Emergence of Dental Tourism

the dental radiology-imaging-devices market in South America is benefiting from the emergence of dental tourism. Patients from neighboring countries are increasingly traveling to South America for affordable dental care, which often includes advanced imaging services. This trend is particularly pronounced in countries known for their high-quality dental services at competitive prices. As dental practices cater to international patients, the demand for sophisticated imaging technologies is likely to rise. This influx of patients not only boosts the local economy but also encourages dental clinics to invest in state-of-the-art radiology equipment, thereby enhancing the overall market landscape.

Rising Oral Health Awareness

In South America, there is a growing awareness regarding oral health, which is positively influencing the dental radiology-imaging-devices market. Public health campaigns and educational initiatives are encouraging individuals to prioritize dental check-ups and preventive care. This heightened awareness is leading to an increase in patient visits to dental clinics, thereby driving the demand for advanced imaging technologies. According to recent studies, approximately 60% of the population in urban areas now seeks regular dental care, which includes radiological assessments. As more patients recognize the importance of early detection of dental issues, the market for imaging devices is expected to witness substantial growth, reflecting a shift towards proactive dental care.

Increase in Dental Procedures

the dental radiology-imaging-devices market in South America is influenced by the rising number of dental procedures being performed. Factors such as an aging population and an increase in dental diseases are contributing to this trend. For instance, the prevalence of dental caries and periodontal diseases has prompted more individuals to seek treatment, leading to a higher demand for imaging services. It is estimated that the number of dental procedures has increased by over 15% in the last five years, which correlates with the growing utilization of radiology in diagnostics and treatment planning. This trend suggests that the market for dental imaging devices will continue to expand as practitioners require advanced tools to support their clinical decisions.

Growth of Dental Insurance Coverage

The expansion of dental insurance coverage in South America is playing a pivotal role in the growth of the dental radiology-imaging-devices market. As more individuals gain access to dental insurance, they are more likely to seek preventive and diagnostic services, including radiological assessments. This trend is particularly evident in urban areas where insurance penetration has increased significantly. With insurance plans often covering a portion of imaging costs, patients are more inclined to undergo necessary imaging procedures. This shift is expected to drive market growth, as dental practices invest in advanced imaging technologies to meet the rising demand for services covered by insurance.

Technological Advancements in Imaging Devices

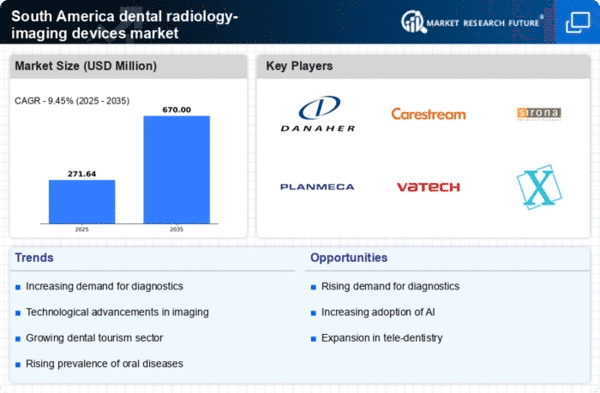

The dental radiology-imaging-devices market in South America is experiencing a surge due to rapid technological advancements. Innovations such as 3D imaging and cone beam computed tomography (CBCT) are enhancing diagnostic accuracy and treatment planning. These technologies allow for detailed visualization of dental structures, which is crucial for effective patient management. The market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, driven by the increasing demand for precise imaging solutions. Furthermore, the integration of digital platforms is streamlining workflows in dental practices, thereby improving operational efficiency. As practitioners seek to adopt the latest technologies, the dental radiology-imaging-devices market is likely to expand significantly in the coming years.