Focus on Preventive Healthcare

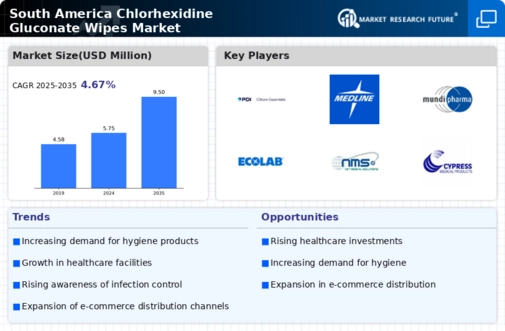

The chlorhexidine gluconate-wipes market is benefiting from a growing focus on preventive healthcare in South America. As healthcare systems shift towards preventive measures, the demand for effective antiseptic solutions is likely to increase. This trend is driven by both healthcare providers and consumers who are becoming more proactive about hygiene and infection prevention. The emphasis on preventive healthcare is expected to lead to a rise in the use of chlorhexidine gluconate wipes in various settings, including hospitals, clinics, and households. Market analysts predict that this focus could result in a market growth rate of approximately 10% annually, reflecting the increasing prioritization of health and safety.

Expansion of E-commerce Platforms

The chlorhexidine gluconate-wipes market is witnessing a transformation due to the expansion of e-commerce platforms in South America. The convenience of online shopping allows consumers and healthcare facilities to access a wider range of antiseptic products, including chlorhexidine gluconate wipes. This shift towards digital purchasing is particularly appealing to consumers seeking personal care products, as it offers ease of access and often competitive pricing. As e-commerce continues to grow, it is expected to play a pivotal role in increasing the availability and sales of chlorhexidine gluconate wipes, potentially boosting market revenues by 15% over the next few years.

Rising Incidence of Chronic Diseases

The chlorhexidine gluconate-wipes market is influenced by the rising incidence of chronic diseases in South America. Conditions such as diabetes and cardiovascular diseases necessitate frequent medical interventions, leading to an increased demand for antiseptic products to prevent infections during treatments. As healthcare providers seek to enhance patient safety, the use of chlorhexidine gluconate wipes becomes more prevalent in both clinical and home care settings. This trend is likely to contribute to a robust market growth trajectory, with estimates suggesting a potential market size of $30 million by 2026, reflecting the growing need for effective infection control solutions.

Increasing Awareness of Infection Control

The chlorhexidine gluconate-wipes market in South America is experiencing a surge in demand due to heightened awareness regarding infection control. Healthcare professionals and institutions are increasingly recognizing the importance of effective antiseptic solutions in preventing healthcare-associated infections (HAIs). This awareness is driven by educational campaigns and guidelines from health authorities, which emphasize the necessity of maintaining hygiene standards. As a result, the adoption of chlorhexidine gluconate wipes is likely to rise, particularly in hospitals and clinics. The market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the growing emphasis on infection prevention measures.

Regulatory Support for Antiseptic Products

The chlorhexidine gluconate-wipes market benefits from supportive regulatory frameworks in South America. Regulatory bodies are increasingly endorsing the use of antiseptic products in healthcare settings, which facilitates market growth. For instance, the approval of chlorhexidine gluconate wipes by health authorities enhances their credibility and encourages healthcare facilities to incorporate them into their infection control protocols. This regulatory support is crucial, as it not only assures quality and safety but also promotes the widespread adoption of these products. The market is expected to see a significant increase in sales, potentially reaching $50 million by 2027, driven by this favorable regulatory environment.