities, such as positron emission tomography (PET), is a strategic pass. Companies develop hybrid imaging structures that combine the strengths of more than one technology, providing clinicians with comprehensive diagnostic records. This integration enhances the diagnostic talents of SPECT systems and expands their applications. Companies strategically position their SPECT structures by emphasizing precise medical packages. This may also consist of oncology, cardiology, neurology, or musculoskeletal imaging. Tailoring advertising and marketing efforts and product features to cope with the specific requirements of every clinical distinctiveness allows corporations to capture areas of interest in markets and improve their presence in specialized healthcare fields. To increase market proportion, groups pursue worldwide market penetration techniques. This entails navigating various regulatory landscapes, establishing distribution networks, and adapting merchandise to satisfy nearby choices and requirements. A global presence enables groups to tap into the growing global demand for superior diagnostic imaging technologies. Building sturdy collaborations with healthcare establishments is a key method. Companies work intently with hospitals, clinics, and study facilities to apprehend their precise imaging wishes and tailor their SPECT systems. Collaborative partnerships make contributions to product improvement, clinical validation, and expanded adoption of SPECT generation. Recognizing the importance of user proficiency, agencies spend money on education and training packages. The purpose of these initiatives is to train healthcare professionals on the optimum use of SPECT systems, interpretation of pix, and upkeep strategies. Well-educated users contribute to the effective utilization of the SPECT era and high-quality user reports. In a healthcare landscape in which cost-effectiveness is critical, organizations may additionally adopt strategies to place their SPECT structures as economically feasible solutions. This approach involves presenting systems with aggressive pricing, value-efficient maintenance, and functions that contribute to average operational efficiency in healthcare settings. Adherence to stringent regulatory requirements is non-negotiable. Companies that prioritize regulatory compliance instill self-belief in healthcare experts and institutions, assuring them of the protection and reliability of SPECT structures. Compliance efforts make contributions to constructing a superb brand image and retaining a robust market position.

Leave a Comment