Expansion of E-Health Platforms

The expansion of e-health platforms is significantly influencing the big data-pharmaceutical-advertising market. As telemedicine and digital health solutions gain traction in South America, pharmaceutical companies are presented with new opportunities to engage with patients through these platforms. The e-health market is expected to grow by 20% annually, driven by the increasing adoption of technology in healthcare. This growth creates a fertile ground for targeted advertising campaigns that leverage big data analytics to reach patients effectively. Consequently, the big data-pharmaceutical-advertising market is poised to evolve, as companies adapt their strategies to align with the changing landscape of healthcare delivery.

Rising Demand for Targeted Marketing

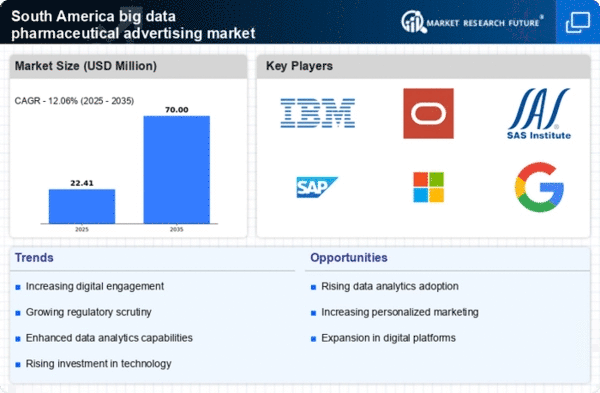

The increasing demand for targeted marketing strategies in the pharmaceutical sector is a key driver for the big data-pharmaceutical-advertising market. As healthcare providers and pharmaceutical companies seek to enhance their outreach, they are leveraging big data analytics to identify specific patient demographics and tailor their advertising efforts accordingly. In South America, the market for targeted advertising is projected to grow at a CAGR of 12% from 2025 to 2030. This growth is fueled by the need for more effective communication with healthcare professionals and patients, ensuring that marketing messages resonate with the intended audience. Consequently, the big data-pharmaceutical-advertising market is witnessing a shift towards more personalized and data-driven campaigns, which are expected to yield higher engagement rates and improved return on investment.

Growing Investment in Digital Marketing

The growing investment in digital marketing initiatives is a significant driver for the big data-pharmaceutical-advertising market. Pharmaceutical companies in South America are increasingly allocating budgets towards digital channels, recognizing the potential for higher reach and engagement. In 2025, it is projected that digital marketing expenditures in the pharmaceutical sector will account for over 40% of total marketing budgets. This shift is largely attributed to the rising internet penetration and smartphone usage across the region, which facilitates direct communication with consumers. Consequently, the big data-pharmaceutical-advertising market is experiencing a surge in demand for data analytics solutions that can optimize digital marketing efforts, ensuring that campaigns are both effective and efficient.

Integration of Advanced Analytics Tools

The integration of advanced analytics tools into the pharmaceutical advertising landscape is transforming the big data-pharmaceutical-advertising market. Companies are increasingly adopting sophisticated analytics platforms that enable them to process vast amounts of data efficiently. In South America, the adoption rate of these tools is estimated to rise by 15% annually, as organizations recognize the value of data-driven insights in shaping their marketing strategies. These tools facilitate real-time data analysis, allowing pharmaceutical companies to monitor campaign performance and adjust their strategies dynamically. As a result, the big data-pharmaceutical-advertising market is evolving, with businesses becoming more agile and responsive to market changes, ultimately leading to enhanced customer engagement and satisfaction.

Regulatory Support for Data Utilization

Regulatory support for data utilization in the pharmaceutical industry is emerging as a crucial driver for the big data-pharmaceutical-advertising market. In South America, governments are increasingly recognizing the importance of data in enhancing healthcare outcomes and are implementing policies that encourage data sharing and collaboration among stakeholders. This regulatory environment fosters innovation and allows pharmaceutical companies to harness big data for more effective advertising strategies. As a result, the big data-pharmaceutical-advertising market is likely to benefit from a more favorable regulatory landscape, which could lead to increased investment in data-driven marketing initiatives and improved patient engagement.