Advancements in Diagnostic Technologies

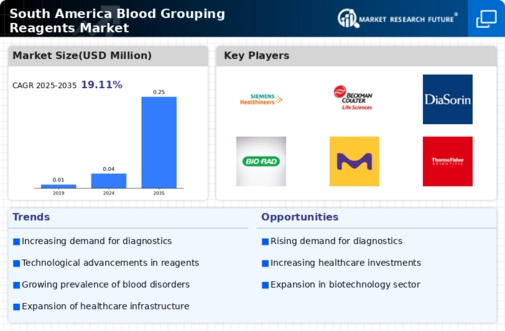

Innovations in diagnostic technologies are transforming the landscape of the blood grouping-reagents market in South America. The introduction of automated systems and point-of-care testing devices enhances the speed and accuracy of blood typing. These advancements are particularly crucial in emergency medical situations where timely decisions can save lives. The market for blood grouping reagents is projected to grow by approximately 10% annually, driven by the increasing adoption of these advanced technologies. Furthermore, the integration of artificial intelligence in diagnostic processes may further streamline operations, making it easier for healthcare providers to deliver precise results. This technological evolution is likely to create new opportunities for manufacturers within the blood grouping-reagents market.

Increasing Demand for Blood Transfusions

The rising incidence of chronic diseases and surgical procedures in South America is driving the demand for blood transfusions. This trend is likely to bolster the blood grouping-reagents market, as accurate blood typing is essential for safe transfusions. According to recent data, the number of blood transfusions in South America has increased by approximately 15% over the past five years. This surge necessitates a corresponding rise in the availability of reliable blood grouping reagents, which are critical for ensuring compatibility between donors and recipients. As healthcare facilities expand their services to meet this demand, the blood grouping-reagents market is expected to experience significant growth, with an emphasis on developing more efficient and accurate testing methods.

Rising Prevalence of Hematological Disorders

The increasing prevalence of hematological disorders, such as anemia and hemophilia, is a significant driver for the blood grouping-reagents market in South America. As awareness of these conditions grows, there is a heightened need for accurate blood typing and testing. Recent statistics indicate that approximately 20% of the population in certain South American countries is affected by some form of blood disorder. This situation necessitates the use of reliable blood grouping reagents to ensure proper diagnosis and treatment. Consequently, the market is likely to expand as healthcare providers seek to enhance their testing capabilities to address the needs of this patient population.

Regulatory Initiatives Promoting Blood Safety

Regulatory bodies in South America are increasingly focusing on blood safety and quality standards, which is positively influencing the blood grouping-reagents market. New regulations are being implemented to ensure that blood products are tested rigorously, thereby increasing the demand for high-quality reagents. For example, recent guidelines have mandated that all blood banks must utilize certified reagents for blood typing. This regulatory push is expected to drive market growth, as manufacturers will need to comply with these standards to remain competitive. The emphasis on safety and quality in blood transfusions is likely to create a more robust market for blood grouping reagents in the region.

Growing Investment in Healthcare Infrastructure

The South American region is witnessing a surge in investment aimed at enhancing healthcare infrastructure. Governments and private entities are allocating substantial funds to improve laboratory facilities and blood banks, which directly impacts the blood grouping-reagents market. For instance, recent initiatives have seen investments exceeding $500 million in upgrading medical facilities across several countries. This influx of capital is expected to facilitate the procurement of advanced blood grouping reagents, thereby improving the overall quality of blood testing services. As healthcare systems evolve, the demand for high-quality reagents will likely increase, positioning the blood grouping-reagents market for robust growth in the coming years.