Government Initiatives and Funding

Government initiatives aimed at improving healthcare access in South America are positively impacting the dental lasers market. Various programs are being implemented to enhance dental care services, particularly in underserved regions. These initiatives often include funding for modern dental equipment, including laser systems, which can significantly improve treatment outcomes. The dental lasers market stands to benefit from these investments, as they may lead to a 25% increase in the adoption of laser technologies in public health facilities. Additionally, partnerships between government bodies and private sectors are likely to facilitate the dissemination of knowledge and training regarding the use of dental lasers, further driving market growth.

Increasing Awareness of Oral Health

The growing awareness of oral health in South America is driving the dental lasers market. As populations become more informed about the importance of dental hygiene and regular check-ups, the demand for advanced dental treatments rises. This trend is particularly evident in urban areas where access to dental care is improving. The dental lasers market benefits from this increased awareness, as patients seek less invasive and more effective treatment options. Moreover, educational campaigns by dental associations and healthcare providers are likely to further enhance public knowledge, potentially leading to a 15% increase in the adoption of laser technologies in dental practices over the next few years.

Rising Incidence of Dental Diseases

The prevalence of dental diseases in South America is a significant driver for the dental lasers market. Conditions such as periodontal disease and dental caries are on the rise, prompting a need for effective treatment solutions. The dental lasers market is positioned to address these challenges, as lasers offer precise and efficient treatment options that can reduce recovery times and improve patient outcomes. Recent studies indicate that approximately 30% of the population in urban areas suffers from some form of dental disease, which is likely to increase the demand for laser-assisted procedures. This trend suggests a robust growth trajectory for the market as dental professionals seek innovative solutions to combat these issues.

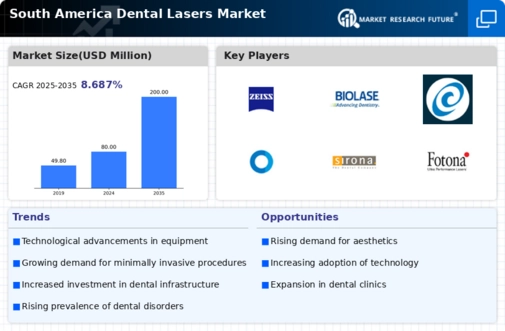

Consumer Preference for Aesthetic Treatments

The increasing consumer preference for aesthetic dental treatments is a notable driver for the dental lasers market. As individuals seek to enhance their smiles and overall dental appearance, the demand for procedures such as teeth whitening, gum contouring, and other cosmetic treatments rises. The dental lasers market is well-positioned to cater to this demand, as laser technologies offer minimally invasive options with quicker recovery times. Market analysis suggests that the aesthetic segment could account for up to 40% of the total dental lasers market in South America by 2026. This shift in consumer behavior indicates a promising future for laser-assisted aesthetic procedures, potentially leading to a surge in market growth.

Technological Integration in Dental Practices

The integration of advanced technologies in dental practices is transforming the landscape of the dental lasers market. As dental professionals adopt digital tools and laser systems, the efficiency and effectiveness of treatments improve significantly. The dental lasers market is experiencing a shift towards more sophisticated laser systems that offer enhanced capabilities, such as improved precision and reduced treatment times. This technological evolution is expected to drive market growth, with projections indicating a potential increase in market size by 20% over the next five years. Furthermore, the collaboration between dental equipment manufacturers and technology firms is likely to foster innovation, leading to the development of next-generation laser systems.