Growing Emphasis on Cost Reduction

In the current economic climate, the emphasis on cost reduction is a prominent driver for the BIM software market in North America. Companies are increasingly seeking ways to optimize resources and minimize waste, which BIM software can effectively address. By providing detailed visualizations and simulations, these tools enable stakeholders to identify potential issues early in the project lifecycle, thus avoiding costly changes during construction. Reports indicate that firms utilizing BIM can achieve cost savings of up to 20% on average. This financial incentive, coupled with the need for improved project efficiency, suggests that the adoption of BIM software will continue to rise as organizations strive to enhance their bottom line.

Adoption of Smart Building Technologies

The adoption of smart building technologies is emerging as a significant driver for the BIM software market in North America. As the construction sector increasingly integrates IoT and automation into building designs, the need for sophisticated modeling tools becomes evident. BIM software enables the design and management of smart buildings by providing detailed data analytics and visualization capabilities. This integration allows for better energy management, sustainability, and operational efficiency. According to industry forecasts, the smart building market is expected to reach $100 billion by 2026, which suggests a growing intersection with BIM technologies. As more firms recognize the benefits of smart buildings, the demand for BIM software is likely to escalate, positioning it as a vital component in modern construction practices.

Enhanced Collaboration Among Stakeholders

The need for enhanced collaboration among various stakeholders in construction projects is a critical driver for the BIM software market. As projects become more multidisciplinary, the ability to share information seamlessly is paramount. BIM software facilitates real-time collaboration among architects, engineers, contractors, and clients, ensuring that all parties are aligned throughout the project lifecycle. This collaborative approach not only improves communication but also reduces the likelihood of errors and rework. In North America, where project teams are often geographically dispersed, the demand for tools that support remote collaboration is likely to grow. The trend indicates that firms investing in BIM solutions may experience improved project delivery times and client satisfaction.

Rising Demand for Efficient Project Management

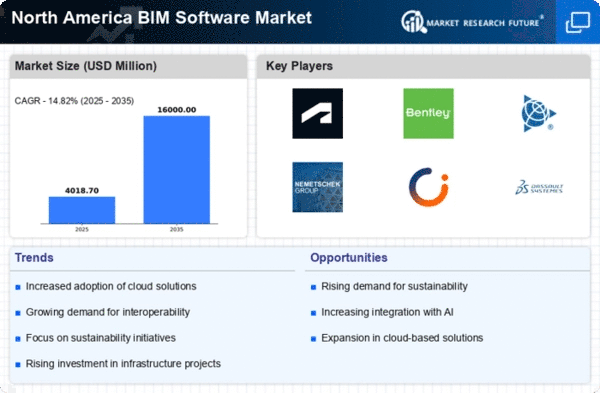

The increasing complexity of construction projects in North America drives the demand for efficient project management solutions. BIM software market is witnessing a surge as stakeholders seek tools that enhance collaboration, streamline workflows, and improve overall project outcomes. According to recent data, the construction sector in North America is projected to grow at a CAGR of 5.5% from 2025 to 2030, indicating a robust need for advanced management solutions. As project timelines shorten and budgets tighten, the ability to visualize and manage projects in real-time becomes crucial. This trend suggests that firms adopting BIM software can potentially reduce project delays and cost overruns, thereby enhancing their competitive edge in the market.

Increased Investment in Infrastructure Development

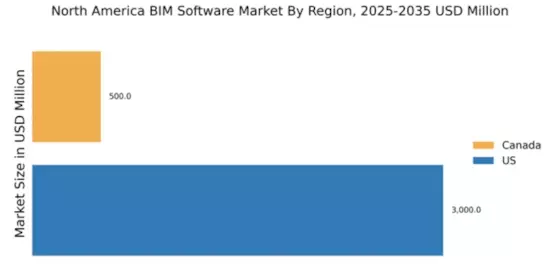

North America is experiencing a significant increase in infrastructure development, which is a key driver for the BIM software market. Government initiatives and private sector investments are fueling projects in transportation, utilities, and public facilities. For instance, the American Society of Civil Engineers estimates that the U.S. needs to invest approximately $4.5 trillion by 2025 to maintain and improve its infrastructure. This escalating investment creates a fertile ground for BIM software adoption, as these tools facilitate better planning, design, and execution of large-scale projects. The integration of BIM in infrastructure projects not only enhances efficiency but also ensures compliance with regulatory standards, thereby positioning firms favorably in a competitive landscape.