Research Methodology on Smart Railways Market

Introduction

The rapid expansion of passenger and freight transport provides an immense amount of opportunity to ensure the efficient functioning of both rail and freight networks. As a result of this, smart railway technologies have become an integral part of rail networks. Smart railways offer transparency and driving information during railway journeys. Smart railway technologies also help in making rail journeys more efficient and secure. Improved Infrastructure, adoption of Innovations, increased connectivity and safety, enhanced customer experience and relief for operators are some of the benefits that customers have gained with the use of smart railways.

Research Objectives

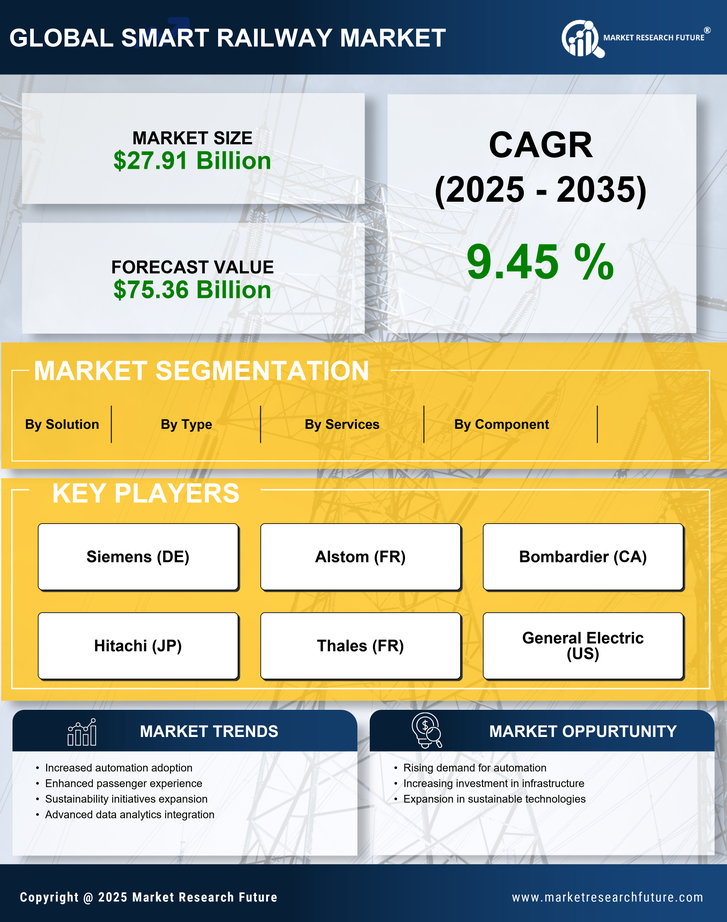

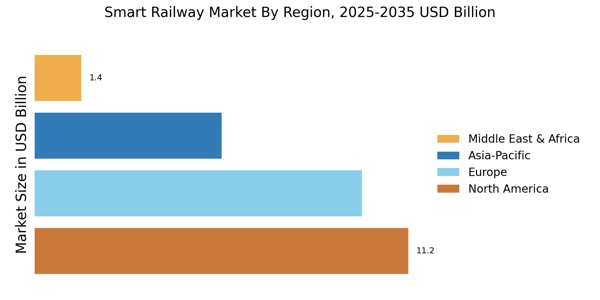

This research looks at the current market trends of the Smart Railways market and how it is expected to develop in the future. The main objective of this research is to discuss the current market dynamics of the Smart Railways market such as drivers, restraints, competitive landscape, regional analysis and its competitive landscape. It also outlines the future outlook of the market and provides forecasts of the potential markets based on the research conducted.

Research Methodology

The research methodology adopted for this report is based on two approaches, primary and secondary research. Primary research includes direct interaction and interviews with key industry experts and stakeholders. Secondary research consists of literature reviews, surveys, articles, white papers and more.

Preliminary Research

The initial phase of research was to analyze the current market trends and dynamics of the Smart Railways market. Several articles and research papers were referred to gain an understanding of the market. The next step was to compile a list of key industry experts and stakeholders who are intimately involved in the market.

Primary Research

Primary research is conducted to validate the findings from the preliminary research and to further gain an understanding of the Smart Railways market. For this purpose, a series of interviews and discussions were conducted with key industry experts and stakeholders that are closely associated with the market.

Secondary Research

Secondary research is conducted to further validate the findings from the primary research. Sources of secondary research included reports, journals, industry associations and web directories. In addition, statistical data related to the Smart Railways market is also collected from reliable and reputed sources.

Data Analysis

The data collected was analysed by employing Synthesizing and PESTLE Analysis, thus providing a comprehensive view of the market trends. The information gained was then validated through primary and secondary research to arrive at market estimates and forecasts.

Scope of Report

This report is centred on the current market trends of the Smart Railways market and its expected outlook in the future The report provides in-depth market analysis and insights, along with an in-depth study of the market dynamics, segmentation and competitive landscape. A comprehensive analysis of the market players, their market share, forecasting, growth trajectory and geographic presence has been provided.

Conclusion

The Smart Railways market is continuously changing and evolving, making it challenging to adequately capture the market dynamics. This research has strived to provide an understanding of the market trends, to provide insights and analysis to the readers.