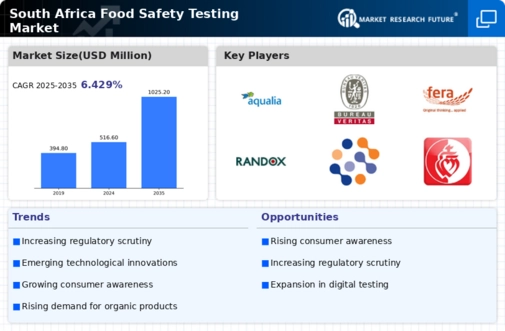

The South Africa Food Safety Testing Market has been increasingly competitive due to rising consciousness regarding food safety and stringent regulations imposed by local authorities to ensure public health. This market encompasses a range of testing services designed to detect contaminants, pathogens, and chemical residues in food products. The rapid industrialization and urbanization, coupled with changing consumer preferences towards more processed and ready-to-eat food, have propelled the demand for food safety testing solutions. Companies in this market are focusing on technological advancements and expanding their service portfolios to improve their competitive positioning and comply with ever-evolving safety standards.

Insights into key players reveal various strategies being implemented to enhance their market share, indicating the high stakes involved in maintaining food quality and safety.

Aqualia has carved a significant niche within the South Africa Food Safety Testing Market by leveraging its specialized expertise in water quality and food safety testing. The company stands out due to its robust analytical capabilities and commitment to quality assurance, making it a trusted service provider among local businesses in the food sector. Aqualia’s strengths lie in its state-of-the-art laboratories, which are equipped to carry out a wide array of tests ranging from microbiological assessments to chemical analyses. The company also emphasizes customer relationships and tailored solutions, ensuring that clients can meet regulatory requirements efficiently.

Aqualia's local presence signifies its deep understanding of South African regulations and consumer expectations, allowing it to effectively address market demands and drive growth.

SGS South Africa operates as a prominent player in the Food Safety Testing Market, renowned for its comprehensive suite of services that includes microbiological testing, chemical analysis, and nutritional testing. The company holds a strong market presence backed by established reputations and extensive experience in the field. SGS South Africa’s strengths are bolstered by its advanced laboratory facilities, skilled personnel, and a broad geographic reach within the country, enabling it to provide consistent and reliable services.

The company actively engages in partnerships and collaborations to enhance its service offerings and has pursued strategic mergers and acquisitions to expand its market capabilities and technological infrastructure. This proactive approach allows SGS South Africa to respond quickly to emerging food safety challenges and maintain a strong foothold in this evolving market landscape.