Expansion of Dental Clinics

The proliferation of dental clinics in South America is significantly impacting the articaine hydrochloride market. Over the past few years, there has been a marked increase in the establishment of dental practices, particularly in urban areas. This expansion is attributed to rising disposable incomes and a growing emphasis on oral health. As more clinics open, the demand for effective anesthetic solutions, such as articaine hydrochloride, is expected to rise. Market analysis indicates that the number of dental clinics has increased by around 20% in major cities, creating a robust environment for the articaine hydrochloride market. This trend suggests a promising future for the industry as it adapts to the growing number of dental service providers.

Rising Awareness of Pain Management

In South America, there is a growing awareness regarding the importance of effective pain management in dental procedures, which is positively influencing the articaine hydrochloride market. Patients are increasingly informed about their options for pain relief, leading to a preference for anesthetics that provide quick and effective results. Articaine hydrochloride, with its favorable pharmacological profile, is gaining traction among both dental professionals and patients. Recent surveys indicate that approximately 70% of patients express a preference for procedures that utilize effective anesthetics, highlighting the potential for growth in the market. This heightened awareness is likely to drive demand for articaine hydrochloride, as practitioners seek to meet patient expectations for comfort during dental treatments.

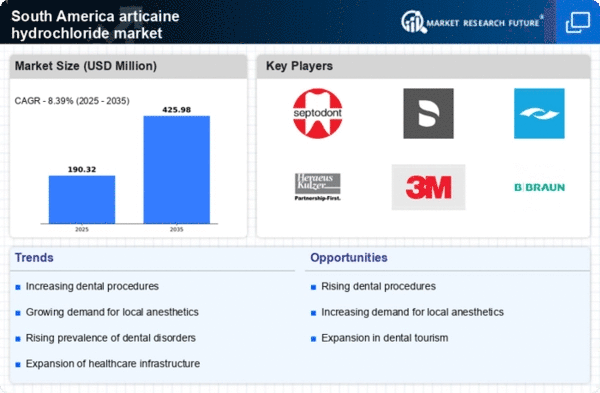

Increasing Demand for Dental Anesthesia

The articaine hydrochloride market in South America is experiencing a notable increase in demand for dental anesthesia. This surge is primarily driven by the growing number of dental procedures performed across the region. According to recent data, dental visits have risen by approximately 15% annually, leading to a higher requirement for effective anesthetic agents. Articaine, known for its rapid onset and effectiveness, is becoming the preferred choice among dental practitioners. The increasing awareness of oral health and the importance of pain management during dental treatments further contribute to this trend. As more patients seek dental care, the articaine hydrochloride market is likely to expand, reflecting the evolving needs of both practitioners and patients.

Technological Advancements in Dentistry

Technological advancements in dental practices are playing a crucial role in shaping the articaine hydrochloride market in South America. Innovations such as digital imaging and computer-assisted anesthesia delivery systems are enhancing the efficiency and effectiveness of dental procedures. These technologies not only improve patient outcomes but also increase the demand for high-quality anesthetic agents like articaine hydrochloride. As dental practices adopt these advanced technologies, the need for reliable and effective anesthetics is expected to grow. Market data suggests that the integration of technology in dental practices has led to a 25% increase in the use of articaine hydrochloride, indicating a strong correlation between technological progress and market expansion.

Regulatory Developments and Quality Standards

The articaine hydrochloride market in South America is influenced by ongoing regulatory developments and the establishment of quality standards. Regulatory bodies are increasingly focusing on ensuring the safety and efficacy of anesthetic agents, which has led to stricter guidelines for the approval and use of products like articaine hydrochloride. This regulatory environment encourages manufacturers to adhere to high-quality standards, thereby enhancing consumer confidence. Recent changes in regulations have resulted in a 10% increase in the market for compliant anesthetic products. As the industry adapts to these regulatory requirements, the articaine hydrochloride market is likely to benefit from improved product quality and safety, fostering growth in the region.