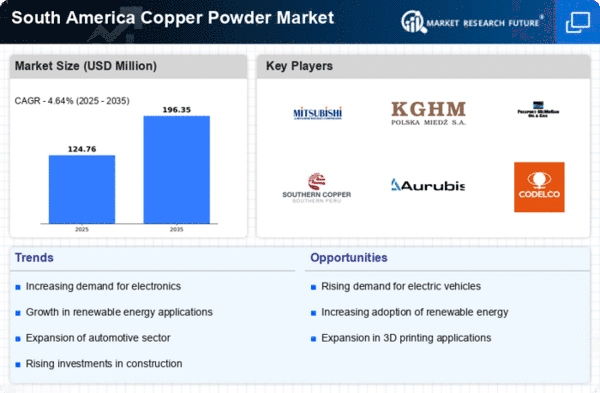

Growing Construction Sector

The construction sector in South America is experiencing robust growth, which is likely to drive demand for copper powder. As urbanization accelerates, the need for high-quality materials in construction increases. Copper powder is utilized in various applications, including concrete additives and coatings, enhancing durability and performance. In 2025, the construction industry in South America is projected to grow by approximately 4.5%, indicating a rising demand for copper powder in this sector. This growth is further supported by government initiatives aimed at infrastructure development, which may lead to increased investments in construction projects. Consequently, the copper powder market is poised to benefit from this expanding sector, as construction companies seek reliable materials to meet their project requirements.

Rising Demand from Electronics Sector

The electronics sector in South America is witnessing a surge in demand, which is likely to impact the copper powder market positively. With the proliferation of consumer electronics and smart devices, the need for high-quality conductive materials is increasing. Copper powder is widely used in the production of electronic components, such as capacitors and resistors, due to its excellent conductivity. In 2025, the electronics market is expected to grow by 7%, further driving the demand for copper powder. This growth may prompt manufacturers to enhance their production capabilities to cater to the electronics industry's requirements, thereby solidifying copper powder's role in this dynamic market.

Advancements in Manufacturing Techniques

Innovations in manufacturing techniques are transforming the copper powder market in South America. The introduction of advanced production methods, such as atomization and mechanical milling, enhances the quality and consistency of copper powder. These techniques allow for the production of finer particles, which are essential for applications in electronics and additive manufacturing. As industries increasingly adopt these advanced techniques, the demand for high-quality copper powder is expected to rise. In 2025, the market for copper powder is anticipated to grow by 6%, driven by these advancements. Manufacturers are likely to invest in state-of-the-art equipment to improve efficiency and reduce production costs, further solidifying the position of copper powder in various industrial applications.

Increasing Use in Renewable Energy Technologies

The shift towards renewable energy technologies is influencing the copper powder market in South America. Copper powder is essential in the production of solar panels and wind turbines, where it is used in electrical contacts and conductive materials. As countries in South America commit to reducing carbon emissions, the demand for renewable energy solutions is expected to rise significantly. In 2025, the renewable energy sector is projected to grow by 8%, creating a substantial market for copper powder. This trend suggests that manufacturers may need to increase production capacity to meet the anticipated demand, positioning copper powder as a critical component in the transition to sustainable energy sources.

Environmental Regulations and Sustainability Initiatives

Environmental regulations and sustainability initiatives are shaping the copper powder market in South America. Governments are increasingly implementing stringent regulations aimed at reducing environmental impact, which may encourage manufacturers to adopt sustainable practices in copper powder production. This shift towards eco-friendly production methods could enhance the market's appeal to environmentally conscious consumers and industries. In 2025, it is anticipated that the demand for sustainably produced copper powder will increase by 5%, as companies seek to comply with regulations and meet consumer expectations. This trend suggests that the copper powder market may need to adapt to these changing dynamics to remain competitive and relevant in the evolving landscape.