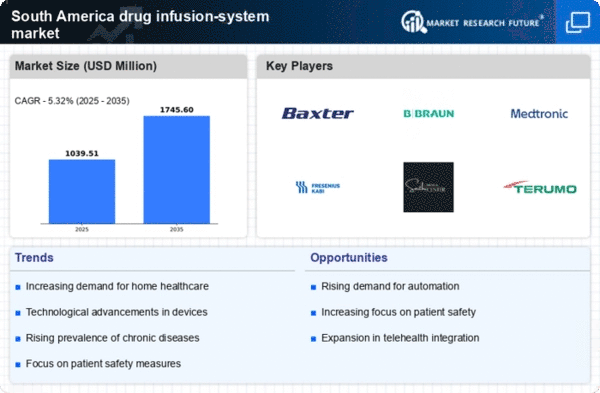

Increasing Healthcare Expenditure

The rising healthcare expenditure in South America is a pivotal driver for the drug infusion-system market. Governments and private sectors are investing more in healthcare infrastructure, which includes advanced medical devices. For instance, Brazil's healthcare spending is projected to reach approximately $200 billion by 2025, indicating a robust growth trajectory. This increase in funding allows for the procurement of sophisticated drug infusion systems, enhancing patient care and treatment outcomes. Moreover, as healthcare budgets expand, hospitals are more likely to adopt innovative technologies that improve efficiency and safety in drug delivery. Consequently, the drug infusion-system market is poised to benefit from this upward trend in healthcare investment, as facilities seek to modernize their equipment and improve service delivery.

Rising Awareness of Patient Safety

There is a growing awareness of patient safety in South America, which is significantly impacting the drug infusion-system market. Healthcare providers are increasingly prioritizing safety protocols to minimize the risk of medication errors and adverse events. This heightened focus on patient safety is leading to the adoption of advanced drug infusion systems that incorporate safety features such as alarms, alerts, and automated dosage calculations. As a result, hospitals and clinics are more inclined to invest in these systems to enhance their safety standards. The drug infusion-system market is thus benefiting from this trend, as facilities seek to comply with regulatory requirements and improve patient outcomes. The emphasis on safety is expected to drive further innovations in infusion technology, creating a more robust market landscape.

Expansion of Home Healthcare Services

The expansion of home healthcare services in South America is emerging as a significant driver for the drug infusion-system market. As the population ages and the demand for at-home care increases, healthcare providers are exploring ways to deliver effective treatments outside traditional hospital settings. Drug infusion systems are becoming essential tools in this context, enabling patients to receive necessary medications in the comfort of their homes. This shift not only enhances patient convenience but also reduces hospital readmission rates. According to estimates, the home healthcare market in South America is expected to grow at a CAGR of over 10% in the coming years. This trend indicates a promising future for the drug infusion-system market, as it aligns with the increasing preference for home-based care solutions.

Growing Prevalence of Chronic Diseases

The escalating prevalence of chronic diseases in South America significantly influences the drug infusion-system market. Conditions such as diabetes, cancer, and cardiovascular diseases are on the rise, necessitating effective management strategies. According to recent statistics, chronic diseases account for nearly 70% of all deaths in the region, underscoring the urgent need for reliable treatment options. Drug infusion systems play a crucial role in managing these conditions, providing precise and controlled delivery of medications. As healthcare providers increasingly focus on chronic disease management, the demand for advanced drug infusion systems is expected to surge. This trend indicates a promising outlook for the drug infusion-system market, as it aligns with the growing need for effective therapeutic solutions.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the drug infusion-system market. Innovations such as smart infusion pumps, which offer features like dose error reduction systems and wireless connectivity, are becoming more prevalent. In South America, the adoption of these technologies is driven by the need for enhanced patient safety and improved clinical outcomes. For example, hospitals are increasingly utilizing electronic health records (EHR) systems that integrate with infusion devices, allowing for real-time monitoring and data analysis. This technological synergy not only streamlines workflows but also reduces the risk of medication errors. As healthcare facilities continue to embrace digital transformation, the drug infusion-system market is likely to experience substantial growth, fueled by the demand for smarter, more efficient solutions.