Increased Data Consumption

The surge in data consumption across various sectors in South America significantly impacts the data center-interconnect market. With the proliferation of mobile devices and the Internet of Things (IoT), data traffic is expected to increase exponentially. Reports indicate that data traffic in the region could grow by over 25% annually, necessitating robust interconnect solutions to manage this influx. As businesses and consumers demand faster and more reliable data services, data centers must enhance their interconnect capabilities to meet these needs. This trend is likely to drive investments in advanced interconnect technologies, thereby propelling the market forward.

Emergence of Edge Computing

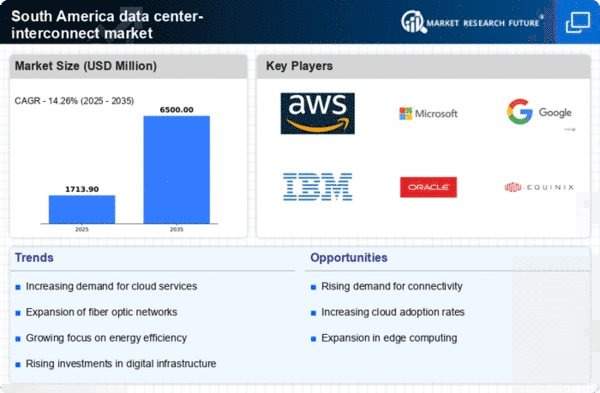

The emergence of edge computing is reshaping the data center-interconnect market in South America. As organizations seek to reduce latency and improve response times, the need for localized data processing is becoming increasingly apparent. This shift is prompting the establishment of smaller, distributed data centers that require efficient interconnect solutions to communicate with larger facilities. The growth of edge computing is expected to contribute to a market increase of around 20% in the next few years, as companies invest in infrastructure that supports this model. Consequently, the data center-interconnect market must adapt to accommodate the unique demands of edge computing.

Expansion of Digital Infrastructure

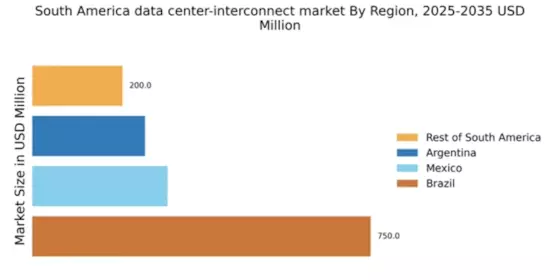

The rapid expansion of digital infrastructure in South America is a primary driver for the data center-interconnect market. Governments and private sectors are investing heavily in enhancing connectivity, which is crucial for supporting the growing demand for data services. For instance, the Brazilian government has initiated several projects aimed at improving internet access in rural areas, which is expected to increase the number of data centers. This expansion is projected to lead to a growth rate of approximately 15% in the data center-interconnect market over the next five years. Enhanced infrastructure not only facilitates better interconnectivity but also attracts foreign investments, further stimulating market growth.

Regulatory Support for Data Privacy

Regulatory frameworks focusing on data privacy and protection are becoming more stringent in South America, influencing the data center-interconnect market. Governments are implementing laws that require businesses to store and process data locally, which in turn drives the demand for interconnected data centers. For example, Brazil's General Data Protection Law (LGPD) mandates that companies adhere to strict data handling practices, encouraging investments in local data centers. This regulatory environment is likely to foster a growth rate of approximately 18% in the data center-interconnect market as organizations seek compliant solutions that ensure data security and privacy.

Growth of E-commerce and Digital Services

The rapid growth of e-commerce and digital services in South America is a significant driver for the data center-interconnect market. As more consumers turn to online shopping and digital platforms for services, businesses are compelled to enhance their digital presence. This shift is leading to an increased demand for data storage and processing capabilities, which in turn necessitates robust interconnect solutions. Projections suggest that the e-commerce sector in South America could grow by over 30% in the coming years, further fueling the need for interconnected data centers. Consequently, this trend is expected to drive substantial investments in the data center-interconnect market.