Market Share

Small UAV Market Share Analysis

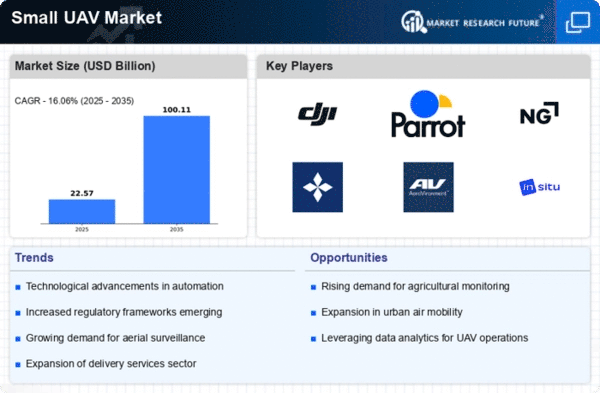

The Small Unmanned Aerial Vehicle (UAV) market has witnessed remarkable growth in recent years, driven by technological advancements and an increasing demand for versatile drone solutions. In this dynamic landscape, companies are strategically positioning themselves to gain a significant market share. One prevalent strategy involves focusing on niche markets and specialized applications. Through designing and modifying UAVs to fit specific industries including agriculture, construction or surveying, organizations are able to meet specialized needs of clients within those fields. Through this approach, a tailored marketing drive can be performed in niche markets, which is equal to building a strong foothold in a particular market and getting a loyal clientele. The other market share positioning strategy around the product differentiation is also of vital importance. With the development of more advanced technologies, the firms work on developing UAVs with specific features or abilities that outperform other competitors. This could be extended flight projections, high-performance battery life, advanced detectors, better data processing, and more. Companies can attract customer who are seeking specific features, by providing exclusive and key functions and this way win a slice of the market and get ahead of their competitors. The fact that there is a steep rise in civil and commercial application processing is one of the most driving factors that are influencing the global small Unmanned Aerial Vehicle (UAV) market. The fast pop up of the commercial small UAVs market is mainly attributed to the improvements in technology and the cost-efficiency that are associated with their acquisition and operation. These UAVs provide a lot of services in such operations as surveying, aerial photo-shooting, monitoring gas and oil pipelines, 3D mapping, wind turbines blade inspection, and so many other fields. In addition to that, the booming of the markets in Asia - Pacific, South America and the Middle East for using Unmanned Aerial Vehicles (UAVs), mainly in military applications is leading to the increased growth of the overall market. Collaboration and partnerships have shown to be crucial in enforcing the market positioning of small UAVs. Through associating with other technology suppliers, businesses widen their product lines and expand their markets. Consider, an UAV manufacturer might jointly partner with a software development firm to merge in advanced analytics solutions into their drones, thereby enabling the end customers with a unified solution with ease. Such alliances, in addition to bringing technical advances into the scene, result in access to each other's customers which is a win-win situation. The pricing strategies, too, are to be regarded in which niche the small UAV industry can carve its position. Firms may find it useful to offer a reasonable pricing in order to target those who are cost-conscious, providing themselves as a mid-range option without sacrificing quality. Additionally, good customer service and support is becoming an essential feature which may help shape the Small UAV market. Companies that prioritize excellent customer service and provide robust support for their products can build trust and loyalty among customers. This not only helps in retaining existing customers but also attracts new ones through positive word-of-mouth and reputation building. In a rapidly evolving industry where technology can be complex, reliable customer support can be a decisive factor in market share acquisition.

Leave a Comment