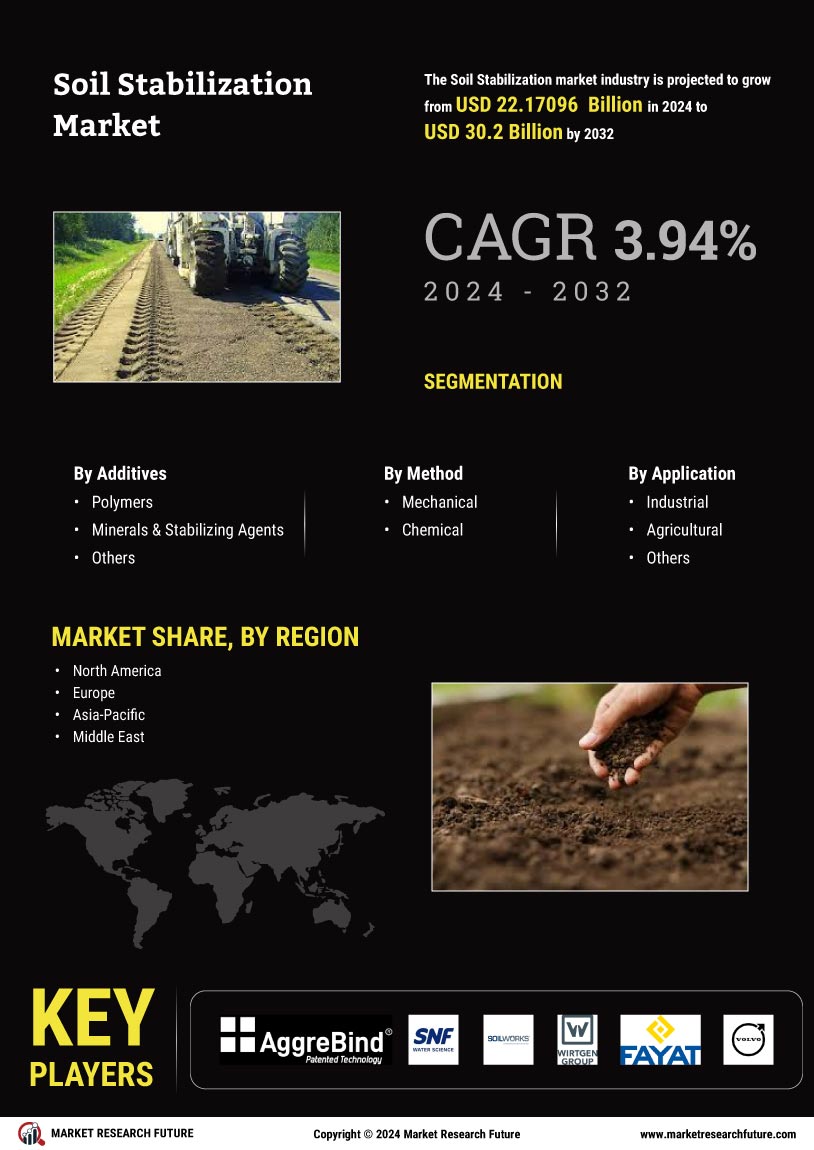

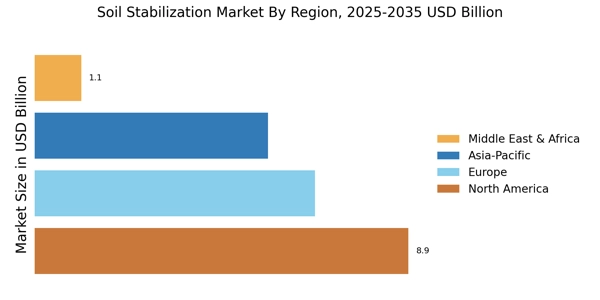

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Soil Stabilization Market area will dominate this market, owing to growing construction activities paired with modernization in construction industries, especially for high-story buildings and unique designs that need the soil of specific properties. Hence it will boost the market growth in this region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Source Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

The Asia-Pacific Soil Stabilization Market accounts for the second-largest market share due to increasing modernization and urbanization. Increasing demand for the construction industry, especially in office and residential areas. Moreover, China’s Soil Stabilization Market held the largest market share, and the Indian Soil Stabilization Market was the fastest-growing market in the Asia-Pacific region.

Europe's Soil Stabilization Market is expected to grow at the fastest CAGR from 2023 to 2032. This is the due presence of a deep-rooted technologically developed structure coupled with higher disposable income. Further, the German Soil Stabilization Market held the largest market share, and the UK Soil Stabilization Market was the fastest-growing market in the European region.

Recent News

November 2023: A novel specialized machine for layer processing in road construction and soil stabilization, the WRC 240(i) Rock Crusher from Wirtgen fractures coarse rocks in situ, such as those found in hand-packed pavement layers (e.g. Telford bases) or stony soils, and perpetually generates a uniform mixture. With a maximum working depth of 510mm and a working breadth of 2,320mm, it is capable of producing 600 tonnes per hour. Wirtgen has broadened its range of wheeled soil stabilizers, including the WRC 240(i), which is specifically engineered for the handling of stony ground.

The machine is capable of simultaneously pulverizing rocks and stones with compressive strengths of up to 200MPa and edge lengths of up to 300mm. This functionality is particularly useful when preparing base layers and involves the addition of cement and water. Cement is pre-spread using a binding agent spreader, while the necessary water is sprayed through the Varioinjection bar of the Rock Crusher into the mixing chamber.

In January 2024, Loam Bio, an Australian company, made its foray into the agricultural biologicals market in the United States with the introduction of CarbonBuilder. This innovative microbial seed treatment is designed to augment soil organic carbon levels and promote overall soil health. Farmers who utilize the product may also participate in SecondCrop, the organization's carbon credit program, which generates income. By 2024, soybean producers in the states of Iowa, Minnesota, Nebraska, North Dakota, South Dakota, and Wisconsin will have access to CarbonBuilder. Through photosynthesis, plants remove carbon from the atmosphere and convert it to particulate organic matter.

This type of carbon is capable of rapidly cycling in and out of the soil. As per the findings of Loam Bio, the soil fungi incorporated in CarbonBuilder are responsible for the stabilization of this carbon and the augmentation of mineral-associated organic matter and aggregate carbon, which are the soil's most stable carbon reservoirs. Greater stability ought to result in a reduction of carbon emissions back into the atmosphere.