Top Industry Leaders in the Smart e-Drive Market

The Electrified Battleground: An In-Depth Exploration of the Competitive Terrain in the Intelligent Electric Propulsion Market

The automotive domain is undergoing a profound transformation, as conventional fuels yield ground to a more environmentally friendly, electrified destiny. At the core of this upheaval lies the intelligent electric propulsion, the cognitive and robust essence of electric vehicles. This intricate amalgamation of batteries, motors, power electronics, and software dictates not only performance and efficiency but also shapes consumer inclinations. With the surge in demand for electric vehicles, the arena of intelligent electric propulsion finds itself immersed in a vigorous contest for supremacy, where established entities, technological behemoths, and burgeoning ventures all strive for a slice of the burgeoning pie.

Key Contenders and Their Stratagems:

- Robert Bosch (Germany)

- Schaeffler (Germany)

- UQM Technologies (U.S.)

- BorgWarner (U.S.)

- Shanghai Edrive (China)

- Infineon (Germany)

- Efficient Drivetrains (U.S.)

- SINOEV (U.S.)

- Siemens (Germany)

- Continental (Germany)

- Aisin Seiki (Japan), among others.

• Dominant Automotive Titans: Seasoned automakers such as Volkswagen, Toyota, and General Motors leverage their substantial resources and manufacturing acumen to devise proprietary electric propulsion systems. VW's MEB platform serves as a prime illustration, empowering numerous electric models under the banners of Audi, Škoda, and Porsche. These entities concentrate on vertical integration, internal research and development, and strategic alliances to fortify their supply chains and streamline costs.

• Tier 1 Suppliers: Industry stalwarts like Bosch, Continental, and Magna International, renowned for automotive components, proactively adapt to the electric vehicle landscape. They furnish modular electric propulsion solutions that cater to an array of vehicle types and financial scopes. Their strategies meld off-the-shelf frameworks with personalized alternatives, providing automakers with the flexibility and scalability they seek.

• Technological Pioneers: Silicon Valley is an active participant in the electric vehicle boom. Technological juggernauts such as Tesla and Apple push the boundaries of electric propulsion technology with AI-fueled control systems, cutting-edge battery management, and self-driving capabilities. Their emphasis on software integration and avant-garde features disrupts the established order.

• Emerging Ventures and Specialized Participants: Nimble entrants like Rimac and Arrival carve distinctive niches. Rimac concentrates on high-performance electric propulsion systems for luxury vehicles, while Arrival revolutionizes the commercial vehicle sector with modular electric platforms tailored for buses and vans. These innovators bring fresh perspectives and nimble development cycles to the market.

Factors Influencing Market Share Assessment: • Technological Supremacy: Entities boasting state-of-the-art electric propulsion systems, delivering superior range, efficiency, and performance, will capture both hearts and market share. Strategic investments in research and development and robust patent portfolios play pivotal roles in this competitive race.

• Cost-Efficiency: Overcoming the hurdle of affordable electric propulsion systems is crucial for widespread electric vehicle adoption. Entities capable of optimizing production processes, strategically sourcing materials, and providing cost-effective solutions will gain a competitive advantage.

• Scalability and Platform Adaptability: Automakers necessitate electric propulsion platforms adaptable to diverse vehicle types and production scales. The key lies in modular designs and customizable options, catering to varied requirements and attaining economies of scale.

• Resilient Supply Chains: Ensuring a continuous supply of critical raw materials like lithium and cobalt is imperative for uninterrupted production. Constructing robust supply chains, diversifying sourcing channels, and exploring recycling avenues are vital for sustained success.

Emerging Trends and Novelties: • Solid-State Batteries: The upcoming generation of batteries promises heightened energy density, faster charging intervals, and enhanced safety. Companies such as Toyota and Samsung heavily invest in developing commercially viable solid-state batteries, poised to challenge the current dominance of lithium-ion batteries.

• Silicon Carbide Power Electronics: The substitution of traditional silicon with silicon carbide in power electronics reduces energy losses and facilitates rapid charging. This technology gains traction due to its efficiency and performance advantages.

• Software-Defined Electric Propulsion: Advanced software algorithms optimize power delivery, enhance energy management, and enable personalized driving experiences. The capability to remotely update software and unveil new features through over-the-air updates becomes a critical distinguishing factor.

• Vehicle-to-Grid (V2G) Integration: Intelligent electric propulsion systems with bi-directional charging capabilities can channel electricity back into the grid during peak demand. This technology not only benefits the grid but also opens avenues for potential revenue streams for electric vehicle owners.

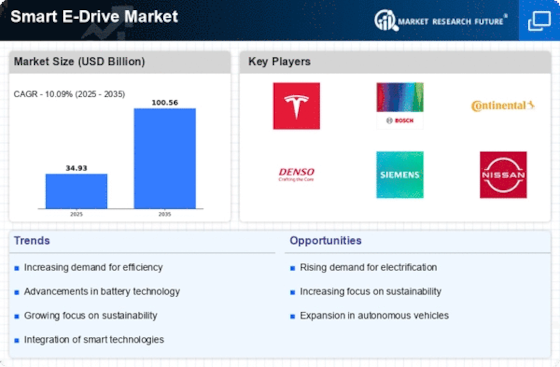

Overall Competitive Landscape: The intelligent electric propulsion market unfolds as a dynamic and swiftly evolving terrain. The competition is intense, featuring established entities, technological giants, and pioneering startups contending for dominance. Success hinges on a blend of factors, including technological supremacy, cost-efficiency, scalability, supply chain resilience, and adaptability to emerging trends. Collaboration and strategic partnerships emerge as pivotal strategies to navigate this intricate ecosystem. As the electric vehicle revolution gains momentum, the intelligent electric propulsion market stands on the brink of explosive growth, with the victors poised to shape the future of mobility.

In-depth research and examination of specific entities, technologies, and regional trends can provide profound insights for market participants and prospective investors.

Industry Progressions and Recent Updates:

Robert Bosch (Germany): • December 19, 2023: Announced a collaborative venture with Contemporary Amperex Technology Co., Ltd. (CATL) to conceptualize and produce high-performance silicon carbide power modules for electric vehicles. (Source: Bosch press release) • November 10, 2023: Unveiled a novel eAxle concept designed for commercial vehicles at the IAA Transportation exhibition in Hanover, Germany. (Source: Bosch website)

Schaeffler (Germany): • December 15, 2023: Disclosed plans to allocate €1 billion for expanding its e-mobility production capacity by 2026. (Source: Reuters) • October 26, 2023: Successfully tested its prototype ePave system, a wireless charging solution for electric vehicles in motion. (Source: Schaeffler website)

UQM Technologies (U.S.): • December 12, 2023: Secured a $20 million contract from a prominent truck manufacturer to provide electric motors for heavy-duty trucks. (Source: UQM Technologies press release) • September 20, 2023: Unveiled the PowerPhase Pro electric motor, enhancing power and efficiency for commercial vehicles. (Source: UQM Technologies website)

BorgWarner (U.S.): • December 07, 2023: Announced a strategic partnership with Geely Technology Group to formulate and supply integrated drive systems for electric vehicles in China. (Source: BorgWarner press release)• August 02, 2023: Acquired Amotech, a leading provider of high-voltage battery disconnect units for electric vehicles. (Source: BorgWarner website)