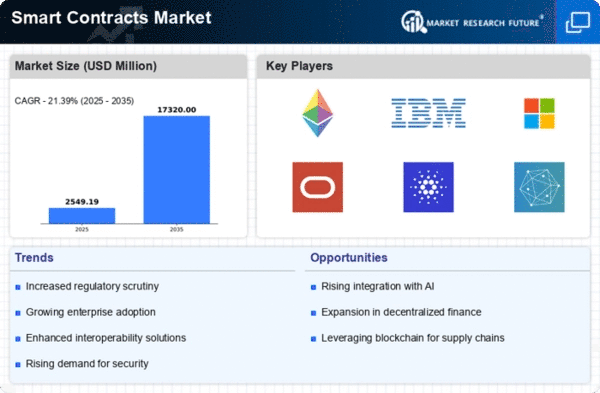

Market Growth Projections

The Global Smart Contracts Market Industry is poised for substantial growth, with projections indicating a market size of 2.1 USD Billion in 2024 and an anticipated increase to 16.5 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 20.58% from 2025 to 2035, driven by factors such as increased blockchain adoption, regulatory support, and the demand for decentralized finance solutions. The market's expansion is indicative of the growing recognition of smart contracts as a transformative technology across various industries, suggesting a robust future for this sector.

Cost Efficiency and Automation

Cost efficiency is a primary driver for the Global Smart Contracts Market Industry, as organizations seek to minimize expenses associated with traditional contract management. Smart contracts automate processes, reducing the need for intermediaries and manual oversight. This automation leads to faster transaction times and lower costs, making smart contracts an attractive option for businesses. For instance, companies in the logistics sector are utilizing smart contracts to automate shipment tracking and payment processes, which enhances operational efficiency. The anticipated compound annual growth rate of 20.58% from 2025 to 2035 underscores the growing recognition of these benefits.

Regulatory Support and Frameworks

The Global Smart Contracts Market Industry benefits from the establishment of regulatory frameworks that support the use of smart contracts. Governments worldwide are recognizing the potential of blockchain technology and are working towards creating legal standards that facilitate its adoption. For example, countries like Switzerland and Singapore have implemented regulations that promote the use of smart contracts in various applications. This regulatory clarity not only boosts investor confidence but also encourages businesses to adopt smart contracts, potentially contributing to a market growth trajectory that could reach 16.5 USD Billion by 2035.

Integration with Internet of Things (IoT)

The integration of smart contracts with Internet of Things (IoT) devices is emerging as a crucial driver for the Global Smart Contracts Market Industry. This convergence enables automated interactions between devices, enhancing operational efficiency across various sectors. For example, in smart cities, IoT devices can trigger smart contracts for utility payments based on real-time consumption data. This integration not only streamlines processes but also fosters innovation in applications such as supply chain management and energy distribution. As IoT adoption continues to rise, the demand for smart contracts is likely to increase, further supporting market growth.

Increasing Adoption of Blockchain Technology

The Global Smart Contracts Market Industry is experiencing a surge in adoption of blockchain technology across various sectors. This trend is driven by the need for enhanced security, transparency, and efficiency in transactions. Industries such as finance, supply chain, and healthcare are increasingly integrating smart contracts to automate processes and reduce operational costs. For instance, the financial sector is leveraging smart contracts to streamline loan agreements and insurance claims, which could potentially lead to a market valuation of 2.1 USD Billion in 2024. As organizations recognize the benefits of blockchain, the demand for smart contracts is likely to escalate.

Rising Demand for Decentralized Finance (DeFi) Solutions

The Global Smart Contracts Market Industry is significantly influenced by the rising demand for decentralized finance solutions. DeFi platforms utilize smart contracts to facilitate financial transactions without intermediaries, appealing to users seeking greater control over their assets. This trend is particularly evident in the cryptocurrency space, where smart contracts underpin various DeFi applications, including lending and trading platforms. As more individuals and institutions engage with DeFi, the demand for smart contracts is expected to grow, further propelling the market's expansion. The increasing user base and transaction volume in DeFi could contribute to the projected market growth.