Emergence of Telehealth Services

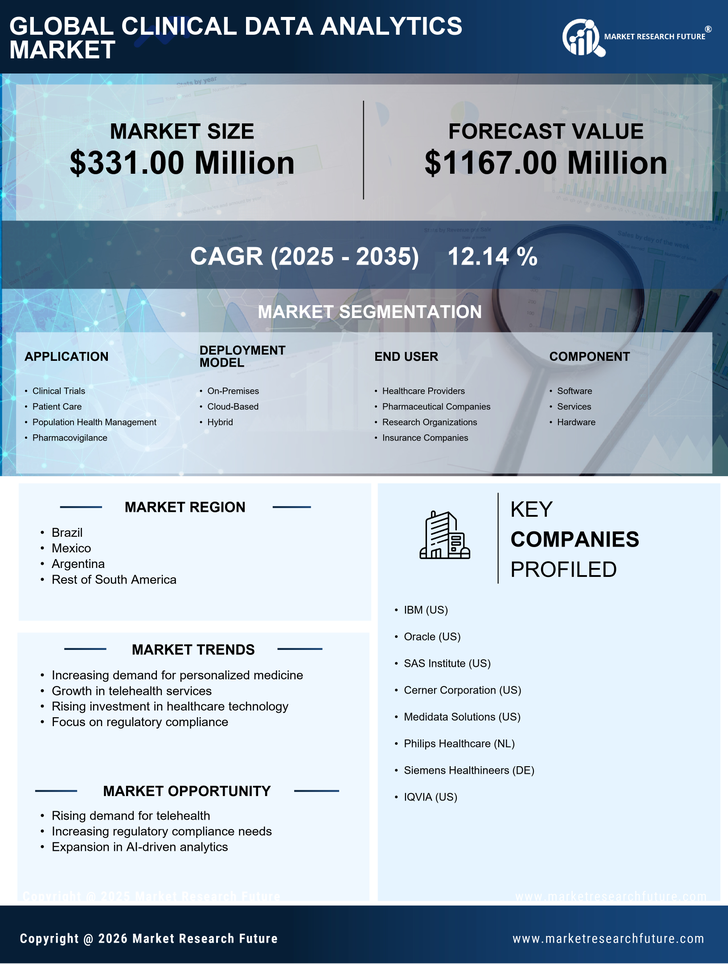

The clinical data-analytics market in South America is significantly impacted by the emergence of telehealth services. The rise of telemedicine has created new avenues for data collection and analysis, as healthcare providers can now gather patient data remotely. This shift is expected to contribute to a market growth of approximately 18% over the next few years. Telehealth platforms generate vast amounts of clinical data, which can be analyzed to improve patient care and operational efficiency. As telehealth becomes more integrated into healthcare systems, the demand for analytics tools that can process and interpret this data will likely increase. This trend highlights the evolving landscape of healthcare delivery and the critical role of data analytics in supporting telehealth initiatives.

Expansion of Healthcare Infrastructure

The clinical data-analytics market in South America is significantly influenced by the ongoing expansion of healthcare infrastructure. Governments and private entities are investing heavily in healthcare facilities, which facilitates the collection and analysis of clinical data. This investment is expected to reach approximately $50 billion by 2026, enhancing the capacity for data analytics. Improved infrastructure not only increases the volume of data available for analysis but also enhances the quality of care provided to patients. As healthcare systems evolve, the need for sophisticated analytics tools becomes paramount, driving growth in the clinical data-analytics market. This expansion is likely to create new opportunities for technology providers and data analysts alike.

Rising Demand for Data-Driven Insights

The clinical data-analytics market in South America experiences a notable surge in demand for data-driven insights. Healthcare providers increasingly recognize the value of leveraging data analytics to enhance patient outcomes and operational efficiency. This trend is evidenced by a projected growth rate of approximately 15% annually in the region. As healthcare systems strive to optimize resource allocation and improve treatment protocols, the integration of advanced analytics becomes essential. The ability to analyze vast datasets allows for more informed decision-making, ultimately leading to better healthcare delivery. Consequently, stakeholders in the clinical data-analytics market are investing in innovative solutions to meet this rising demand, indicating a robust growth trajectory for the industry.

Growing Emphasis on Preventive Healthcare

The clinical data-analytics market in South America is witnessing a growing emphasis on preventive healthcare strategies. As healthcare costs continue to rise, stakeholders are increasingly focusing on preventing diseases rather than merely treating them. This shift is supported by data analytics, which enables healthcare providers to identify at-risk populations and implement targeted interventions. The market for preventive healthcare analytics is projected to grow by 20% over the next five years. By utilizing data to predict health trends and outcomes, healthcare organizations can allocate resources more effectively, thereby improving overall public health. This trend underscores the critical role of data analytics in shaping future healthcare policies and practices.

Increased Collaboration Among Healthcare Stakeholders

The clinical data-analytics market in South America benefits from increased collaboration among various healthcare stakeholders. Partnerships between hospitals, research institutions, and technology firms are becoming more common, fostering an environment conducive to innovation. Collaborative efforts are aimed at sharing data and best practices, which enhances the overall quality of clinical data analytics. This trend is likely to lead to the development of more comprehensive analytics solutions tailored to the unique needs of the region. As stakeholders work together, the clinical data-analytics market is expected to expand, with a projected growth rate of 12% annually. Such collaboration not only improves data quality but also accelerates the adoption of advanced analytics technologies.