Global Soluble Fiber Market Overview

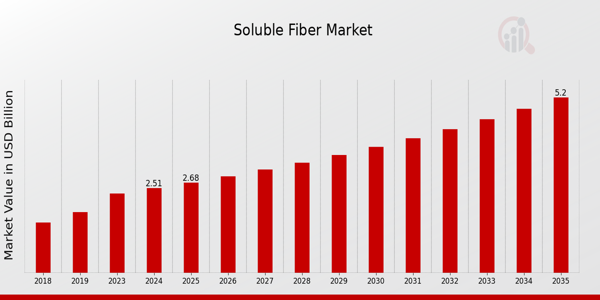

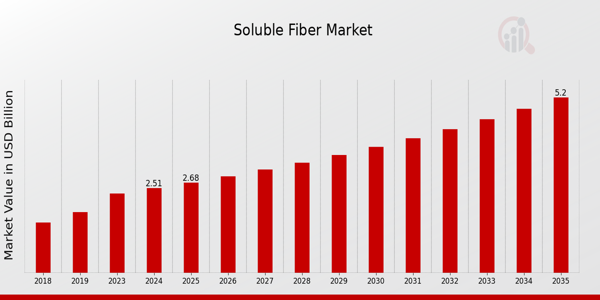

Soluble Fiber Market Size was estimated at 2.35 (USD Billion) in 2024.The Soluble Fiber Market Industry is expected to grow from 2.51(USD Billion) in 2025 to 5.2 (USD Billion) by 2035. The Soluble Fiber Market CAGR (growth rate) is expected to be around 6.86% during the forecast period (2025 - 2035)

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Soluble Fiber Market Trends Highlighted

The Global Soluble Fiber Market is experiencing significant trends driven by rising consumer awareness of the health benefits of soluble fiber. The shift towards healthier diets and lifestyles is catalyzing increased demand for food products that are rich in dietary fiber. As more individuals seek to manage weight and improve gut health, food manufacturers are responding by incorporating soluble fibers, such as inulin and oat fiber, into a wide range of products.

Furthermore, there is a growing trend towards plant-based foods, which often contain higher levels of soluble fiber, aligning with global movements toward sustainability and plant-derived ingredients.Opportunities exist for companies developing new soluble fiber sources and innovative applications. The health food sector, including snacks, beverages, and functional foods, presents a rich landscape for introducing novel soluble fiber formulations. As governments worldwide emphasize public health and nutrition, particularly in combating dietary-related diseases, the potential for market growth is substantial. Policy support and regulations promoting fiber-rich diets can further enhance market penetration and product innovation.

In recent times, consumer preference for natural and minimally processed ingredients has accelerated, signaling a shift away from synthetic additives in food products. This trend aligns with the overall move towards transparency and clean labeling in the food industry. Additionally, the post-pandemic focus on immune health and overall wellness has prompted increased interest in dietary fibers, highlighting the importance of digestive health. The Global Soluble Fiber Market is thus on a promising trajectory, driven by evolving consumer behaviors and an expanding range of applications in everyday products.

Soluble Fiber Market Drivers

Increased Demand for Dietary Fiber

The Global Soluble Fiber Market Industry is experiencing significant growth due to the increased awareness among consumers regarding the health benefits of dietary fiber. Research from various health organizations indicates that fiber intake can prevent chronic diseases such as heart disease and diabetes. The World Health Organization has highlighted that around 30% of adults do not meet the recommended daily intake of dietary fiber, which is about 25 to 30 grams per day.With a rising global population that is becoming increasingly health-conscious, consumers are seeking products with higher fiber content.

Many established food manufacturers are responding to this demand by reformulating their products to include soluble fibers like inulin and psyllium. This shift is expected to drive growth in the Global Soluble Fiber Market as dietary fiber products are integrated into a wider variety of foods and beverages, catering to a larger audience looking to improve their overall health.

Rising Incidence of Digestive Disorders

The Global Soluble Fiber Market Industry is also benefitting from the rising incidence of digestive disorders such as irritable bowel syndrome (IBS) and constipation. According to the International Foundation for Gastrointestinal Disorders, IBS affects an estimated 10-15% of the global population. With the increase in gastrointestinal issues, there is a heightened demand for products that can help manage these conditions, including those rich in soluble fiber.Companies like Procter Gamble and Nestlé are innovating their product lines to include soluble fibers that aid digestion, thereby contributing to the growth of the Global Soluble Fiber Market.

Growing Incorporation in Functional Foods

There is a notable trend in the Global Soluble Fiber Market Industry towards the incorporation of soluble fibers into functional foods. Government initiatives are promoting the development of functional foods to enhance public health. For instance, the U.S. Food and Drug Administration has established guidelines that recognize soluble fibers as beneficial for heart health. A report from the American Heart Association indicates that increasing fiber consumption could reduce the risk of cardiovascular diseases by 10%.Food manufacturers are responding by creating fortified products that contain soluble fibers, which support health claims and address consumer demands.

This trend is expected to drive significant growth in the Global Soluble Fiber Market in coming years.

Rise in Veganism and Plant-Based Diets

The rise of veganism and plant-based diets is another key driver of growth in the Global Soluble Fiber Market Industry. Published data from various health organizations indicate a significant increase in plant-based dietary habits, with surveys showing that nearly 40% of the global population is shifting towards vegetarian or vegan eating patterns. Soluble fibers, which are abundant in plant-based foods, align perfectly with consumers' desire for healthier eating.This trend is encouraging established food brands, such as Unilever and General Mills, to invest in the development of new products that feature soluble fibers prominently.

The growing adoption of these diets not only supports individual health goals but also promotes sustainable food practices, leading to increased demand for soluble fiber ingredients across the market.

Soluble Fiber Market Segment Insights

Soluble Fiber Market Application Insights

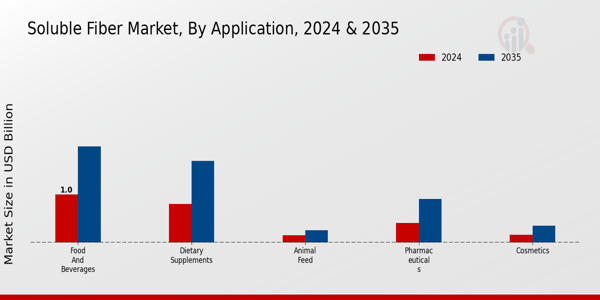

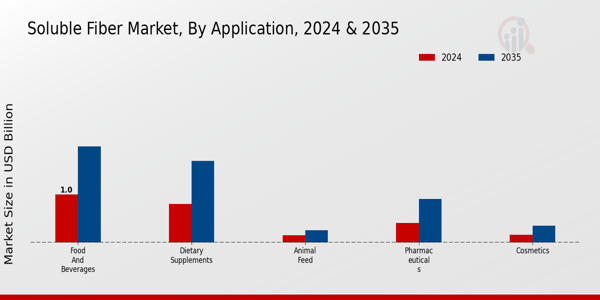

The Global Soluble Fiber Market has shown remarkable growth in the Application segment, which includes essential categories like Food and Beverages, Dietary Supplements, Pharmaceuticals, Animal Feed, and Cosmetics. In 2024, the overall market value is projected to reach 2.51 USD Billion, reflecting the increasing demand for health and wellness products that incorporate soluble fiber.

The Food and Beverages application dominates the market with a valuation of 1.0 USD Billion in 2024 and is expected to grow to 2.0 USD Billion by 2035, highlighting its critical role in developing functional foods that cater to health-conscious consumers.Dietary Supplements follow closely, valued at 0.8 USD Billion in 2024 and projected to rise to 1.7 USD Billion by 2035. This growth is driven by rising health awareness and the need for dietary interventions to manage various health conditions, making it a significant contributor to the overall market.

The Pharmaceuticals sector, while smaller, holds a valuation of 0.4 USD Billion in 2024 and is expected to double to 0.9 USD Billion by 2035, indicating its valuable application in healthcare products aimed at improving gastrointestinal health.

Meanwhile, the Animal Feed segment, valued at 0.15 USD Billion in 2024, is anticipated to grow modestly to 0.25 USD Billion by 2035, as increasing focus on animal nutrition propels the use of soluble fibers for improving digestion in livestock.The Cosmetics application, worth 0.16 USD Billion in 2024 and expected to reach 0.35 USD Billion by 2035, sees a growing integration of soluble fibers in product formulations aimed at enhancing skin health and overall appearance.

The overall market dynamics illustrate a robust trajectory of growth driven by changing consumer preferences toward healthier options across various sectors, marking the significance of soluble fiber in diverse applications. Key trends include a rising incidence of obesity and associated health risks which contribute to the demand for functional foods and supplements loaded with fiber content.However, challenges such as raw material availability and the need for further research into novel soluble fibers may impact growth trajectories.

Despite these challenges, opportunities abound, particularly in expanding markets and advancements in product development, making the Application segment a critical component of the Global Soluble Fiber Market statistics moving forward.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Soluble Fiber Market Source Insights

The Global Soluble Fiber Market, focused on the Source segment, is exhibiting notable growth as it responds to the increasing demand for dietary fibers globally. The segmentation reveals significant components like Psyllium, known for its effectiveness in promoting regularity, while Inulin is valued for its prebiotic properties, fostering gut health. Oligofructose also plays a crucial role in enhancing dietary fiber intake, contributing to the rise in health-conscious consumer segments.Pectins, derived from fruits, are utilized for their gelling properties in food applications, making them essential for food innovation.

Guar Gum, with its high viscosity, is another important ingredient, mainly used in various food and pharmaceutical products. As the market continues to evolve, innovations in these segments present opportunities for growth while responding to rising health trends and dietary preferences on a global scale. The market is driven by increasing consumer awareness about health, however, challenges like fluctuating raw material supply and the need for stringent quality standards are to be navigated effectively.

Soluble Fiber Market Function Insights

This growth can be attributed to rising health consciousness and a shift towards functional foods. Within the Function segment, various applications such as Thickening Agents, Stabilizers, Emulsifiers, Fat Replacers, and Texturizers play essential roles in the food industry, enhancing texture and improving nutritional profile products. Thickening Agents and Stabilizers are particularly significant as they ensure product consistency and shelf stability, which is vital in consumer satisfaction.Emulsifiers facilitate the mixing of oil and water, thus broadening the scope of food formulations. Fat Replacers serve as a healthier alternative in low-fat food segments, aligning with consumer demand for healthier eating options.

Meanwhile, Texturizers contribute to mouthfeel and overall sensory experience, crucial for customer preference in various food applications. Overall, the Global Soluble Fiber Market data indicates a robust opportunity driven by innovation in food formulations, as well as an increasing preference for ingredients that provide health benefits, resulting in a comprehensive market growth trajectory.

Soluble Fiber Market Form Insights

The market segmentation in terms of Form includes Powder, Liquid, and Granule, which are crucial as they cater to different consumer preferences and application methods. The Powder form is particularly significant because of its versatility and ease of incorporation into various food products, while the Liquid form is beneficial for beverages and ready-to-drink solutions.Granule forms are often preferred for their convenience and ease of use in baking and cooking applications. Furthermore, the trends towards plant-based diets and the rising awareness of health benefits associated with soluble fibers are driving demand across all forms.

This market also faces challenges, such as supply chain disruptions and fluctuating raw material prices. However, there are ample opportunities for innovation in product formulations and expanding applications, particularly in health supplements and functional foods, which are projected to become key growth drivers in the coming years.The Global Soluble Fiber Market statistics indicate a robust growth trajectory that highlights the importance of each form in meeting diverse consumer needs and preferences.

Soluble Fiber Market Regional Insights

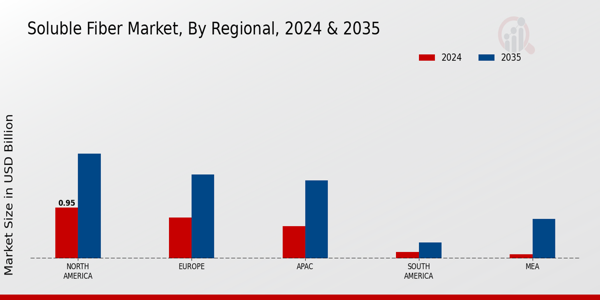

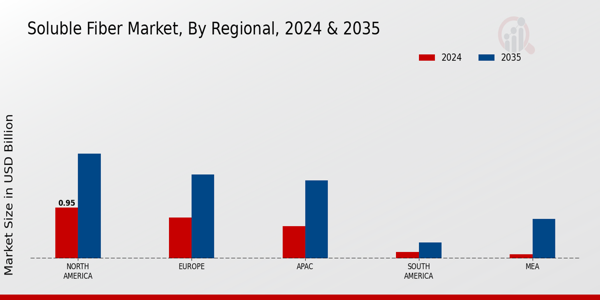

The Global Soluble Fiber Market exhibits notable regional dynamics, reflecting varied consumer demands and health trends across different areas. In 2024, the North America region leads with a valuation of 0.95 USD Billion, expected to rise to 1.95 USD Billion by 2035, illustrating significant market growth driven by rising health awareness and dietary fiber consumption. Europe follows closely, valued at 0.76 USD Billion in 2024 and projected to reach 1.56 USD Billion in 2035, showcasing an increasing preference for health-focused food products.

The APAC segment, starting at 0.6 USD Billion in 2024 and growing to 1.45 USD Billion by 2035, highlights expanding markets due to urbanization and dietary shifts toward healthier options. Meanwhile, South America and MEA sectors, although smaller, with values of 0.12 USD Billion and 0.08 USD Billion in 2024 respectively, are anticipated to grow significantly, driven by increasing consumer awareness of dietary fibers. The diverse nature of these regions underscores the importance of tailored marketing strategies and product developments catering to local preferences, providing ample opportunities for businesses within the Global Soluble Fiber Market industry.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Soluble Fiber Market Key Players and Competitive Insights

The Global Soluble Fiber Market has been experiencing significant growth, driven by rising consumer awareness of health and dietary considerations, alongside increased demand for prebiotic and functional ingredients across various industries. This market consists of various players that compete based on product innovation, quality, pricing strategies, and distribution capabilities. Companies are constantly striving to capitalize on the health benefits associated with soluble fiber, which include digestive health, weight management, and heart health attributes.

As consumer preferences continue to shift towards healthier food options, competitors in this space are focusing on enhancing their product offerings and expanding their market reach through strategic partnerships and collaborations. Sweetener Solutions has established itself as a notable player within the Global Soluble Fiber Market, leveraging its expertise in sweetener technology to provide high-quality soluble fiber products. The company has succeeded in fostering strong relationships with key stakeholders, including food and beverage manufacturers, supplement companies, and healthcare organizations.

One of the company's significant strengths lies in its extensive product portfolio that addresses various dietary needs, allowing Sweetener Solutions to cater to a diverse range of consumer preferences. Its commitment to research and development ensures a consistent flow of innovative soluble fiber products that resonate with health-conscious consumers. Furthermore, Sweetener Solutions has built a solid distribution network, enhancing its global presence and making its products more readily available across multiple regions.DuPont is another major player in the Global Soluble Fiber Market, recognized for its innovative approach and strong market presence.

The company offers an array of soluble fiber products that are integral to functional foods and dietary supplements, with an emphasis on promoting health and wellness. DuPont's strengths lie in its robust research capabilities and commitment to sustainability, which enable the company to develop products that not only meet regulatory standards but also align with consumer demands for natural ingredients. DuPont has also engaged in strategic mergers and acquisitions to bolster its product offerings and enhance its competitive position in the market.

By integrating new technologies and expanding its research facilities, DuPont continues to strengthen its portfolio while paving the way for future innovations in soluble fiber solutions, thereby reinforcing its influence in the global landscape.

Key Companies in the Soluble Fiber Market Include

Soluble Fiber Market Industry Developments

The Global Soluble Fiber Market has been experiencing significant developments recently, with key players such as Sweetener Solutions, DuPont, Kerry Group, Beneo, Fiberstar, Archer Daniels Midland, Cargill, Green Plains Inc., Ingredion, Manitowoc Foodservice, MGP Ingredients, Tate and Lyle, Fibreline, and Nexira being at the forefront. In July 2023, Archer Daniels Midland completed the acquisition of a North American soluble fiber manufacturer to bolster its product portfolio and expand its reach. The market is witnessing considerable growth, with a notable increase in demand for functional foods and dietary supplements that incorporate soluble fibers, driven by rising health consciousness among consumers.

In addition to this, various companies are investing in Research and Development to innovate new soluble fiber products. The industry has seen mergers aimed at expanding capabilities, such as Tate and Lyle's strategic partnership established in mid-2022 to enhance processing technologies. With an increasing market valuation, the global soluble fiber market is projected to grow exponentially over the next few years, reflecting the rising inclination towards healthier dietary options and sustainable food products. Recent advancements have contributed significantly to negotiating better supply chains and enhancing product offerings in this sector the last couple of years.

Soluble Fiber Market Segmentation Insights

-

Soluble Fiber Market Application Outlook

-

Soluble Fiber Market Source Outlook

-

Soluble Fiber Market Function Outlook

-

Soluble Fiber Market Form Outlook

-

Soluble Fiber Market Regional Outlook

-

Europe

-

South America

-

Asia Pacific

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2023 |

2.35(USD Billion) |

| MARKET SIZE 2024 |

2.51(USD Billion) |

| MARKET SIZE 2035 |

5.2(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

6.86% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Sweetener Solutions, DuPont, Kerry Group, Beneo, Fiberstar, Archer Daniels Midland, Cargill, Green Plains Inc., Ingredion, Manitowoc Foodservice, MGP Ingredients, Tate and Lyle, Fibreline, Nexira |

| SEGMENTS COVERED |

Application, Source, Function, Form, Regional |

| KEY MARKET OPPORTUNITIES |

Rising health consciousness, Demand for clean-label products, Growth in functional foods, Increased use in food processing, Expansion in dietary supplements |

| KEY MARKET DYNAMICS |

increasing health consciousness, rising functional food demand, growing dietary fiber supplements, regulatory support for health claims, expanding applications in food industry |

| COUNTRIES COVERED |

North America, Europe, APAC, South America, MEA |

Soluble Fiber Market Highlights:

Frequently Asked Questions (FAQ):

The Global Soluble Fiber Market is expected to be valued at 2.51 billion USD in 2024.

By 2035, the Global Soluble Fiber Market is projected to reach a value of 5.2 billion USD.

The expected CAGR for the Global Soluble Fiber Market from 2025 to 2035 is 6.86%.

North America is anticipated to have the largest market share in the Global Soluble Fiber Market in 2024, valued at 0.95 billion USD.

The Food and Beverages segment of the Global Soluble Fiber Market is expected to be valued at 2.0 billion USD by 2035.

The Dietary Supplements segment is projected to be valued at 0.8 billion USD in the Global Soluble Fiber Market in 2024.

The Pharmaceuticals segment is expected to contribute approximately 0.9 billion USD to the market by 2035.

Major players in the Global Soluble Fiber Market include Sweetener Solutions, DuPont, Kerry Group, Beneo, and Cargill.

The APAC region is expected to have a market size of 0.6 billion USD in the Global Soluble Fiber Market in 2024.

The anticipated market size for the Cosmetics segment in the Global Soluble Fiber Market by 2035 is approximately 0.35 billion USD.