Research Methodology on Smart Grid Market

1. Introduction

This research report, commissioned by Market Research Future (MRFR) to explore and assess the Smart Grid Market, is based on a comprehensive and methodologically sound overview and analysis of the market. The purpose of the research is to provide an in-depth market analysis comprising integrated research elements, including a thorough evaluation of the market, its existent and forecasted market size and composition, value chain, analysis of demand and supply side trends and the relationships between the different entities and within the wider energy sector.

The research is framed by a comprehensive, multifaceted research methodology which seeks to provide answers to the research inquiries not just in terms of market size, composition and status but also promptly and with reliable accuracy and precision. The proposed methodology is structured as follows:

2. Research Objectives

The research aims to provide a comprehensive evaluation of:

-The current and potential size and composition of the Smart Grid Market

-Demand and supply factors driving the market

-The market opportunity and the associated value chain

-Impact of key drivers and market risks

-Threats and opportunities facing the market

3. Data Collection and Analysis

Data collection is the most vital part of any research process and MRF has utilized secondary sources extensively to acquire an initial snapshot of the market, its size and key participants. In order to provide the most comprehensive analysis and accurate forecast of the Smart Grid Market, MRFR has used primary and secondary data sources. This includes interviews and surveys, data obtained from interviews with corporate executives, research papers and trade magazines, reports from governments, consultancies, and international organizations and existing academic literature.

MRFR also monitors and harnesses technological developments, and evaluates data from publicly available sources such as stock, bonds and other financial information, acquired from market reports and company databases.

The primary research was preceded by secondary research obtained from government sources, trade bodies, business associations, and other organizations. Statistical and analytical techniques, such as regression and rating analysis, have been utilized to orchestrate data. Besides, demographic and regional analysis has been applied to derive applicable findings.

4. Models and Hypotheses

The current state of the Smart Grid Market and its forecasted trajectory are analysed using Porter's Five Force Model. This model is based on the interactions between five key actors in the market: suppliers, buyers, substitute products, new entrants, and industry competitors. By mapping out the market and the relationships between the actors, Porter's Five Force Model seeks to predict the expected profitability of the market.

Additionally, the economic and industrial life cycle model is employed to evaluate the market maturity and likelihood of new entrants. This model evaluates elements such as supply and demand, competition, technological innovation, product life cycle, and profit potential.

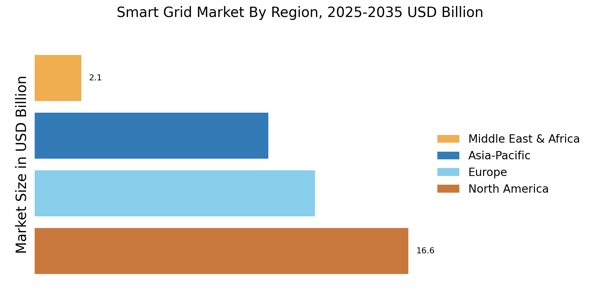

Furthermore, the smart grid market is also evaluated using the demographic and regional analysis approach. This involves segmenting the market by age groups, gender, lifestyle, and geographic areas in which customers reside. This approach helps to paint a clearer picture of the potential opportunities for the market in different regions.

5. Conclusion

This research report provides a comprehensive and methodologically sound overview and analysis of the Smart Grid Market and its current and predicted trajectory. The research methodology seeks to provide answers to the questions raised not just in terms of market size, composition and status but also promptly and with reliable accuracy and precision.

The research methodology is based on reliable secondary and primary data obtained from multiple sources and includes interviews, surveys and data obtained from corporate executives, trade magazines and reports, and existing academic literature. Additionally, the research utilizes Porter's Five Force Model, the economic and industrial life cycle model and the demographic and regional analysis approach to evaluate the market in a fair and balanced manner. It must be noted that while the research methodology is based on reliable and accurate data and assumptions, the results of the research must still be taken with due caution.