Civilian Demand for Firearms

The Global Small Arms Industry is also influenced by the rising civilian demand for firearms. Factors such as personal safety concerns, hunting, and sport shooting contribute to this trend. In many countries, there is a growing acceptance of firearm ownership, leading to increased sales of small arms to civilians. For instance, the number of registered firearms in the United States has reached over 400 million, reflecting a robust civilian market. This demand is expected to sustain the growth of the industry, as manufacturers adapt their offerings to meet the needs of civilian customers.

Rising Global Defense Budgets

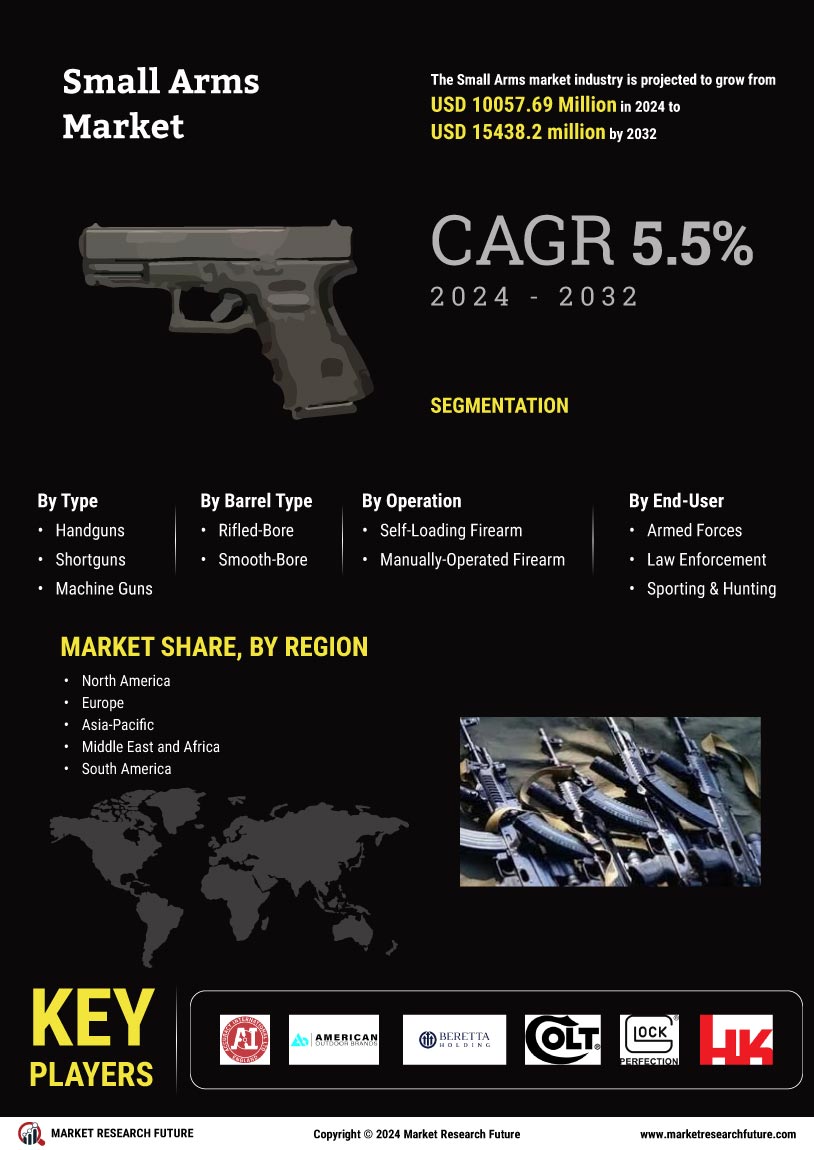

The Global Small Arms Industry is experiencing growth driven by increasing defense budgets across various nations. Countries are prioritizing military modernization and enhancing their defense capabilities, leading to a surge in demand for small arms. For instance, the global defense spending is projected to reach approximately 2.1 trillion USD in 2024, with a significant portion allocated to small arms procurement. This trend indicates a robust market environment, as governments seek to bolster their military readiness in response to evolving security threats. As a result, the Global Small Arms Industry is anticipated to grow to 10.1 USD Billion in 2024.

Regulatory Changes and Policies

Regulatory changes and policies play a significant role in shaping the Global Small Arms Industry. Governments are continuously revising their firearms regulations, which can either facilitate or hinder market growth. For example, some countries are implementing stricter controls on firearm sales, while others are easing restrictions to promote civilian ownership. These regulatory environments can create opportunities for manufacturers to expand their market presence or adapt their strategies accordingly. As such, understanding the regulatory landscape is crucial for stakeholders in the Global Small Arms Industry.

Escalating Geopolitical Tensions

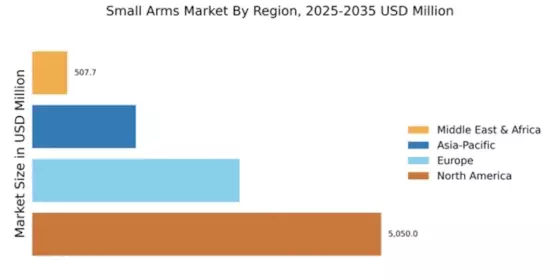

Geopolitical tensions are a critical driver of the Global Small Arms Industry. Ongoing conflicts and territorial disputes in regions such as Eastern Europe and the Middle East have heightened the demand for small arms. Nations are increasingly investing in their military capabilities to address perceived threats, which in turn fuels the small arms market. For example, the conflict in Ukraine has prompted neighboring countries to enhance their military arsenals. This environment of uncertainty is likely to sustain the market's growth trajectory, with projections indicating an increase to 18.1 USD Billion by 2035.

Technological Advancements in Small Arms

Technological advancements are reshaping the Global Small Arms Industry, leading to the development of more efficient and effective weaponry. Innovations such as smart ammunition, modular weapon systems, and enhanced targeting technologies are becoming increasingly prevalent. These advancements not only improve the operational capabilities of small arms but also attract investment from defense contractors and governments alike. As a result, the market is poised for growth, with a projected compound annual growth rate of 5.5% from 2025 to 2035. This trend underscores the importance of technological innovation in driving market dynamics.