Rising Prevalence of Chronic Diseases

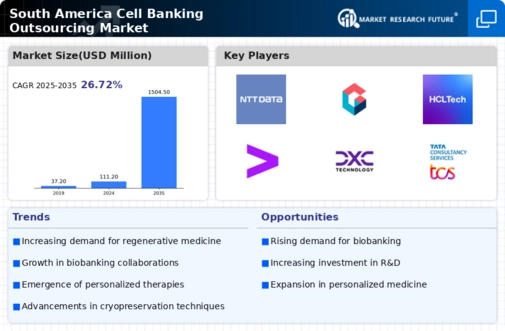

The prevalence of chronic diseases in South America is on the rise, which is driving demand for cell banking services. Conditions such as diabetes, cancer, and cardiovascular diseases are becoming more common, necessitating the need for effective treatment options. The cell banking-outsourcing market is responding to this trend by providing essential biobanking services that support research into these diseases. For example, the market is projected to grow by 10% annually as healthcare providers seek to utilize stored cells for innovative therapies. This growing need for personalized medicine and targeted therapies is likely to further propel the demand for cell banking services in the region.

Growing Awareness of Stem Cell Research

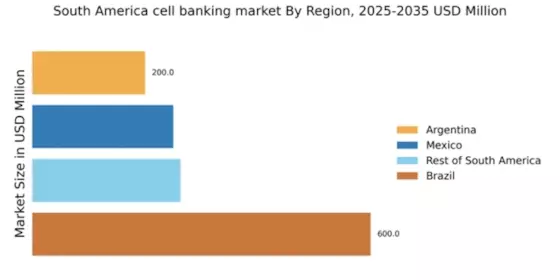

There is a growing awareness and interest in stem cell research across South America, which is positively influencing the cell banking-outsourcing market. As public understanding of the potential benefits of stem cell therapies increases, more individuals are opting to bank their stem cells for future medical use. This trend is particularly evident in countries like Argentina and Chile, where educational campaigns have led to a 30% rise in stem cell banking inquiries. Consequently, the cell banking-outsourcing market is likely to see a corresponding increase in demand for services that facilitate the collection, processing, and storage of stem cells, thereby enhancing the overall market landscape.

Regulatory Support for Biobanking Initiatives

Regulatory support for biobanking initiatives in South America is fostering a conducive environment for the cell banking-outsourcing market. Governments are implementing policies that encourage the establishment of biobanks and streamline the regulatory processes involved. For instance, recent legislation in Colombia has simplified the approval process for biobanking operations, which is expected to boost market growth by 12% over the next few years. This regulatory framework not only enhances the credibility of the cell banking-outsourcing market but also instills confidence among stakeholders, leading to increased investments and participation in biobanking activities.

Technological Advancements in Cryopreservation

Technological advancements in cryopreservation techniques are significantly impacting the cell banking-outsourcing market in South America. Innovations in freezing and storage methods enhance the viability of biological samples, which is crucial for research and therapeutic applications. The introduction of automated systems and improved cryogenic storage solutions has led to a 20% increase in sample preservation efficiency. As these technologies become more accessible, the cell banking-outsourcing market is expected to expand, attracting more clients who require reliable and high-quality biobanking services. This trend indicates a shift towards more sophisticated and efficient biobanking practices in the region.

Increasing Investment in Healthcare Infrastructure

The cell banking-outsourcing market in South America is experiencing a surge in investment aimed at enhancing healthcare infrastructure. Governments and private entities are allocating substantial funds to improve biobanking facilities, which is crucial for the preservation and storage of biological samples. For instance, Brazil has seen a 15% increase in healthcare spending, which directly impacts the capacity and capabilities of cell banking services. This investment not only facilitates better storage solutions but also promotes research and development in regenerative medicine. As a result, the cell banking-outsourcing market is likely to benefit from improved facilities and technologies, leading to enhanced service offerings and increased client trust.