Increasing Healthcare Expenditure

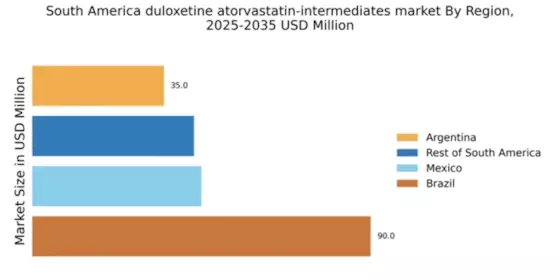

The rising healthcare expenditure in South America is a pivotal driver for the duloxetine atorvastatin-intermediates market. Governments and private sectors are investing more in healthcare, which is likely to enhance the availability of pharmaceuticals, including intermediates. For instance, healthcare spending in countries like Brazil and Argentina has seen an increase of approximately 10% annually. This trend suggests a growing market for intermediates, as pharmaceutical companies seek to meet the rising demand for effective treatments. The increased funding may also facilitate research and development initiatives, further propelling the duloxetine atorvastatin-intermediates market. As healthcare systems evolve, the need for high-quality intermediates becomes more pronounced, potentially leading to a more competitive landscape in the region.

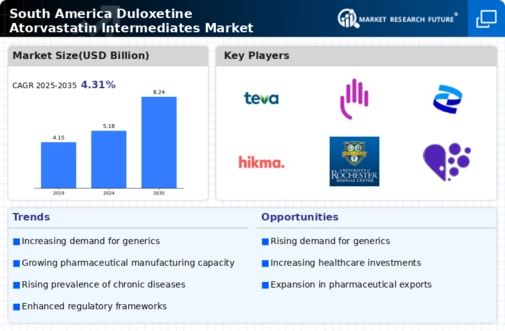

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases in South America is a critical driver for the duloxetine atorvastatin-intermediates market. Conditions such as diabetes, hypertension, and depression are becoming more common, necessitating effective pharmaceutical interventions. Reports indicate that approximately 30% of the population in major South American countries suffers from at least one chronic condition. This growing health crisis is likely to drive demand for medications that utilize intermediates like duloxetine and atorvastatin. Consequently, the duloxetine atorvastatin-intermediates market may see heightened activity as pharmaceutical companies strive to develop and produce effective treatments to address these health challenges.

Technological Advancements in Synthesis

Technological advancements in the synthesis of pharmaceutical intermediates are shaping the duloxetine atorvastatin-intermediates market. Innovations in chemical processes and production techniques are enhancing efficiency and reducing costs. For example, the adoption of green chemistry practices is becoming more prevalent, which may lead to more sustainable production methods. As these technologies evolve, they could potentially lower the barriers to entry for new players in the duloxetine atorvastatin-intermediates market. Furthermore, improved synthesis methods may result in higher purity and yield of intermediates, which is crucial for pharmaceutical applications. This trend suggests a dynamic shift in the market landscape, driven by the need for more efficient and environmentally friendly production.

Expansion of Pharmaceutical Manufacturing

The expansion of pharmaceutical manufacturing capabilities in South America significantly influences the duloxetine atorvastatin-intermediates market. Countries such as Brazil and Colombia are enhancing their production facilities to meet both local and international demands. This expansion is expected to increase the output of intermediates, thereby reducing reliance on imports. Recent data indicates that the pharmaceutical manufacturing sector in Brazil has grown by 8% in the last year, which may lead to a more robust supply chain for intermediates. As local manufacturers ramp up production, the duloxetine atorvastatin-intermediates market could experience a surge in availability, potentially lowering costs and improving access to essential medications.

Growing Regulatory Support for Pharmaceuticals

The growing regulatory support for pharmaceuticals in South America is a significant driver for the duloxetine atorvastatin-intermediates market. Regulatory bodies are increasingly streamlining approval processes for new drugs and intermediates, which may encourage innovation and investment in the sector. For instance, recent reforms in Brazil have aimed to expedite the registration of new pharmaceutical products, potentially reducing the time to market. This supportive regulatory environment could lead to an influx of new products utilizing intermediates, thereby expanding the duloxetine atorvastatin-intermediates market. As regulations become more favorable, companies may be more inclined to invest in research and development, further stimulating market growth.