Market Analysis

In-depth Analysis of Smart Robot Market Industry Landscape

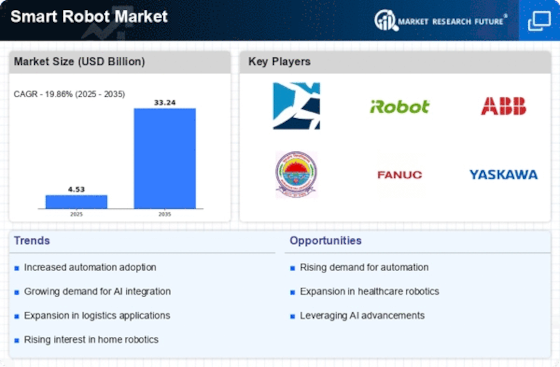

The landscape of the smart robot market is currently changing quickly and dynamically due to the growth of technology and the growing need for automation in many sectors. A number of variables that affect the smart robot industry's growth, acceptance, and innovation combine to form the market dynamics. The constant advancement of machine learning and artificial intelligence (AI) technology is a major force behind industry dynamics. Intelligent robots are getting better at recognizing and interacting with their surroundings. Due to their increased capacity for complicated job execution and precision brought about by AI advancements, smart robots are becoming more and more appealing as solutions for businesses looking to save labor costs and increase productivity. The market for smart robots is very dynamic due in large part to the increasing need for automation in many sectors. Organizations are starting to realize the advantages of integrating intelligent robots into their operations, ranging from manufacturing and logistics to consumer services and healthcare. The adoption of smart robots in many industries is being driven by the need for enhanced operational efficiency, accuracy, and the capacity to manage hazardous or repetitive activities. Furthermore, the dynamics of the market are impacted by the growing cooperation between technology businesses and conventional robot producers. This partnership encourages the incorporation of cutting-edge technology, including cameras, sensors, and networking systems, into intelligent robots. Because of this, intelligent robots can carry out activities alone and may also interact and cooperate with others. Another factor that makes the market for smart robots more dynamic is the competitive environment. Innovative solutions are being introduced into the market by a multitude of firms, spanning from startups to well-established players. Continuous research and development efforts are being driven by this rivalry to produce robots that are more competent and economical. As a result, there is a constant flow of new product introductions and technology developments in the market. Standards and regulatory changes can have a significant impact on how the smart robot industry is shaped. The rising prevalence of smart robots across sectors has led to a growing emphasis on developing policies and standards to guarantee their ethical and safe application. Ensuring compliance with these standards is increasingly important to manufacturers and end users.

Leave a Comment