Surge in Data Center Investments

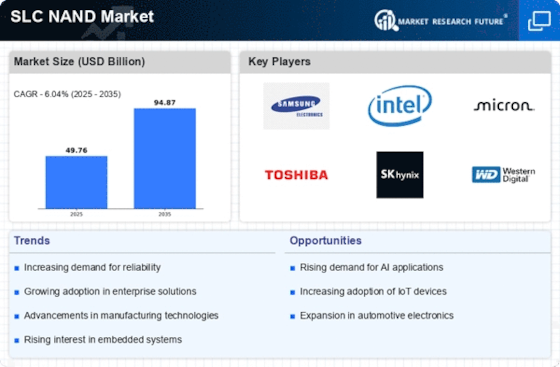

The ongoing expansion of data centers is a crucial driver for the SLC NAND Market. With the increasing volume of data generated daily, organizations are investing heavily in data center infrastructure to ensure efficient data management and storage. SLC NAND Market flash memory offers superior performance and reliability, making it an attractive option for data centers that require high-speed data access and low latency. Recent reports indicate that The SLC NAND Market is expected to grow at a compound annual growth rate of over 10% through 2026. This growth is likely to create substantial opportunities for SLC NAND Market manufacturers, as data centers seek to upgrade their storage solutions to handle the escalating data demands.

Increasing Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is driving the SLC NAND Market. As more devices become interconnected, the demand for reliable and high-performance storage solutions intensifies. SLC NAND Market flash memory, known for its durability and speed, is particularly suited for IoT applications, where data integrity and quick access are paramount. According to recent estimates, the number of IoT devices is projected to reach 30 billion by 2030, which could significantly boost the SLC NAND Market. This trend suggests that manufacturers are likely to invest in SLC NAND Market technology to meet the growing storage needs of these devices, thereby enhancing their market presence.

Advancements in Automotive Technology

The advancements in automotive technology are emerging as a vital driver for the SLC NAND Market. With the rise of electric vehicles (EVs) and autonomous driving systems, the demand for high-performance storage solutions is increasing. SLC NAND Market flash memory is particularly suited for automotive applications due to its reliability and speed, which are critical for real-time data processing in vehicles. As the automotive industry continues to innovate, the integration of advanced driver-assistance systems (ADAS) and infotainment systems is likely to drive the demand for SLC NAND Market. Market forecasts suggest that the automotive semiconductor market could reach over 100 billion by 2025, indicating a substantial opportunity for SLC NAND Market manufacturers to capitalize on this growing sector.

Growing Need for Enhanced Data Security

The escalating concerns regarding data security are propelling the SLC NAND Market forward. As cyber threats become more sophisticated, organizations are prioritizing secure storage solutions to protect sensitive information. SLC NAND Market flash memory offers robust security features, including encryption capabilities, which are essential for safeguarding data. The increasing regulatory requirements surrounding data protection are also driving the demand for secure storage solutions. Recent studies indicate that The SLC NAND Market is projected to grow significantly, potentially exceeding 200 billion by 2025. This trend suggests that SLC NAND Market manufacturers may focus on enhancing security features in their products to cater to the evolving needs of businesses, thereby strengthening their position in the market.

Emergence of Artificial Intelligence Applications

The rise of artificial intelligence (AI) applications is influencing the SLC NAND Market significantly. AI systems require vast amounts of data to function effectively, necessitating high-performance storage solutions. SLC NAND Market flash memory, with its fast read and write speeds, is well-positioned to support the data-intensive requirements of AI applications. As organizations increasingly adopt AI technologies across various sectors, the demand for SLC NAND Market is expected to rise. Market analysts suggest that the AI market could reach a valuation of over 500 billion by 2024, which may lead to a corresponding increase in the SLC NAND Market as companies seek to optimize their storage capabilities for AI workloads.