Regulatory Support for Biotechnology

Regulatory support for biotechnology initiatives in South America is playing a pivotal role in shaping the cell culture-media market. Governments are increasingly recognizing the importance of biotechnology for economic development and public health. This support includes streamlined approval processes for biopharmaceutical products, which in turn drives the demand for cell culture media. As regulatory frameworks become more favorable, companies are likely to invest more in research and development, leading to an increased need for specialized media. The biotechnology sector in South America is expected to grow at a CAGR of 8% through 2030, indicating a robust environment for the cell culture-media market. This regulatory landscape fosters innovation and encourages the development of new media formulations tailored to specific applications.

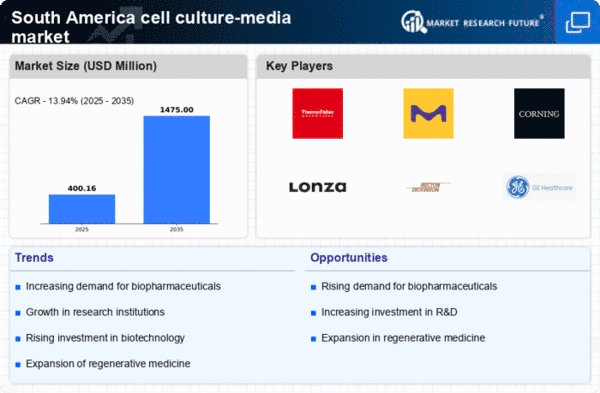

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals in South America is a key driver for the cell culture-media market. As the biopharmaceutical sector expands, the need for high-quality cell culture media becomes paramount. This demand is fueled by the growing prevalence of chronic diseases and the need for innovative therapies. In 2025, the biopharmaceutical market in South America is projected to reach approximately $30 billion, indicating a robust growth trajectory. Consequently, the cell culture-media market is likely to experience a corresponding increase in demand, as these products are essential for the development and production of biopharmaceuticals. The emphasis on research and development in this sector further propels the need for specialized media formulations, thereby enhancing the overall market landscape.

Increased Focus on Regenerative Medicine

The growing focus on regenerative medicine in South America is emerging as a significant driver for the cell culture-media market. Regenerative medicine aims to repair or replace damaged tissues and organs, necessitating the use of specialized cell culture media to support stem cell growth and differentiation. As research institutions and biotech companies invest in regenerative therapies, the demand for high-quality media formulations is likely to rise. The regenerative medicine market in South America is anticipated to reach $5 billion by 2026, which could lead to a substantial increase in the cell culture-media market. This trend indicates a shift towards more personalized medicine approaches, further emphasizing the need for tailored media solutions.

Growing Academic and Research Institutions

The proliferation of academic and research institutions in South America is a crucial driver for the cell culture-media market. These institutions are increasingly engaged in life sciences research, necessitating the use of advanced cell culture media for various applications, including drug discovery and toxicology studies. The number of research publications in the life sciences has been steadily increasing, with a notable rise in collaborative projects between universities and biotech firms. This trend is expected to bolster the demand for cell culture media, as researchers require high-quality products to achieve reliable results. The investment in research infrastructure is projected to grow, further enhancing the market landscape for cell culture media in the region.

Technological Advancements in Cell Culture

Technological advancements in cell culture techniques are significantly influencing the cell culture-media market in South America. Innovations such as 3D cell culture systems and automated bioreactors are enhancing the efficiency and effectiveness of cell culture processes. These technologies allow for more accurate modeling of human physiology, which is crucial for drug development and toxicity testing. As a result, the market for advanced cell culture media is expected to grow, with a projected CAGR of around 10% from 2025 to 2030. The integration of artificial intelligence and machine learning in cell culture processes also suggests a future where media formulations can be optimized in real-time, further driving the demand for specialized media in the region.