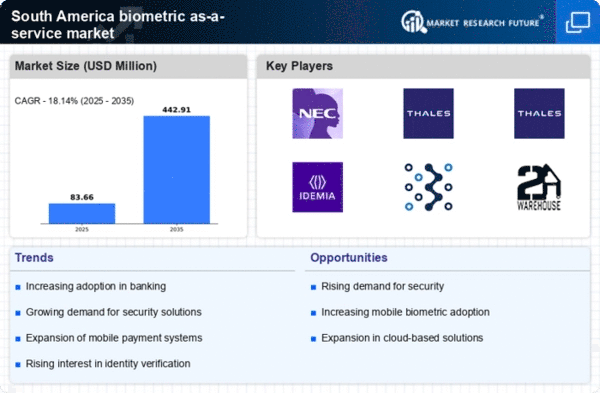

Increasing Demand for Secure Transactions

The biometric as-a-service market in South America is experiencing a notable surge in demand for secure transaction methods. As cyber threats escalate, businesses and consumers alike are seeking robust solutions to protect sensitive information. The integration of biometric authentication, such as fingerprint and facial recognition, is becoming a preferred choice for financial institutions and e-commerce platforms. In 2025, it is estimated that the market for biometric solutions in financial services could reach approximately $1.5 billion, reflecting a growth rate of around 20% annually. This increasing demand is driven by the need for enhanced security measures, which are essential for maintaining consumer trust and ensuring compliance with regulatory standards. Consequently, the biometric as-a-service market is poised for significant expansion as organizations prioritize secure transaction methods.

Rising Awareness of Biometric Technologies

The growing awareness of biometric technologies among consumers and businesses is a pivotal driver for the biometric as-a-service market in South America. As individuals become more informed about the benefits of biometric authentication, such as convenience and security, the demand for these services is likely to increase. Surveys indicate that approximately 65% of consumers in urban areas are willing to adopt biometric solutions for identity verification. This trend is particularly evident in sectors like retail and healthcare, where secure access to sensitive data is paramount. The biometric as-a-service market is expected to capitalize on this awareness, with projections suggesting a market growth of around 15% annually over the next five years. This heightened interest is likely to spur innovation and competition among service providers.

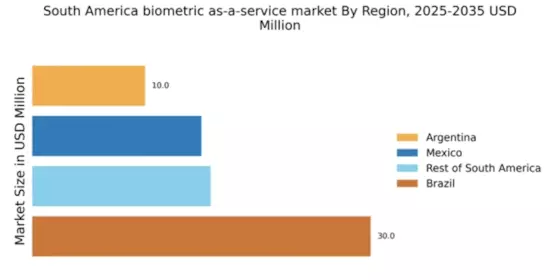

Government Initiatives for Digital Identity

In South America, government initiatives aimed at enhancing digital identity verification are significantly influencing the biometric as-a-service market. Various countries are implementing national identification programs that leverage biometric technologies to streamline access to services and improve security. For instance, Brazil's government has launched a biometric identification system that aims to integrate various public services, thereby increasing efficiency and reducing fraud. This initiative is expected to bolster the biometric as-a-service market, as private sector entities align their offerings with government standards. By 2026, the market could see an increase in adoption rates by up to 30%, driven by these government-led initiatives. Such developments not only enhance the credibility of biometric solutions but also encourage private investments in the sector.

Technological Advancements in Biometric Solutions

Technological advancements are playing a crucial role in shaping the biometric as-a-service market in South America. Innovations in artificial intelligence and machine learning are enhancing the accuracy and efficiency of biometric systems, making them more appealing to businesses. For instance, the development of advanced facial recognition algorithms has improved the reliability of identity verification processes. As these technologies evolve, the cost of implementation is expected to decrease, making biometric solutions more accessible to small and medium-sized enterprises. By 2027, the biometric as-a-service market could witness a growth rate of approximately 25%, driven by these technological advancements. This evolution not only enhances user experience but also broadens the scope of applications for biometric services across various sectors.

Growing Need for Compliance with Data Protection Laws

The increasing emphasis on data protection laws in South America is significantly impacting the biometric as-a-service market. With regulations such as the General Data Protection Law (LGPD) in Brazil, organizations are compelled to adopt secure methods for handling personal data. Biometric authentication offers a viable solution to meet these compliance requirements, as it provides a secure means of verifying identity without compromising sensitive information. As businesses strive to align with these regulations, the biometric as-a-service market is likely to experience a surge in demand. It is projected that by 2026, compliance-related investments in biometric solutions could account for up to 40% of the total market share. This trend underscores the critical role of biometric technologies in ensuring data security and regulatory adherence.