Growth of Renewable Energy Sector

The base oil market in South America is witnessing growth driven by the expansion of the renewable energy sector. As countries in the region increasingly invest in renewable energy sources, such as wind and solar, the demand for lubricants and base oils used in these technologies is on the rise. For instance, lubricants used in wind turbine gearboxes require high-performance base oils to ensure efficiency and longevity. This segment is projected to grow at a rate of approximately 5% annually, reflecting the increasing integration of renewable energy solutions. The alignment of the base oil market with the renewable energy sector not only diversifies its applications but also positions it favorably in the context of sustainable development.

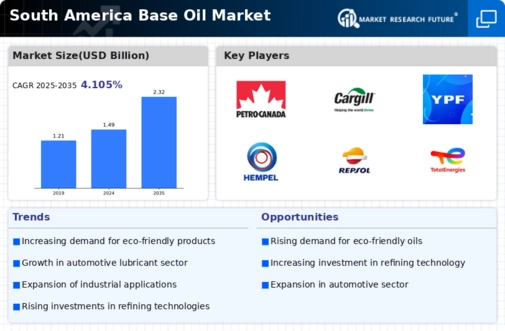

Expansion of Industrial Applications

The base oil market in South America is significantly influenced by the expansion of industrial applications. Industries such as manufacturing, construction, and mining are increasingly utilizing base oils in various processes, including machinery lubrication and hydraulic fluids. This trend is expected to contribute to a steady growth rate of around 4% annually in the industrial segment of the base oil market. The rising industrial activities, coupled with the need for efficient lubrication solutions, are likely to drive the demand for high-performance base oils. Additionally, the ongoing investments in infrastructure projects across South America may further enhance the consumption of base oils in industrial applications, thereby positively impacting the overall market.

Rising Demand for Automotive Lubricants

The base oil market in South America is experiencing a notable increase in demand for automotive lubricants. This surge is primarily driven by the growing automotive sector, which has seen a rise in vehicle ownership and usage. As of 2025, the automotive lubricants segment is projected to account for approximately 60% of the total base oil consumption in the region. The increasing focus on vehicle performance and longevity is prompting manufacturers to utilize high-quality base oils, thereby enhancing the overall market dynamics. Furthermore, the shift towards more efficient and environmentally friendly lubricants is likely to further bolster this demand, as consumers become more aware of the benefits of using superior base oil products.

Regulatory Support for Quality Standards

The base oil market in South America is benefiting from regulatory support aimed at enhancing quality standards. Governments in the region are increasingly implementing stringent regulations to ensure that base oils meet specific performance and environmental criteria. This regulatory framework is expected to drive the demand for high-quality base oils, as manufacturers strive to comply with these standards. As of 2025, it is anticipated that compliance with these regulations could lead to a market shift, with an estimated 30% of base oil products being required to meet higher quality specifications. This trend not only promotes the use of superior base oils but also encourages manufacturers to invest in research and development, further advancing the industry.

Technological Advancements in Refining Processes

Technological advancements in refining processes are playing a crucial role in shaping the base oil market in South America. Innovations in refining technologies are enabling manufacturers to produce higher quality base oils with improved performance characteristics. These advancements not only enhance the efficiency of production but also reduce environmental impact, aligning with the growing sustainability trends in the region. As of 2025, it is estimated that the adoption of advanced refining technologies could lead to a reduction in production costs by up to 15%, making high-quality base oils more accessible to various sectors. This shift is likely to attract new players into the market, fostering competition and innovation.