Research Methodology on BIM Software Market

1. Introduction

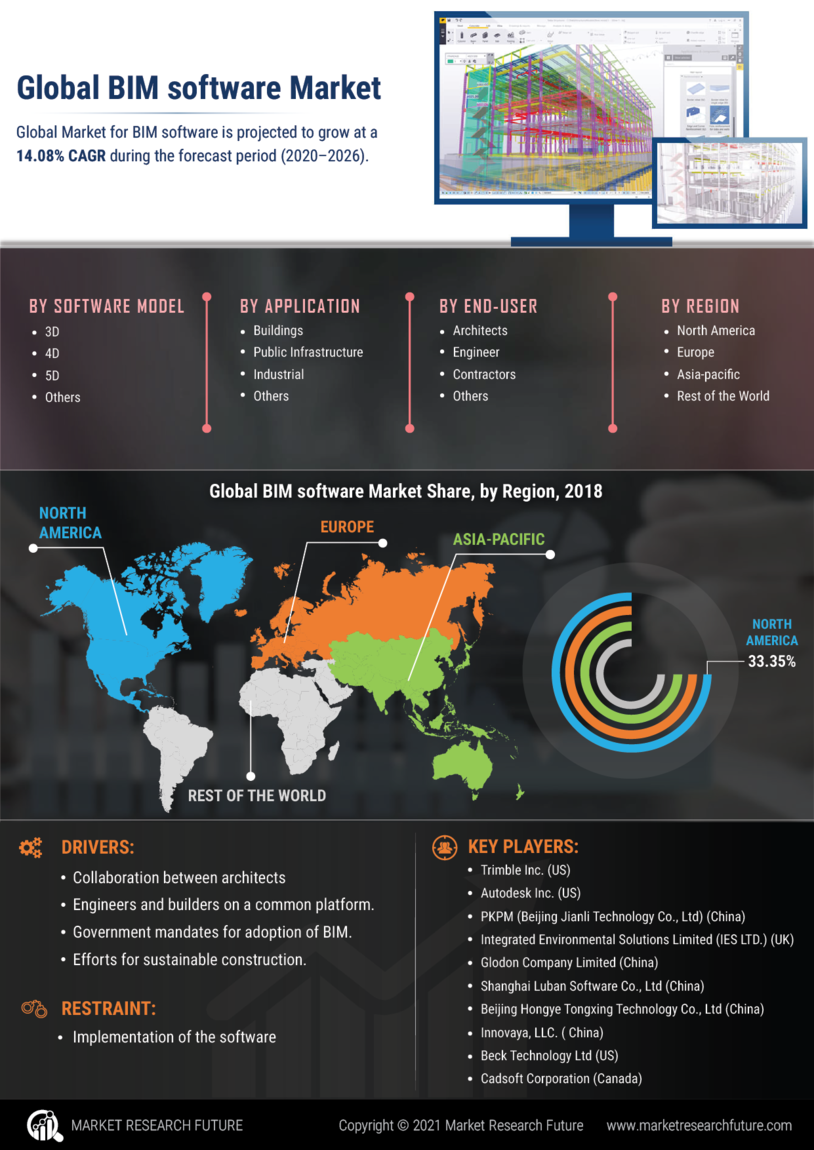

The Building Information Modelling (BIM) Software Market is expected to grow at a robust rate in the coming years. The ever increasing demand for improved construction efficiencies and the intensification of advanced technologies are expected to be the major drivers for the market's growth.

BIM solutions provide improved decision-making capabilities and streamlined workflow processes for architects, engineers, and contractors by facilitating improved data accuracy, project collaboration, and automated clash detection. The report encompasses a comprehensive analysis of the BIM Software Market across some of the key regions/countries globally.

2. Research Methodology

This research report is based on an in-depth qualitative and quantitative analysis of the BIM Software Market. A comprehensive research methodology is employed to understand the nuances of the BIM Software market. The research approach involves secondary and primary research, which is based on both qualitative and quantitative analysis, as well as industry-leading market research techniques.

Primary Research

Primary research is conducted to gain a better understanding of the BIM Software market. Industry-leading analysts and experts in the field of BIM software were interviewed, to identify key industry trends and developments over the past few years. Market participants, such as vendors, suppliers, and service providers, were interviewed to identify the key market scenarios.

Secondary Research

Secondary research is conducted to gain an understanding of the BIM Software market. Sources such as industry associations, journals, market research, and other sources of information related to the BIM Software market were consulted.

3. Data Collection

To gain an in-depth understanding of the key drivers and restraints that are affecting the BIM Software market, both qualitative and quantitative data are collected. Market issues such as drivers, opportunities, trends, and restraints for the BIM Software market are gleaned from a variety of industry and market research reports, publications, and industry databases. In addition, data is gathered through interviews with industry experts, vendors, and service providers.

4. Data Analysis

Data gathered from primary and secondary research is analyzed and segmented based on region, application, industry, and other parameters. The data is further organized into market dynamics to develop a clear understanding of the BIM Software market. Furthermore, market data is validated through various research activities and is further analyzed using various analytical tools such as Porter’s Five Forces analysis, SWOT analysis, and other statistical tools to arrive at clear market insights.

5. Conclusion

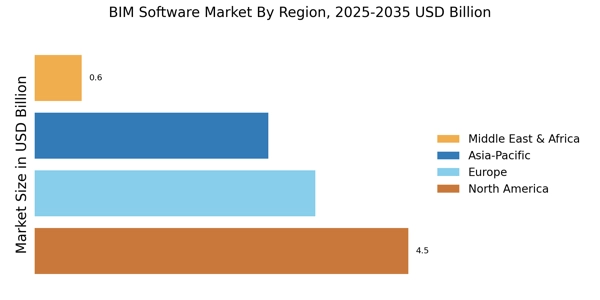

This research report provides a comprehensive analysis of the BIM Software market and provides a detailed overview of the global BIM Software market, including its historical and forecasted market size, demand drivers, leading players, and key industry trends. Furthermore, the report provides an in-depth analysis of the regional and global market, including market segmentation by application, industry, and region.

The data gathered from primary and secondary sources is further analyzed with the aid of various analytical tools such as Porter’s Five Forces analysis, SWOT analysis, and other statistical tools. Overall, this report provides a comprehensive understanding of the global BIM Software market, and assists in making informed decisions.