Increased Focus on Home Automation

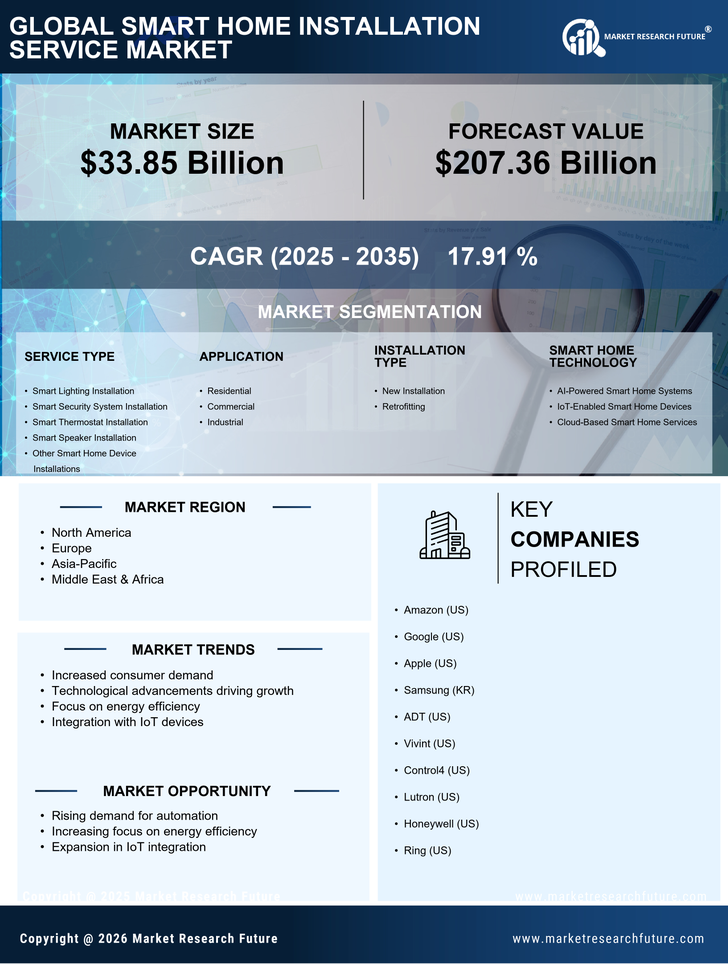

The Smart Home Installation Service Market is significantly influenced by the increasing focus on home automation. Homeowners are increasingly recognizing the benefits of automating various aspects of their living spaces, such as lighting, heating, and security systems. This trend is reflected in market data, which indicates that the home automation segment is projected to grow at a compound annual growth rate of over 25% in the coming years. As more consumers seek to integrate multiple smart devices into cohesive systems, the need for professional installation services becomes paramount. This shift towards automation is likely to drive growth within the Smart Home Installation Service Market.

Growing Awareness of Energy Efficiency

The Smart Home Installation Service Market is also propelled by a growing awareness of energy efficiency among consumers. As energy costs continue to rise, homeowners are increasingly seeking solutions that reduce consumption and lower utility bills. Smart home technologies, such as energy-efficient appliances and smart thermostats, offer significant savings potential. Market Research Future indicates that homes equipped with smart devices can reduce energy usage by up to 30%. This awareness drives consumers to seek professional installation services to optimize their smart home systems, thereby enhancing the overall appeal of the Smart Home Installation Service Market.

Rising Consumer Demand for Smart Homes

The Smart Home Installation Service Market experiences a notable surge in consumer demand for smart home technologies. As more individuals seek to enhance their living environments, the installation of smart devices becomes increasingly prevalent. According to recent data, approximately 30% of households are expected to adopt smart home technologies by 2026. This growing interest is driven by the desire for convenience, energy efficiency, and improved security. As consumers become more aware of the benefits associated with smart home systems, the demand for professional installation services is likely to rise, thereby propelling the Smart Home Installation Service Market forward.

Enhanced Security Concerns Among Homeowners

Enhanced security concerns are a critical driver of the Smart Home Installation Service Market. With rising crime rates and increasing awareness of home security, homeowners are prioritizing the installation of smart security systems. These systems, which include smart locks, cameras, and alarm systems, provide real-time monitoring and control. Market data suggests that the demand for smart security solutions is expected to grow significantly, with projections indicating a market size increase of over 20% by 2027. As homeowners seek to protect their properties, the need for professional installation services becomes essential, thereby bolstering the Smart Home Installation Service Market.

Technological Advancements in Smart Devices

Technological advancements play a pivotal role in shaping the Smart Home Installation Service Market. Innovations in artificial intelligence, machine learning, and the Internet of Things (IoT) have led to the development of more sophisticated smart home devices. These advancements not only enhance functionality but also improve user experience. For instance, smart thermostats and lighting systems now offer greater control and customization options. As these technologies evolve, the complexity of installation increases, necessitating professional services. Consequently, the demand for skilled installers is expected to grow, further stimulating the Smart Home Installation Service Market.