Rising Geriatric Population

The demographic shift towards an aging population in South America is a crucial driver for the bone biopsy market. As individuals age, the prevalence of bone-related disorders, such as fractures and malignancies, tends to increase. This demographic trend necessitates enhanced diagnostic capabilities, including bone biopsies, to manage and treat these conditions effectively. The bone biopsy market is poised to expand as healthcare systems adapt to the needs of older adults, with estimates suggesting that the market could grow by 10% over the next five years, reflecting the increasing demand for specialized care.

Advancements in Biopsy Techniques

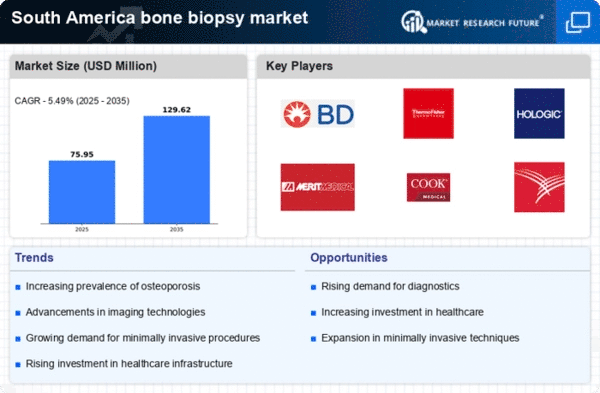

Innovations in biopsy techniques are significantly impacting the bone biopsy market in South America. The introduction of minimally invasive procedures, such as image-guided biopsies, is enhancing the accuracy and safety of bone sampling. These advancements not only reduce patient recovery time but also improve diagnostic outcomes. As healthcare providers adopt these new technologies, the market is likely to see an increase in procedure volumes. The bone biopsy market may experience a surge in demand, with projections indicating a potential market value increase of approximately $150 million by 2027, driven by these technological improvements.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and funding for diagnostic services are positively influencing the bone biopsy market in South America. Various countries are implementing policies to enhance healthcare infrastructure, which includes increasing the availability of advanced diagnostic tools. Such initiatives may lead to greater investment in medical technologies, thereby facilitating the growth of the bone biopsy market. With projected government spending on healthcare expected to rise by 15% in the next few years, the market is likely to benefit from enhanced resources and improved patient access to necessary procedures.

Increasing Awareness of Bone Health

The growing awareness regarding bone health in South America is driving the bone biopsy market. Educational campaigns and health initiatives are emphasizing the importance of early detection of bone diseases, which may lead to increased demand for diagnostic procedures, including biopsies. As populations become more informed about conditions such as osteoporosis and bone cancers, the need for accurate diagnostic tools is likely to rise. This trend is reflected in the increasing number of healthcare facilities offering specialized services. The bone biopsy market is expected to benefit from this heightened awareness, potentially leading to a growth rate of around 8% annually in the coming years.

Collaboration with Research Institutions

Collaborations between healthcare providers and research institutions are fostering innovation within the bone biopsy market in South America. These partnerships are essential for developing new techniques and improving existing methodologies for bone sampling. Research initiatives often lead to clinical trials that validate the efficacy of novel biopsy approaches, which can enhance patient outcomes. The bone biopsy market stands to gain from these collaborations, as they may result in the introduction of cutting-edge technologies and practices. This synergy is expected to contribute to a market growth rate of approximately 7% over the next few years, as new solutions are integrated into clinical practice.