Expansion of Clinical Trials

The biotechnology pharmaceutical-services-outsources market in South America is witnessing a significant expansion in the number of clinical trials being conducted. This growth is attributed to the region's diverse patient population, which offers a unique opportunity for researchers to gather data on the efficacy and safety of new drugs. In 2025, it is estimated that clinical trials in South America will account for around 20% of all trials conducted in emerging markets. This trend not only enhances the region's attractiveness for pharmaceutical companies but also encourages the outsourcing of clinical trial services to specialized providers, thereby driving growth in the biotechnology pharmaceutical-services-outsources market.

Increasing Demand for Advanced Therapies

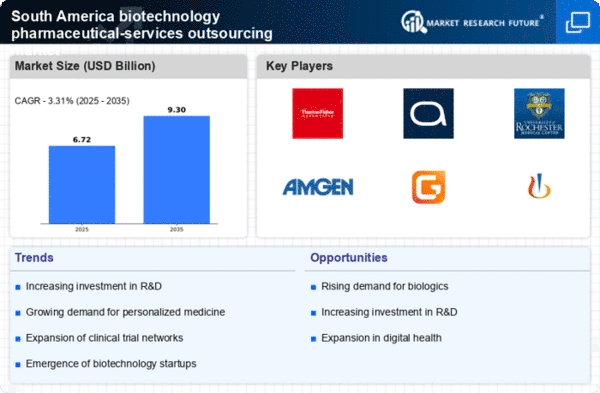

The biotechnology pharmaceutical-services-outsources market in South America is experiencing a notable surge in demand for advanced therapies, particularly in the fields of gene therapy and regenerative medicine. This trend is driven by a growing awareness of the potential benefits of these innovative treatments among healthcare providers and patients alike. As a result, investment in biotechnology research and development is expected to rise, with projections indicating a growth rate of approximately 15% annually in the sector. The increasing prevalence of chronic diseases and genetic disorders further fuels this demand, compelling pharmaceutical companies to explore outsourcing options to enhance their capabilities in developing and delivering these advanced therapies.

Rising Investment in Biotechnology Startups

The biotechnology pharmaceutical-services-outsources market in South America is benefiting from a surge in investment directed towards biotechnology startups. Venture capital funding has increased significantly, with estimates suggesting that investments in the sector could reach $500 million by the end of 2025. This influx of capital is fostering innovation and enabling startups to develop novel therapies and technologies. As these companies grow, they often seek to outsource various services, including manufacturing and clinical trials, to established providers, thereby contributing to the overall expansion of the biotechnology pharmaceutical-services-outsources market in the region.

Technological Advancements in Drug Development

Technological advancements are playing a crucial role in shaping the biotechnology pharmaceutical-services-outsources market in South America. Innovations such as artificial intelligence and machine learning are streamlining drug discovery processes, reducing timeframes and costs associated with bringing new drugs to market. In 2025, it is projected that the adoption of these technologies could lead to a reduction in development costs by up to 30%. As biotechnology firms increasingly seek to leverage these advancements, there is a growing trend towards outsourcing specific functions to specialized service providers, thereby enhancing efficiency and productivity within the biotechnology pharmaceutical-services-outsources market.

Strengthening Partnerships Between Academia and Industry

The biotechnology pharmaceutical-services-outsources market in South America is witnessing a strengthening of partnerships between academic institutions and industry players. These collaborations are essential for fostering innovation and translating research findings into practical applications. In 2025, it is anticipated that such partnerships will lead to an increase in joint ventures and collaborative projects, enhancing the capabilities of both academia and industry. This trend not only accelerates the development of new therapies but also encourages the outsourcing of research and development activities to academic institutions, thereby enriching the biotechnology pharmaceutical-services-outsources market landscape.