Small Arms Size

Market Size Snapshot

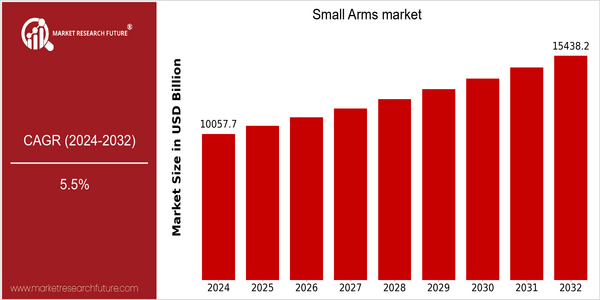

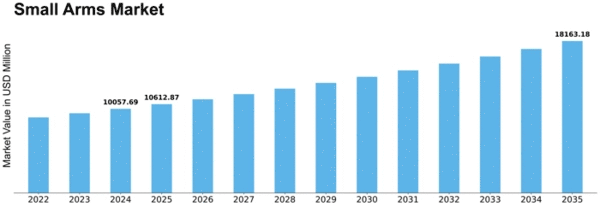

| Year | Value |

|---|---|

| 2024 | USD 10057.69 Billion |

| 2032 | USD 15438.2 Billion |

| CAGR (2024-2032) | 5.5 % |

Note – Market size depicts the revenue generated over the financial year

The armaments market is expected to grow to a value of about 10 billion dollars in 2024 and 15 billion dollars in 2032. The growth rate is 5.5%. This is largely due to the growing demand for small arms, which is a consequence of increasing international tensions, modernization programs and the increasing concern for personal security. Also, technological advances in the manufacture of small arms, such as the integration of smart technology and the use of improved materials, contribute to the growth of the market. Modular weapons systems and improved ammunition appeal to both military and civilian consumers. The main market players, such as Lockheed Martin, BAE Systems and Heckler & Koch, are involved in strategic initiatives such as cooperation, investment in research and development and the introduction of new products to strengthen their market position and meet changing customer requirements. All this indicates a strong market for small arms in the coming years.

Regional Market Size

Regional Deep Dive

The market for small arms is characterized by a complex interplay of demand from both the civilian and military sectors in various regions. In North America the market is influenced by a strong gun culture, a legal framework and the constant development of new gun technology. In Europe, on the other hand, the market is characterized by stringent regulations that determine market dynamics, while Asia-Pacific is experiencing rapid growth due to increased defense budgets and rising security concerns. Middle East and Africa are characterized by geopolitical tensions that drive the demand for small arms, while Latin America is experiencing crime and violence that also influence the market. Each region offers its own opportunities and challenges that shape the market for small arms.

Europe

- The European Union's Firearms Directive has led to stricter regulations on civilian firearm ownership, prompting manufacturers to adapt their offerings to comply with new standards.

- Countries like Germany and France are investing in advanced small arms technology, focusing on modular designs and enhanced lethality, which is expected to drive innovation in the market.

Asia Pacific

- Countries such as India and China are significantly increasing their defense budgets, leading to a surge in demand for small arms and ammunition, with local manufacturers like Indian Ordnance Factories stepping up production.

- The rise of non-state actors and terrorism in the region has prompted governments to enhance their security measures, further driving the demand for small arms.

Latin America

- Countries like Brazil and Mexico are facing high levels of violence, prompting governments to invest in small arms for law enforcement and military use, with local manufacturers like Taurus gaining prominence.

- Recent legislative efforts in Brazil to ease gun ownership laws are expected to boost the civilian market for small arms, reflecting a shift in public sentiment towards firearm ownership.

North America

- The U.S. continues to lead in small arms production and consumption, with companies like Smith & Wesson and Sturm, Ruger & Co. innovating in firearm technology, including smart guns and enhanced safety features.

- Recent regulatory changes, such as the proposed 'Bipartisan Background Checks Act', aim to tighten gun control, which could impact sales and consumer behavior in the market.

Middle East And Africa

- Ongoing conflicts in regions like Syria and Yemen have led to a high demand for small arms, with companies like IWI (Israel Weapon Industries) capitalizing on this need by supplying advanced weaponry.

- The African Union's initiatives to combat illegal arms trafficking are influencing market dynamics, as governments seek to regulate and control small arms proliferation.

Did You Know?

“Approximately 393 million civilian-owned firearms are estimated to exist in the United States, which is more than the total population of the country, highlighting the deep-rooted culture of gun ownership.” — Small Arms Survey 2018

Segmental Market Size

Small arms play a key role in the security and defense industry, and is currently in a stable position, backed by the current geopolitical tensions and the rising military budgets. The growing need for personal and national security is also a major factor, along with the regulatory support for police and military modernization. Technological developments, such as smart sights and lightweight materials, further strengthen the small arms market in all its applications. The market for small arms is now in a mature phase, with a number of strong market leaders such as Smith & Wesson and Glock setting the standards. North America and Europe lead the way in terms of military, police and civilian self-defense. Changing trends such as urbanization and rising crime rates are also contributing to the growth. New production methods such as 3D printing and advanced materials are making small arms more accessible and efficient for the end-users.

Future Outlook

The small arms market is set to grow at a robust CAGR of 5.5% between 2024 and 2032. The growth is due to the increasing concern for security, increasing military spending, and the growing civilian market for self-defense and hunting. As nations continue to modernize their armed forces and enhance their defense capabilities, the demand for advanced small arms is likely to rise, especially in regions with geopolitical tensions. The integration of smart technology and advanced materials will reshape the small arms landscape. Lighter weight and improved performance are the result of innovations in materials and design. The changing requirements of the military and law enforcement agencies will be met by innovations in lightweight materials and design. And the increasing acceptance of private ownership of firearms due to changing regulations and the growing concern for personal security will further penetrate the market. By 2032, the civilian share of the small arms market is expected to be around 30%, resulting in a major shift in the buyer behavior and the market dynamics. The small arms market is going through a period of change, which is full of both challenges and opportunities, as it adapts to the rapidly changing global landscape.

Leave a Comment