Government Initiatives and Support

Government initiatives aimed at enhancing disaster preparedness and response are playing a crucial role in shaping the disaster recovery-service market in South America. Various governments are implementing policies that encourage businesses to adopt disaster recovery plans. For instance, funding programs and tax incentives are being offered to organizations that invest in recovery services. This support is likely to stimulate market growth, as businesses are more inclined to allocate resources towards disaster recovery solutions. The disaster recovery-service market is thus benefiting from a favorable regulatory environment that promotes resilience and preparedness.

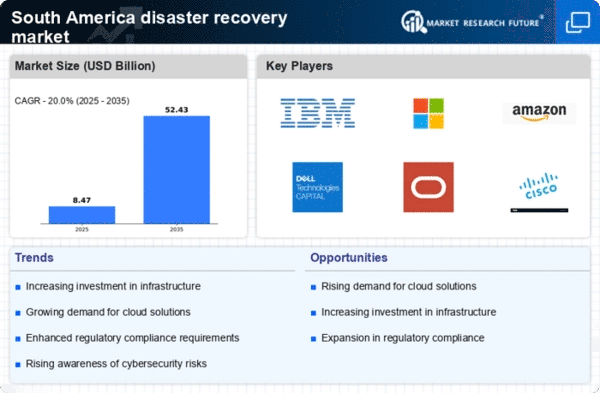

Rising Frequency of Natural Disasters

The increasing frequency of natural disasters in South America appears to be a primary driver for the disaster recovery-service market. Events such as floods, earthquakes, and landslides have been on the rise, prompting organizations to prioritize disaster recovery strategies. According to recent data, the region has experienced a 30% increase in natural disasters over the past decade. This trend necessitates robust recovery services to mitigate risks and ensure business continuity. Companies are investing in comprehensive disaster recovery plans to safeguard their assets and maintain operational resilience. The disaster recovery-service market is thus witnessing heightened demand as businesses seek to protect themselves against unpredictable events.

Growing Awareness of Cybersecurity Threats

As cyber threats become more sophisticated, the awareness surrounding cybersecurity risks has surged in South America. Organizations are increasingly recognizing the importance of integrating disaster recovery services with cybersecurity measures. The disaster recovery-service market is adapting to this shift, with a focus on providing solutions that address both physical and digital threats. Recent studies indicate that cyberattacks have risen by 40% in the region, leading to significant financial losses for businesses. Consequently, companies are investing in disaster recovery services that encompass data protection and recovery from cyber incidents, thereby enhancing their overall security posture.

Increased Focus on Business Continuity Planning

The emphasis on business continuity planning is becoming increasingly pronounced in South America, driving demand for disaster recovery services. Organizations are recognizing that effective recovery strategies are essential for maintaining operations during and after a disaster. The disaster recovery-service market is responding to this need by offering tailored solutions that align with specific business requirements. Recent surveys indicate that over 60% of companies in the region are prioritizing business continuity as a key component of their strategic planning. This trend suggests a growing recognition of the value of disaster recovery services in ensuring long-term sustainability.

Technological Advancements in Recovery Solutions

Technological advancements are significantly influencing the disaster recovery-service market in South America. Innovations such as cloud computing, artificial intelligence, and automation are enhancing the efficiency and effectiveness of recovery solutions. These technologies enable organizations to streamline their recovery processes, reduce downtime, and minimize losses. The market is witnessing a shift towards more sophisticated recovery solutions that leverage these advancements. Data indicates that the adoption of cloud-based recovery services has increased by 25% in the past year, reflecting a broader trend towards digital transformation in the disaster recovery-service market.