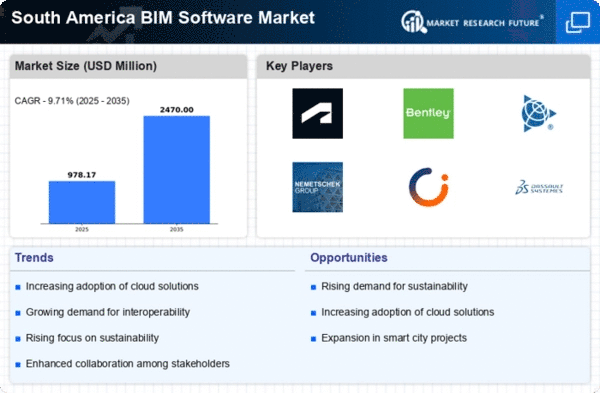

Sustainability Initiatives

The emphasis on sustainability in construction practices is shaping the bim software market in South America. As environmental concerns rise, stakeholders are seeking solutions that minimize waste and optimize resource use. Bim software enables better energy modeling and lifecycle analysis, which are crucial for sustainable design. For instance, the adoption of green building certifications is becoming more prevalent, with countries like Chile promoting eco-friendly construction practices. This shift towards sustainability is expected to drive the bim software market, as companies leverage technology to achieve their environmental goals and comply with emerging sustainability regulations.

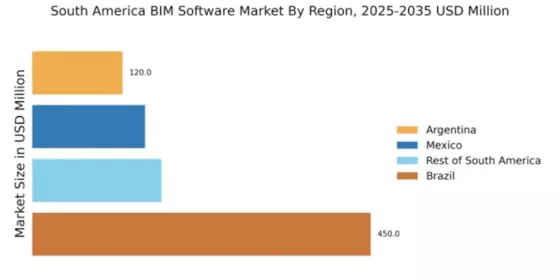

Rising Infrastructure Investments

The increasing investments in infrastructure development across South America are driving the bim software market. Governments and private sectors are allocating substantial budgets to enhance transportation, energy, and urban development projects. For instance, Brazil's infrastructure spending is projected to reach $100 billion by 2025, which is likely to boost the demand for advanced bim software solutions. These investments necessitate efficient project management and collaboration, which bim software can facilitate. As a result, the bim software market is expected to experience significant growth, as stakeholders seek to optimize resources and improve project outcomes through digital modeling and simulation.

Regulatory Compliance and Standards

The implementation of stringent regulatory frameworks in South America is influencing the bim software market. Countries are increasingly adopting building codes and standards that require the use of digital tools for project planning and execution. For example, Argentina has introduced regulations mandating the use of bim methodologies in public construction projects. This trend indicates a growing recognition of the benefits of bim software in ensuring compliance with safety and quality standards. Consequently, the bim software market is likely to expand as firms invest in technology to meet these regulatory requirements and enhance their competitive edge.

Growing Demand for Collaborative Workflows

The need for enhanced collaboration among project stakeholders is a key driver of the bim software market in South America. As construction projects become more complex, effective communication and coordination are essential for success. Bim software facilitates real-time collaboration, allowing architects, engineers, and contractors to work together seamlessly. This trend is particularly evident in large-scale projects, where multiple teams must coordinate their efforts. The bim software market is likely to benefit from this demand for collaborative tools, as firms recognize the value of integrated workflows in improving project efficiency and reducing delays.

Technological Advancements in Software Solutions

The rapid evolution of technology is significantly impacting the bim software market in South America. Innovations such as artificial intelligence, machine learning, and augmented reality are being integrated into bim solutions, enhancing their capabilities. These advancements allow for more accurate modeling, predictive analytics, and immersive visualization experiences. As firms seek to leverage these technologies to gain a competitive advantage, the bim software market is poised for growth. The increasing availability of advanced software solutions is likely to attract more users, driving adoption rates and expanding the overall market.