Market Growth Projections

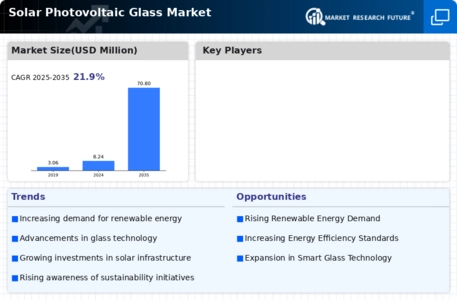

The Global Solar Photovoltaic Glass Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 70.8 USD Billion by 2035, the industry is on a robust upward trajectory. The expected CAGR of 21.59% from 2025 to 2035 highlights the increasing adoption of solar technologies and the expanding applications of photovoltaic glass in various sectors. This growth is driven by a combination of factors, including technological advancements, supportive government policies, and rising consumer awareness regarding sustainability. The market's future appears promising, with numerous opportunities for innovation and expansion.

Government Policies and Incentives

Government policies play a crucial role in shaping the Global Solar Photovoltaic Glass Market Industry. Many countries are introducing favorable regulations and financial incentives to encourage solar energy adoption. For instance, tax credits, rebates, and feed-in tariffs are common strategies employed to stimulate investment in solar technologies. These initiatives not only enhance the attractiveness of solar projects but also create a conducive environment for photovoltaic glass manufacturers. As a result, the market is expected to witness significant growth, aligning with global sustainability goals and the increasing focus on reducing carbon emissions.

Rising Demand for Renewable Energy

The Global Solar Photovoltaic Glass Market Industry is experiencing heightened demand due to the global shift towards renewable energy sources. Governments worldwide are implementing policies and incentives to promote solar energy adoption, which is driving the need for photovoltaic glass. For instance, the International Energy Agency indicates that solar power generation is expected to increase significantly, contributing to a cleaner energy mix. This trend is reflected in the projected market value of 8.24 USD Billion in 2024, with expectations to reach 70.8 USD Billion by 2035, showcasing a robust growth trajectory fueled by renewable energy initiatives.

Technological Advancements in Solar Glass

Technological innovations are propelling the Global Solar Photovoltaic Glass Market Industry forward. Enhanced manufacturing processes and materials are leading to the production of more efficient and durable photovoltaic glass. For example, the development of bifacial solar panels, which utilize both sides of the glass for energy generation, is gaining traction. This advancement not only improves energy output but also reduces the overall cost per watt of solar energy. As a result, the market is poised for substantial growth, with a projected CAGR of 21.59% from 2025 to 2035, indicating a strong future for technologically advanced solar glass solutions.

Growing Urbanization and Infrastructure Development

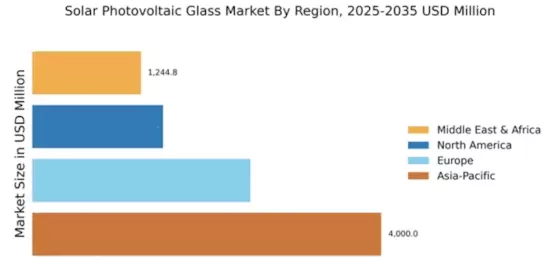

Urbanization and infrastructure development are driving the Global Solar Photovoltaic Glass Market Industry. As cities expand, the demand for energy-efficient buildings and sustainable construction practices rises. Photovoltaic glass is increasingly being integrated into building facades and rooftops, providing dual functionality as both a structural element and an energy source. This trend is particularly evident in regions experiencing rapid urban growth, where energy demands are escalating. The incorporation of solar glass in new constructions is likely to contribute to the market's growth, as urban planners and architects seek innovative solutions to meet energy needs sustainably.

Increasing Awareness of Environmental Sustainability

There is a growing awareness of environmental sustainability among consumers and businesses, which is positively impacting the Global Solar Photovoltaic Glass Market Industry. As climate change concerns escalate, stakeholders are increasingly prioritizing eco-friendly solutions. This shift in mindset is driving the adoption of solar technologies, including photovoltaic glass, as a means to reduce carbon footprints. Educational campaigns and advocacy efforts are further amplifying this trend, encouraging individuals and organizations to invest in renewable energy sources. Consequently, the market is expected to expand as more entities recognize the long-term benefits of sustainable energy solutions.